Seven economic charts of the week that you really should see

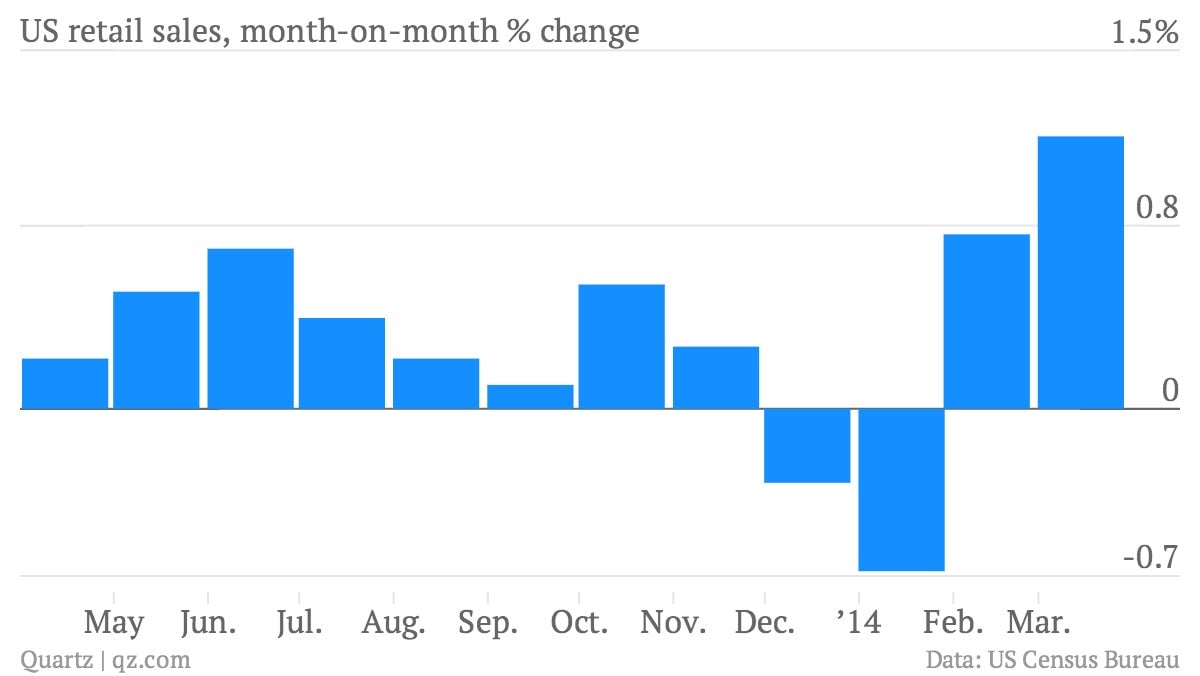

In March, US retail sales posted the biggest month-on-month gain since May 2012.

US retail sales were strong

- In March, US retail sales posted the biggest month-on-month gain since May 2012.

