Diet Coke isn’t saving the soda industry like it was supposed to

Diet soda was supposed to save the soda industry in a world worried by sugar. Instead it’s only dragging it down.

Diet soda was supposed to save the soda industry in a world worried by sugar. Instead it’s only dragging it down.

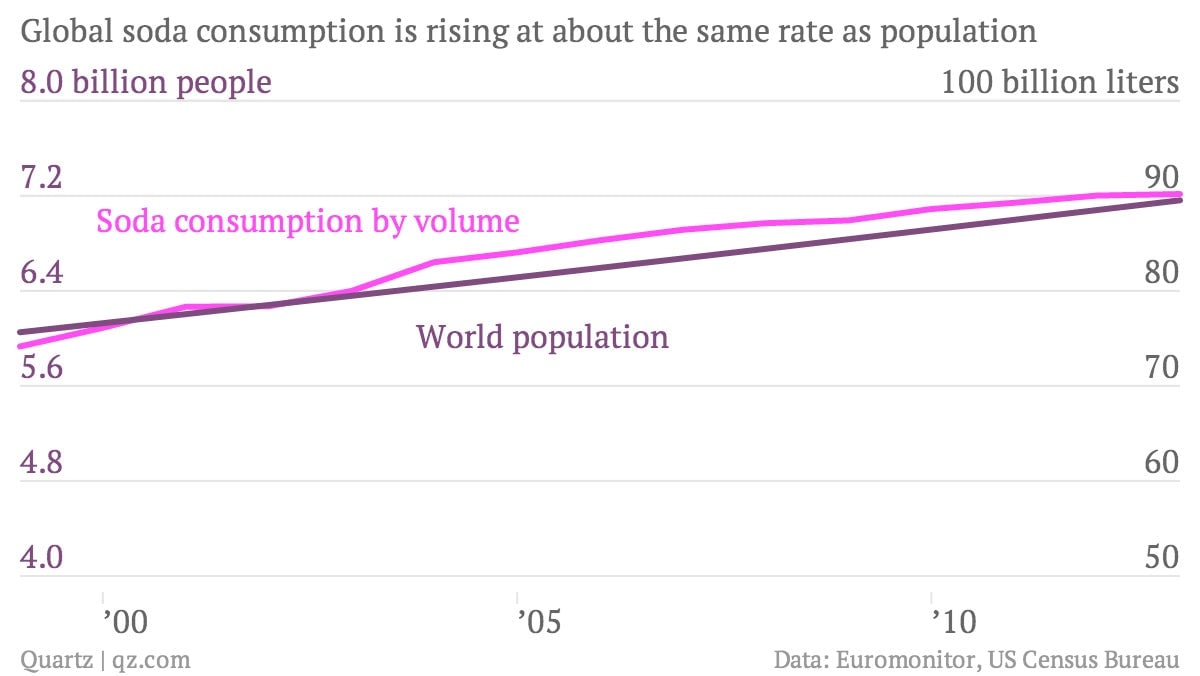

Global soda sales are effectively flat. Since 2000, they’ve risen by about 18%, the same as the global population.

The US in particular, has been weighing the industry down.

American consumption of fizzy drinks has dipped in each of the past five years, and by 30% since the turn of the century. By 2018, it is expected to have fallen by 40% since 2000, according to data from Euromonitor.

