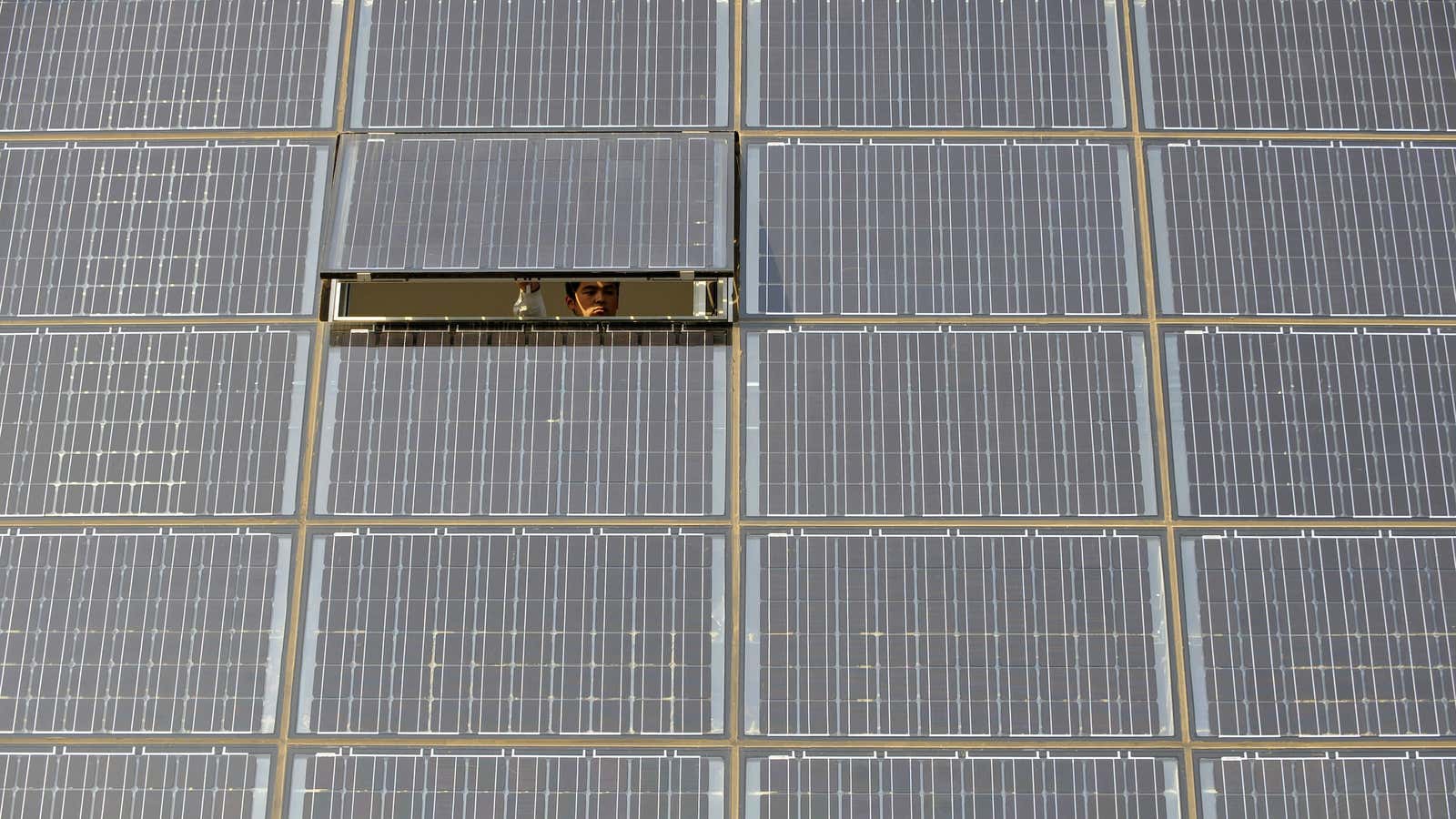

Chinese solar equipment maker Shanghai Chaori Solar Energy Science just missed a deadline to make interest payments of 89.8 million yuan ($14.7 million) on its corporate bonds, becoming the country’s first company to ever default. Shanghai Chaori warned earlier this week it was having difficulty raising enough funds to make the payment, according to the Wall Street Journal (paywall).

Some analysts have labeled this looming default China’s “Bear Stearns moment.” But in the long run, Beijing allowing a company to fail—especially one that is relatively small—could actually be a really good thing for China’s financial system. As Quartz’s Gwynn Guilford reported earlier this week:

Specifically, the default of Shanghai Chaori Solar Energy on its 1-billion-yuan ($163-million) bond might help speed the pace of market reform. If the government refuses to bail out the maker of solar cells and panels, this will be the first bond default in the People’s Republic of China’s history. Yes, that’s right: in China’s whole $1.5-trillion publicly traded corporate-debt market, no company has ever defaulted.

Letting this default happen could be a massive deal for a couple of reasons. For one, a default will force the market to start pricing in risk, explains Leland Miller, president of China Beige Book (CBB) International, a research firm.

“Anything that can inject risk in the system and differentiate what is backstopped and not backstopped is a very good thing for China,” says Miller. “Right now everyone thinks the banks are backstopping everything and that the government is backstopping [the banks]. And that’s very, very dangerous, especially in a year where you’re likely to see a lot of defaults.”

Read the piece in full here.