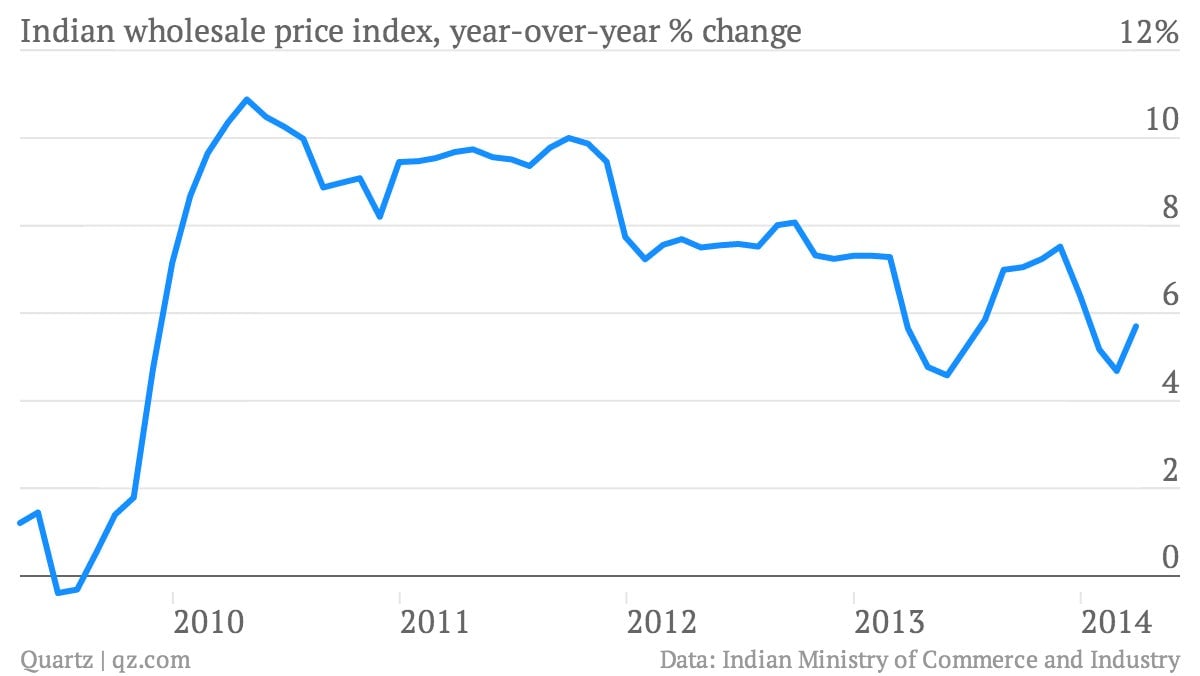

Indian inflation ticked up

- The country’s gauge of wholesale prices for March rose 5.7% on increasing food prices. But observers still think that the Reserve Bank won’t need to hike rates just yet.

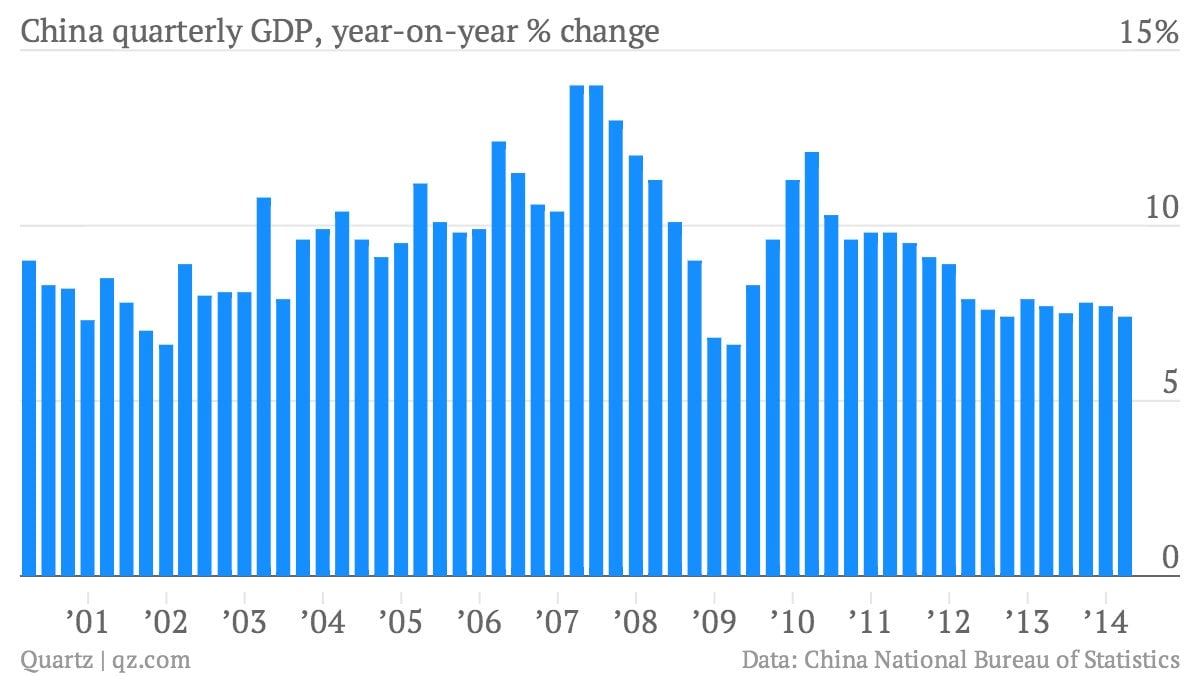

China’s economy slowed

- Economic output grew 7.4% year-on-year in the first quarter. That’s the slowest rate since the third quarter of 2012. But Chinese stocks rallied on expectations the government would respond to the slow growth by pumping in more stimulus.

UK unemployment hits a five-year low

- Even more amazing, real wages kept pace with inflation in the UK for the three months through February. It remains to be seen whether signs of pep in the British economy will be enough to keep prime minister David Cameron’s Conservative-led coalition in power.