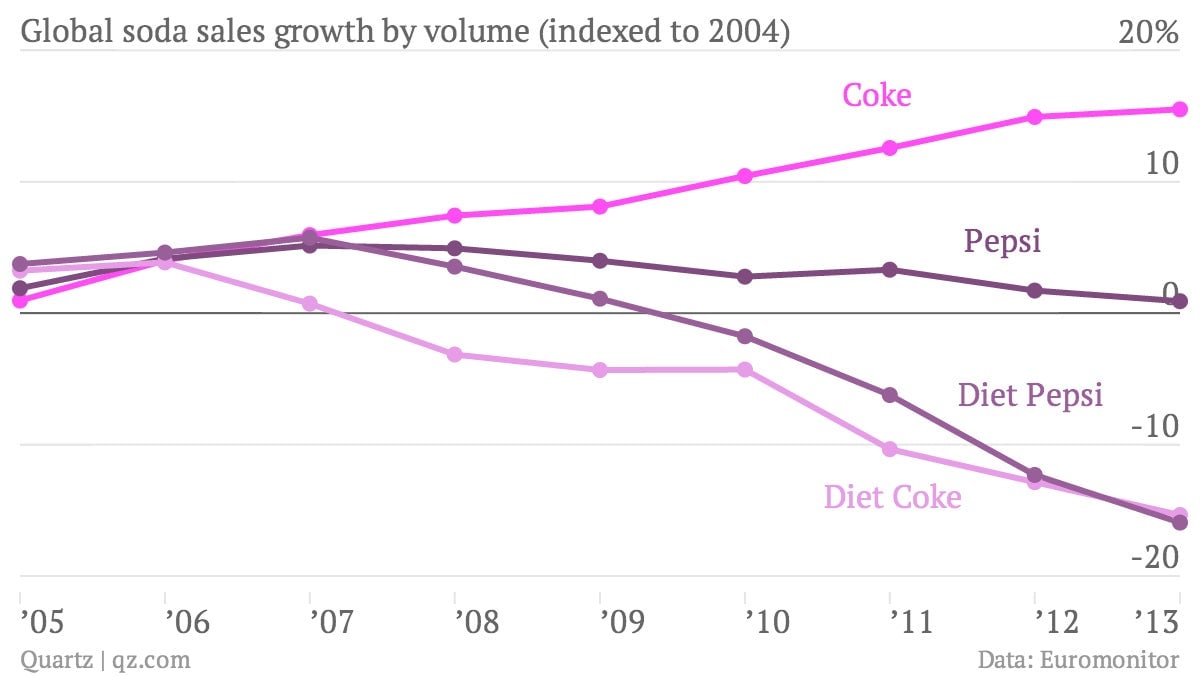

But surprisingly, it’s Diet Coke and Diet Pepsi leading that downward trend. Regular Coca-Cola consumption is climbing, and regular Pepsi consumption is roughly where it was a decade ago, but diet soda consumption for both brands is tanking. Have a look:

Coca-Cola and Pepsi are easily the world’s two largest carbonated beverage brands—together, they account for 55% of the soda the world drinks, per Euromonitor’s data. And Diet Coke and Diet Pepsi together account for roughly 10% of global soda intake. So the tumble in diet soda sales is a big deal for the two soda behemoths. Slow US sales have been ”largely due to softer Diet Coke volumes,” according to Coca-Cola CEO Muhtar A. Kent.

The slowdown of diet sodas is especially surprising given that sugar substitutes like aspartame were supposed to help counter a shift away from regular soda by consumers. But concerns about artificial sweeteners have proved just as potent as those surrounding sugar. Food and beverage companies are using more and more of them, but a handful of studies (paywall) show that consumers are only becoming more wary.

“People are turning away from sodas because of artificial sweeteners,” Jonas Feliciano, industry analyst at Euromonitor, told Quartz in an interview. US store sales of low- and no-calorie soda dropped another 6.8% in the 12 months leading up to November last year, according to the Wall Street Journal. Drops in diet soda sales have dwarfed those in the regular category. ”The industry was banking that lower-calorie sodas would help soda sales, but they haven’t,”

The global disinterest in diet sodas hasn’t, of course, been lost on the world’s two largest soda brands. “All of our $1 billion sparkling brands, except for Diet Coke and Coca-Cola Light, grew in 2013,” Coca-Cola’s Kent said in an earnings call last week. As for Pepsi, the last time the company spoke of Diet Pepsi in an earnings call was back in 2011, when CEO Indra Nooyi assured investors that the company was going to start investing more in it.

Neither Coca-Cola nor Pepsi responded immediately to requests for comment.