If you own a Roku, you’re likely using it more than you ever have before.

Roku Inc., manufacturer of the popular streaming media devices, reported its second-quarter earnings yesterday (pdf). The company revealed its users watched a combined 14.6 billion hours of TV and movies during the period—an increase of 2.3 billion hours from the previous quarter.

Broken out across the number of active Roku accounts—43 million, up from 39.8 million in the first quarter—the average Roku user streamed 339.5 hours of content in that period, or the equivalent of 14 days. In other words, Roku users spent almost 16% of their lives this spring using their Roku boxes.

The 339.5 hours streamed per account were easily a quarterly record. That was up 10% from the prior quarter, up 18% from the same quarter in 2019, and up 46% from the same quarter in 2017.

Accordingly, Roku’s average revenue per user was also up 18% year-over-year, to $24.92. The company said its advertising business grew in the quarter as advertisers increasingly shift their spending from traditional TV to streaming—accelerating a trend that existed even before the pandemic. Monetized video ad impressions were up 50% from the same period last year.

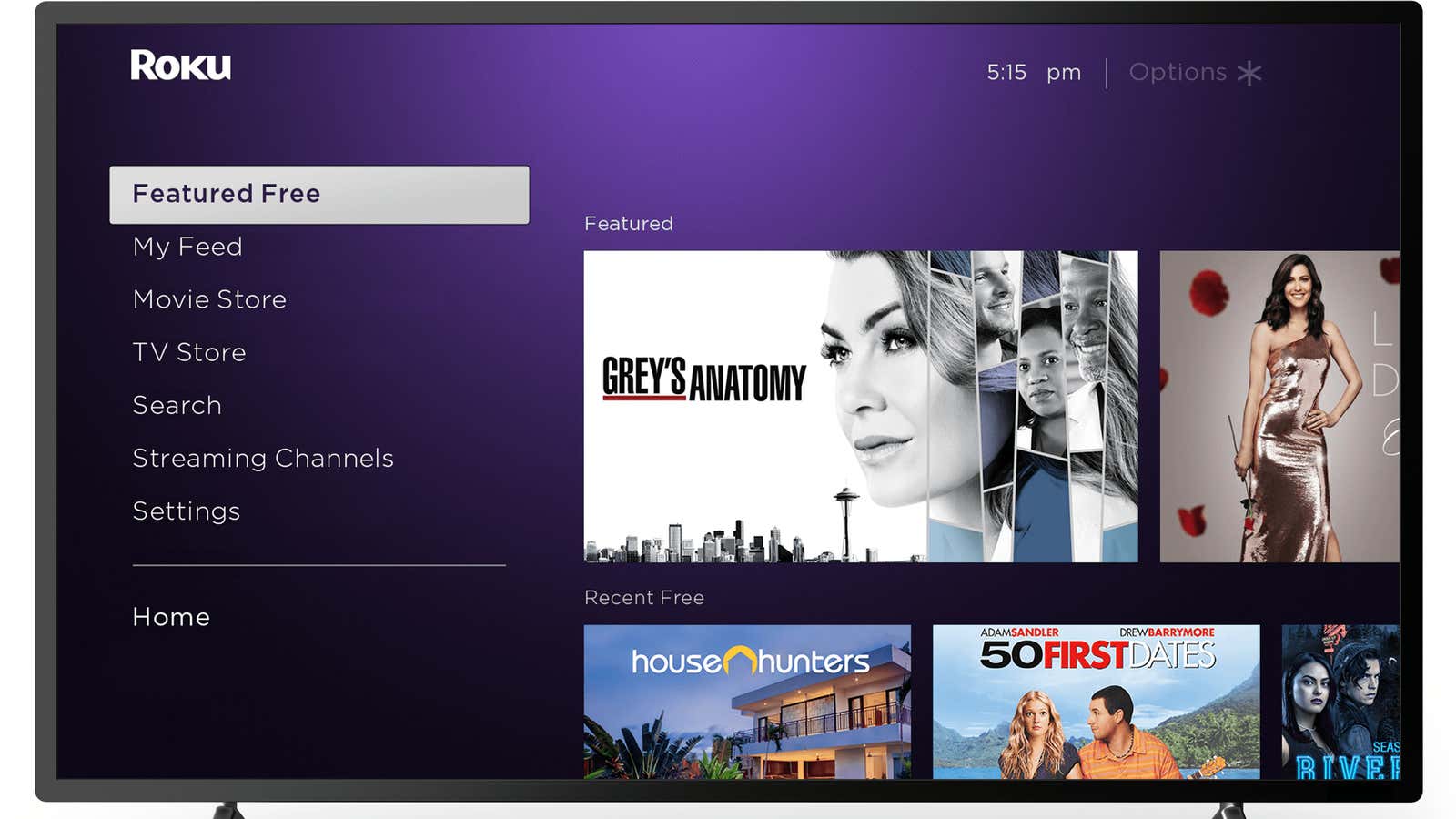

Most ads on Roku exist on the home screen and its free channels, but recently some users have complained about an increase in interactive pop-up ads during some commercials.

“As economic pressures caused advertisers to further re-evaluate how much and where to invest media dollars, Roku delivered strong growth in our ad business, particularly relative to the overall TV ad market that was down,” the company said in a letter to investors. TV ad spending in the US declined 29% year-over-year, Roku added, citing data from the media intelligence firm Magna Global.

The math is simple. The more time users spend streaming on Roku, the more advertisers want to advertise there and the more revenue Roku generates. The company said engagement with the platform peaked in the middle of the quarter, but still remains higher than what it was before Covid-19.

Though streaming and traditional television are clearly headed in opposite directions, Americans, at least, still watch more regular TV. Driven by older age demographics, US viewers on average watched 3.5 hours of live or on-demand TV per day in 2019, versus only 38 minutes spent streaming.

But the pandemic has closed the gap. Without live sports for most of the past four months, Americans have continued ditching their cable TV packages. AT&T’s base of TV subscribers has eroded 18% in the last year alone. Comcast and other major cable providers have posted similar declines in recent months. Soon, there won’t be a gap at all. Streaming will be the predominant form of TV consumption, and Roku appears ready to capitalize.

Correction: This post has been updated to reflect that Roku has 43 million accounts globally, not just in the US.