For Switzerland’s two dominant banks, size matters. But there is a twist to the competition between UBS and Credit Suisse in recent years—both are desperately trying to shrink. The main target for reduction is the capital-intensive, error-prone investment banking operations at both groups, which suffered to varying degrees from damaging stumbles before and after the financial crisis.

Credit Suisse broke new ground in creative accounting with its latest quarterly results, published today, as it sought to highlight its viable core business from the various “non-strategic” parts of the group that it will wind down in the coming years. (Those non-strategic parts are a random assortment of unloved activities within the investment banking and asset management units.) The bank reported a 2% rise in fourth quarter net profit, missing market expectations thanks largely to a chunky legal charge. But if you strip out this and a host of other inconvenient missteps from the headline numbers, what the bank terms its “underlying” and “strategic” earnings are much more flattering.

Over the past year, Credit Suisse’s share price has been flat, while rival UBS has gained some 16%. Arguably, this is in part because UBS has been more successful cutting itself down to size—and, to be fair, it had more to cut after making bigger missteps than its Swiss rival. As both UBS and Credit Suisse face comparable pressures—strict new regulations, eroding fixed-income businesses—a side-by-side comparison of the Swiss banking giants is revealing.

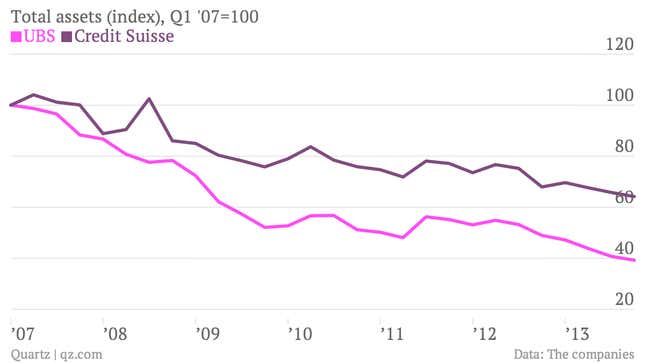

In terms of sheer size, UBS is only 40% as large as it was at the start of 2007, as measured by total assets. Credit Suisse’s shrinkage has been less dramatic over this period.

A similar pattern applies to risk-weighted assets, with UBS trimming these assets by 13% over the past year, more than double the pace of reduction at Credit Suisse. This is also reflected in value-at-risk, a measure of how much money the firm can lose in a day of trading, which is falling faster at UBS’s investment bank than at Credit Suisse’s equivalent division.

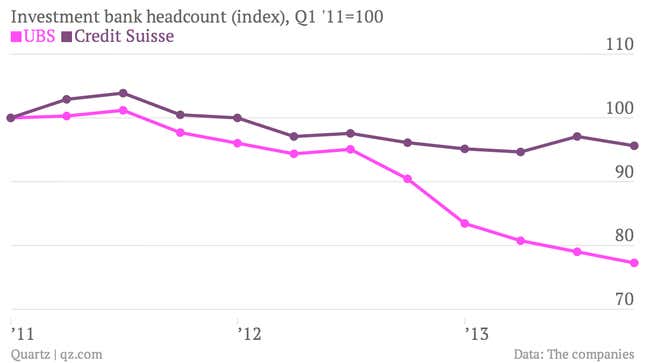

UBS has been much more aggressive in reducing headcount. It has pledged to cut some 6,000 employees from its ranks at the end of 2013, with further heavy cuts expected at its investment bank.

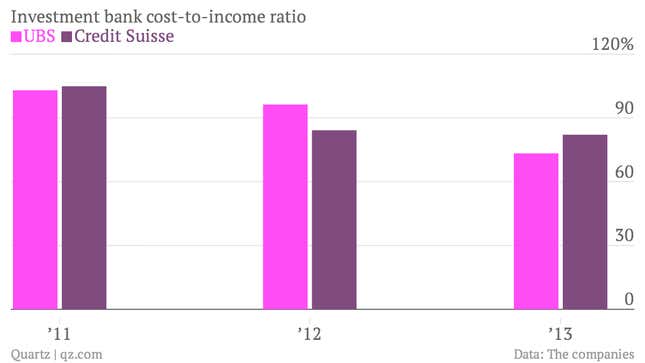

Thanks to this aggressive restructuring, UBS has made more progress in reducing the cost-to-income ratio at its investment bank, a key measure of efficiency. Credit Suisse, meanwhile, missed its 70% target badly in its latest quarter, instead recording a 101% cost-to-income ratio. Worries are growing about its ability to contain costs in its capital markets business.

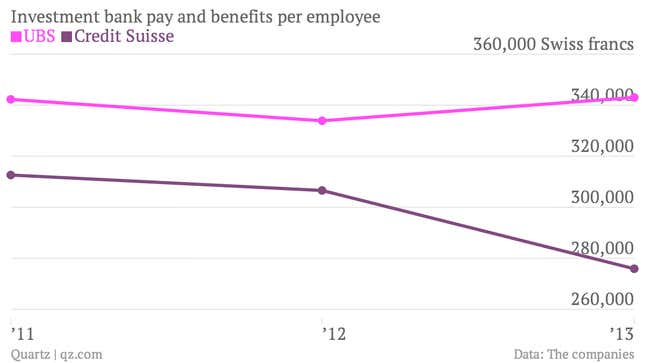

But declining costs at these investment banks do not necessarily imply lower pay for the bankers that survive the cull. Pay per employee at UBS’s investment bank has remained steady over the past few years, while it has drifted downwards at Credit Suisse. To the extent that an investment banker’s pay reflects their abilities—a debatable notion—this could represent another point scored by UBS on its biggest local rival in the race to squeeze more value out from a smaller, safer base of operations.