Deutsche Bank delivered a solid set of earnings, if you ignore all the bad stuff

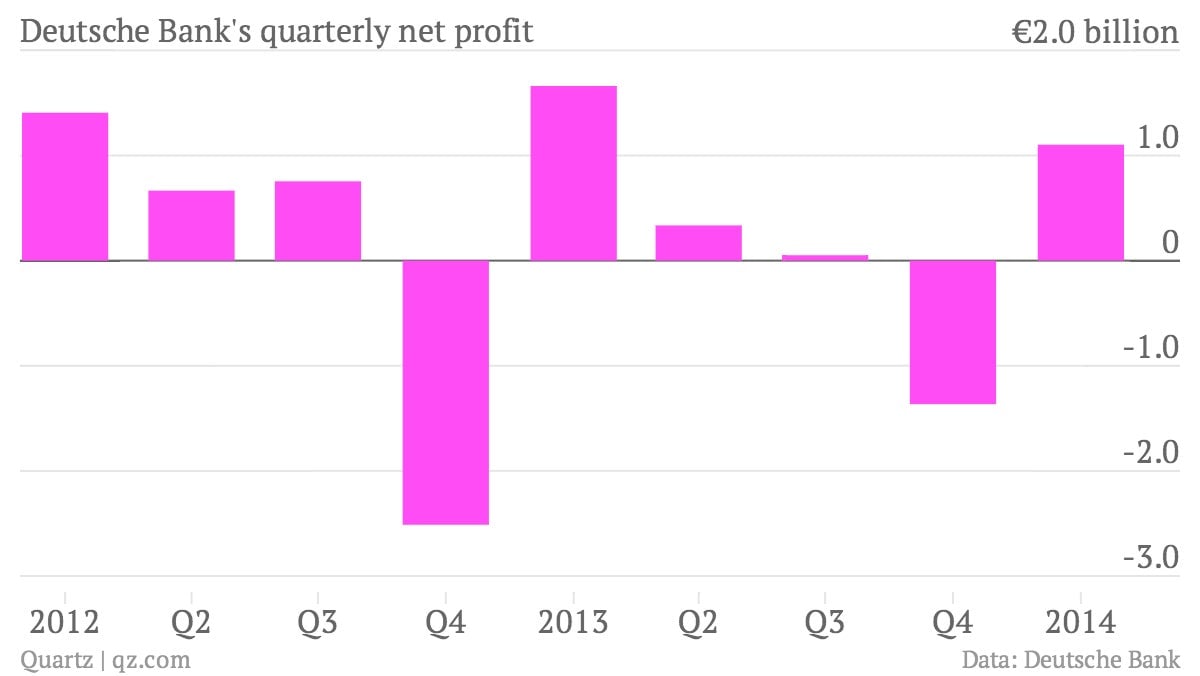

The numbers: Solid, at first glance. The German banking giant’s first-quarter profit fell by 34%, but beat analyst expectations. Its share price jumped by more than 3% on the news.

The numbers: Solid, at first glance. The German banking giant’s first-quarter profit fell by 34%, but beat analyst expectations. Its share price jumped by more than 3% on the news.

The takeaway: The steady decline of debt, currency, and commodity trading has lowered the bar for global investment banks, and Deutsche Bank’s trading unit, which accounts for nearly 30% of group revenues, managed to surpass these more modest estimates. The bank’s fixed-income, currencies, and commodities unit saw sales fall by 10% in the first quarter, a stronger result than all of its Wall Street rivals aside from Morgan Stanley.

What’s interesting: Dig into the details and Deutsche Bank’s performance is less robust than it appears. Like other banks, the bank quarantines its most toxic assets in a “non-core” unit to be be wound down or sold off. This accounting maneuver flatters what’s left in the “core” business, which is naturally what the bank emphasizes in its earnings reports. In the first quarter, reclassifying a big chunk of the bank’s faltering commodities business as ”non-core” boosted what was left behind; adding this back to the group’s “core” trading results would have produced a 16% decline in revenue at the unit, a more pedestrian performance in comparison with its peers. The group also avoided significant legal costs and didn’t add to its €1.8 billion ($2.5 billion) litigation reserve in the quarter. But considering that the bank’s ongoing legal issues run to four full pages in its earnings report, this is unlikely to be repeated in future quarters.