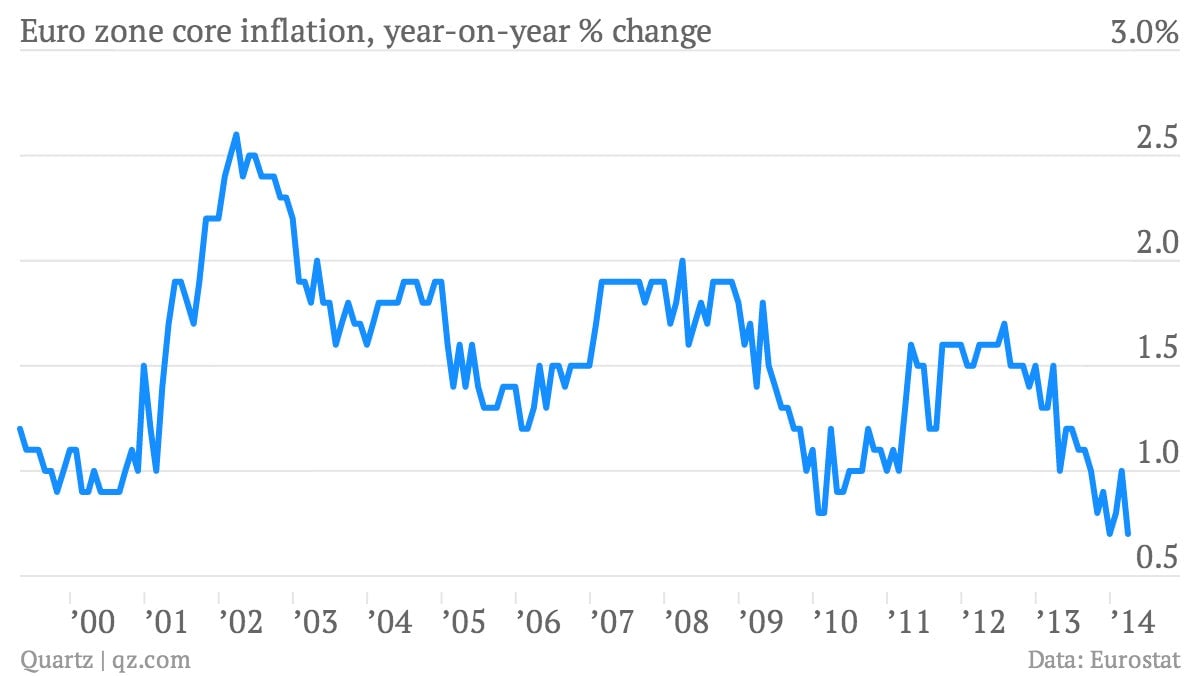

Europe continues courting deflation

- A second look at core inflation—price rises excluding noisy categories such as food, energy, tobacco and alcohol—showed euro zone price increases were even softer than first thought in March. Core euro-zone inflation was 0.7% during the month, compared to the prior year. It was 1.0% in February. Deflation—an economically debilitating, widespread decrease in prices—seems a real risk.

