November sales figures for Detroit’s “big three” automakers are out, and like last month, they’re looking good:

- Ford has its best November since 2004, selling more than 190,000 vehicles, up 7% from last year.

- GM’s sales surged by 16%, the best November for the company since 2007.

- Chrysler’s sales were also up 16% compared to a year ago, its strongest November in six years.

It’s a good sign for the US economy, given that automakers are both a huge employer and a major customer for other industries. It’s also further vindication for the Obama Administration’s 2009 bailout of the sector.

But as we’ve previously discussed, there’s good reason to be at least slightly concerned: The boom in auto sales coincides with a massive increase in cheap auto loans, many of which are subprime. These loans are packaged together and sold on to increasingly yield-hungry investors. Issuance of securities backed by subprime auto loans have more than doubled since 2010 to $17 billion this year, but remain below their 2005 peak, Businessweek reports, citing Deutsche Bank.

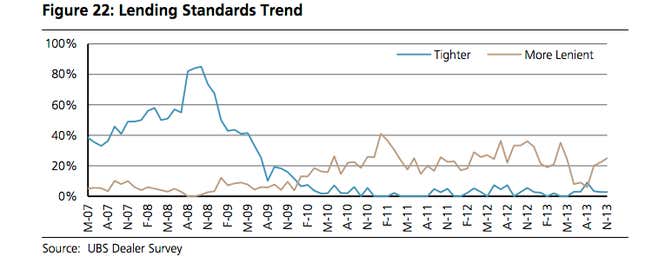

What’s more, a recent survey of auto dealers by UBS found that lending standards for financing auto purchases have been easing since mid-year. The chart below shows the percentage of auto dealers who think lending standards are getting tighter versus more lenient:

Neither Wall Street or Main Street seems all that concerned. UBS is forecasting a record year for GM in 2014, with its North American profit to increase by some $2 billion, up 27% from this year. Auto dealers, according to the UBS survey, expect industrywide car sales to increase by 2.6% in 2014.

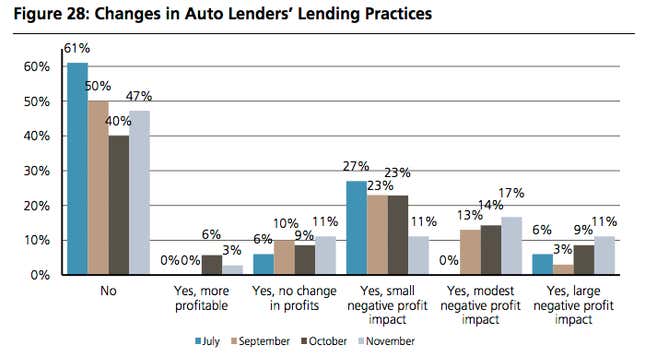

Of course, surging auto debt comes at a time when falling credit card debt has been falling sharply. Slate’s Matt Yglesias has argued that credit card lending standards have tightened far more than auto lending standards have since the financial crisis. He puts this down to the greater strength of the car lobby relative to the banking lobby. The UBS survey supports this notion. Most dealers say warnings from the Consumer Financial Protection Bureau have had no impact on lending practices this year, as shown in the chart below.

The pressing question these numbers raise is whether consumers are shifting their spending and debts from credit cards to auto loans. The New York Fed’s latest household debt and credit report shows that while housing debt has fallen since 2008, non-housing debt, which includes credit cards and car loans, is actually back at pre-crisis highs. If consumers are piling up on auto loans, the economy may have moved on to its next bubble.