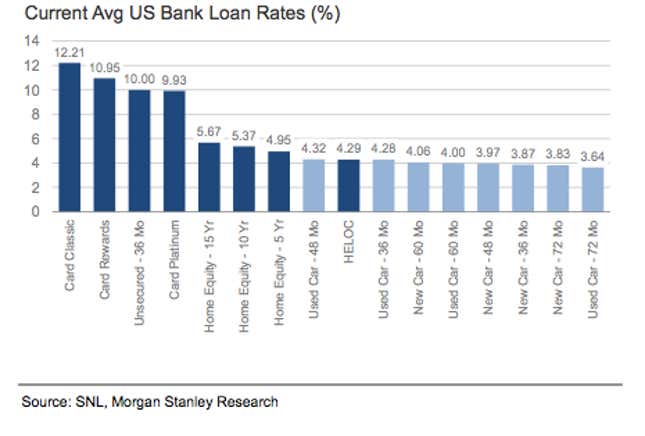

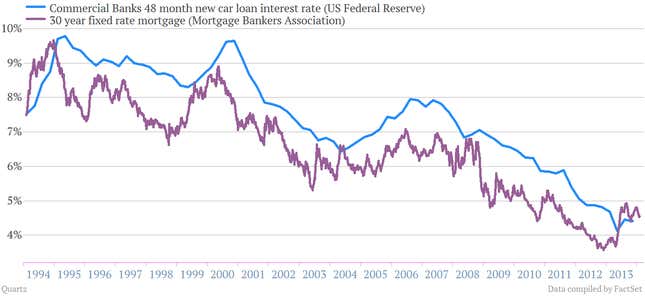

The cheapest form of consumer financing currently available in America is a car loan. But it wasn’t always thus. In fact, for the better part of the past 20 years, car loans have had higher interest rates than home loans.

In other words, extremely cheap financing for cars, which are underpinning booming vehicle sales, can’t be fully explained by record low interest rates across the entire US economy. Some of the dynamics at play include shifts in spending patterns—into cars and improvements to existing homes and away from new homes—and relatively loose lending standards in the auto-market.

At any rate, as we’ve previously discussed, there are reasons to keep an eye on the boom in auto lending, which is showing some signs of being in a bubble.

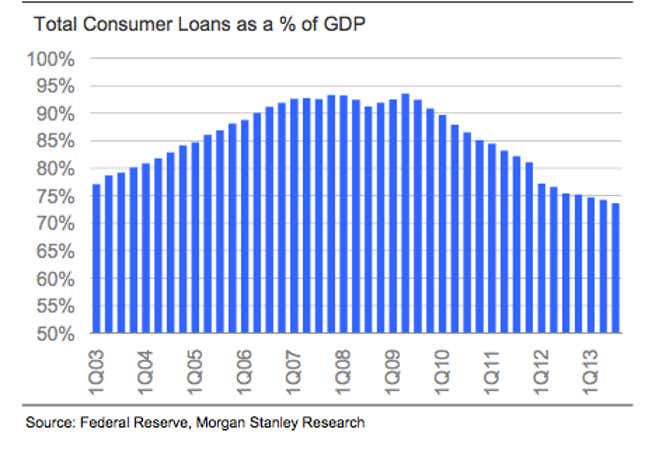

Yet analysts at Morgan Stanley, for their part, think it could have further to run. They base this view on a simple equation: Banks have room to lend more (loan to deposit ratios are still well below pre-crisis peaks), and consumers also have room to borrow more. As the below chart shows, while auto loans might be up, overall consumer borrowing is also way below its pre-crisis peak:

Because auto loans are so much cheaper than other loans, that’s where consumers are most likely to borrow as the economy improves, Morgan Stanley argues. America’s automakers, whose share prices have been under pressure so far in 2014 (General Motors is down 14% year to date), certainly hope so.

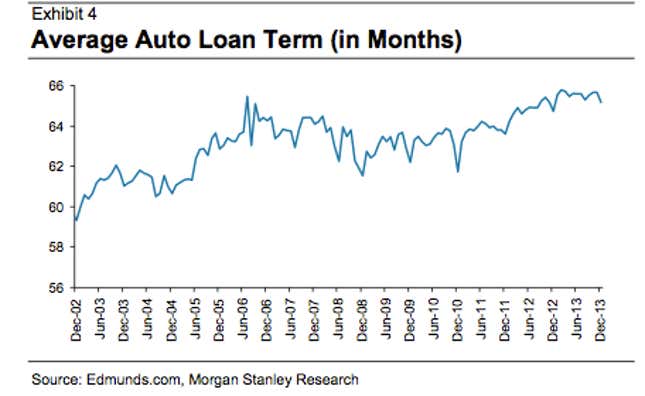

Another interesting point identified by Morgan Stanley is that the average term of auto loans is getting longer. Just over a decade ago, the average term of a car loan was less than 60 months. Now it is above 65 months.

In one sense, this is encouraging, as it keeps a lid on the size (but not the duration) of the monthly repayments on a car loan. But we can’t help but feel that the chickens are going to eventually come home to roost in the car market. This quote has a particularly eerie ring to it: “Consumers tend to buy their cars like they buy their houses. Lower payment, bigger car. Longer payment terms, bigger car,” the Morgan Stanley analysts write. “Everyone wins as long as credit keeps flowing and consumers keep buying.”