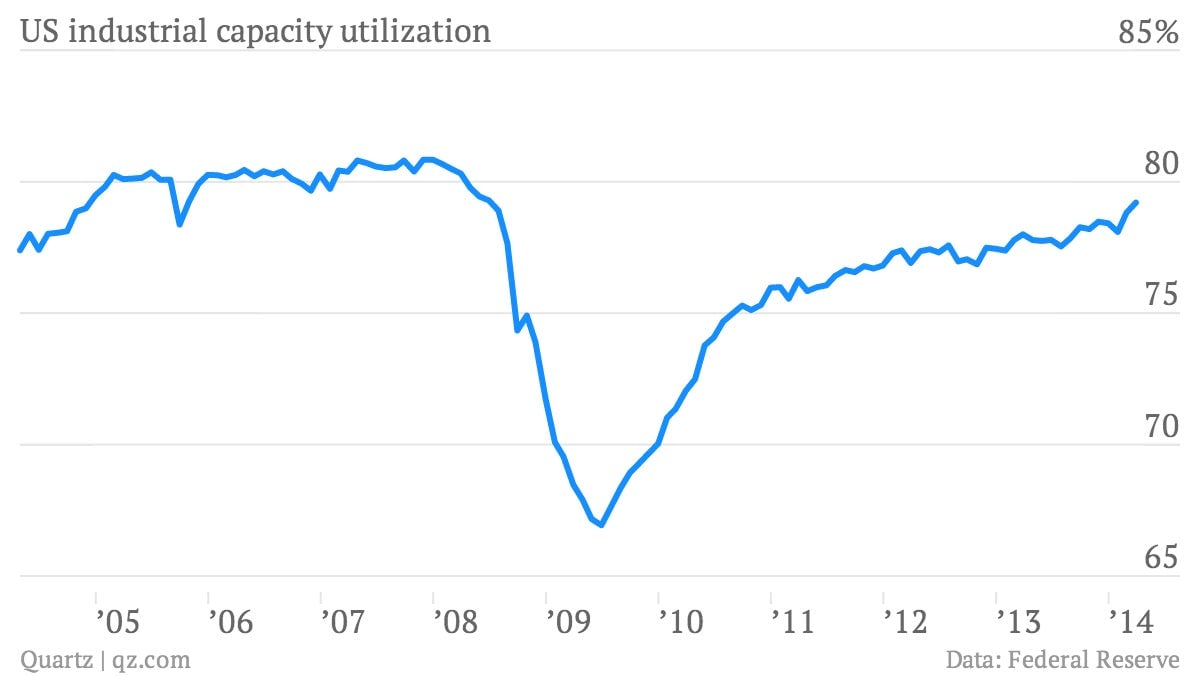

US capacity utilization hits post-crisis high

- Low capacity utilization is traditionally seen as an indicator that companies can put more of their people and equipment to work without setting off an inflationary spiral of wages and prices. In normal times, especially high utilization rates could put pressure on the Federal Reserve to raise interest rates. But in a speech Wednesday, Fed chair Janet Yellen emphasized that she remains more concerned about economic slack and persistently low inflation, rather than the risk of rising prices, which suggests interest rates will stay low for a while longer.

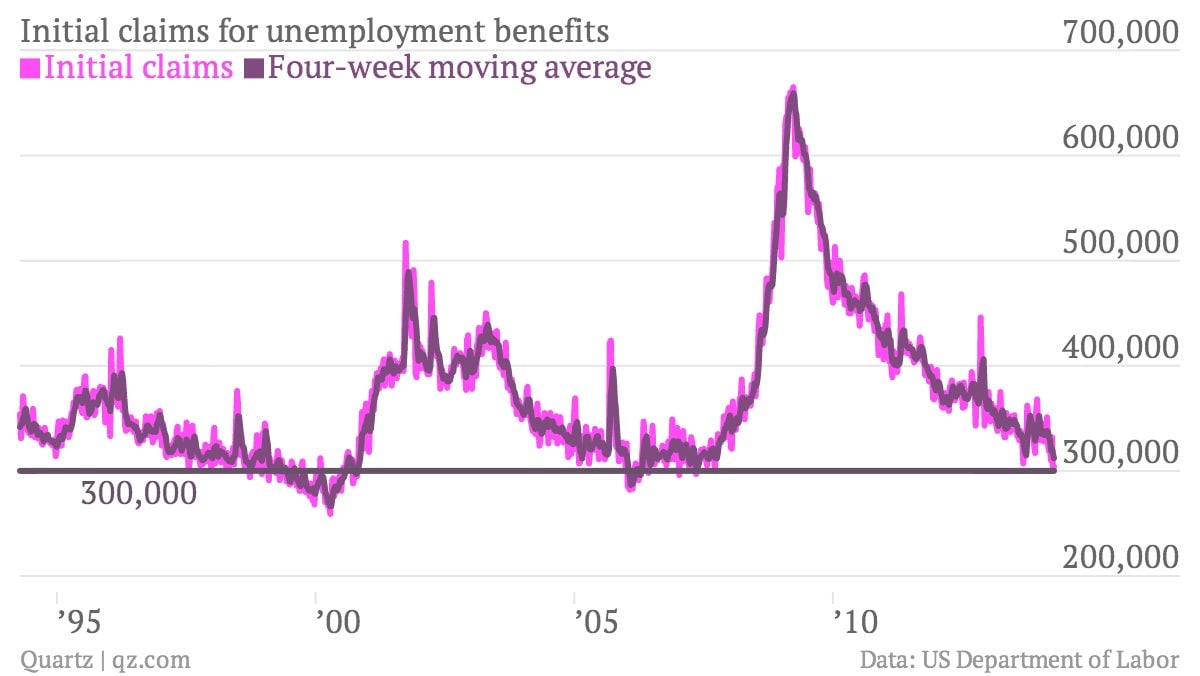

US job market shows strength

- Weekly jobless claims stayed at their lowest levels since the financial crisis. Jobless claims this low are a throwback to the ”boom” times in the late 1990s and before the financial crisis hit.