When the latest SARS-CoV-2 variant, dubbed omicron, emerged from southern Africa on Nov. 26, the World Health Organization quickly urged the world to avoid “knee-jerk responses.” Oil traders didn’t get the memo.

By the end of the day, oil prices had fallen more than $10 per barrel, the biggest one-day drop since the calamity of mid-April 2020, when the first global lockdowns briefly sent prices negative for the first time. Oil traders are increasingly on edge about new coronavirus variants, having seen the havoc they can wreak on the global economy, and were keen to sell off their holdings before demand started to evaporate. In August, after many countries temporarily returned to lockdown measures in response to the Delta variant, the International Energy Agency curtailed its expectations for oil demand growth for 2021 by 9%.

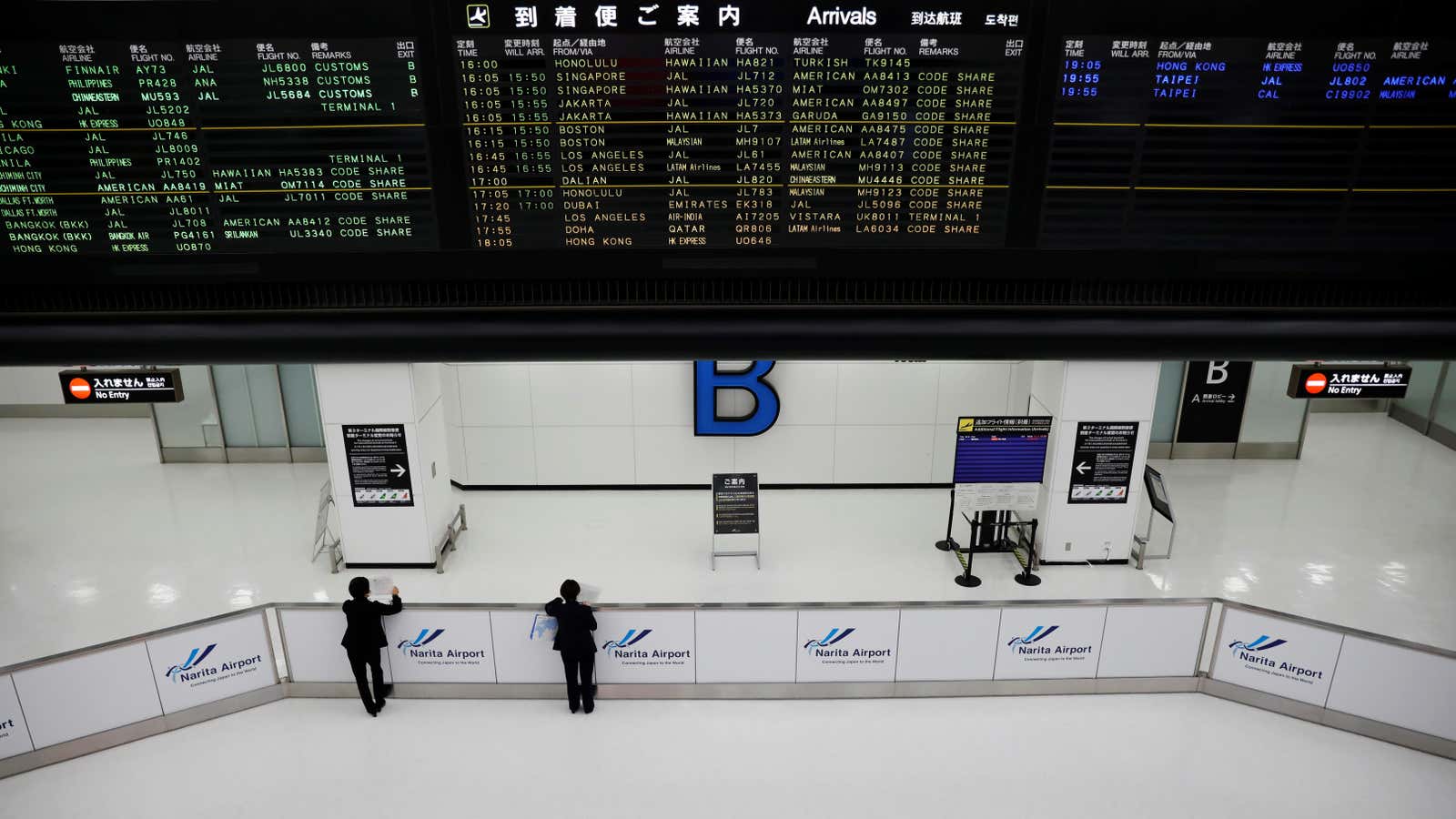

Oil traders are particularly worried about the omicron reaction in China, which has tended to implement some of the world’s strictest lockdown measures and is thus highly influential on the oil demand outlook, especially for aviation fuel, Louise Dickson, senior oil market analyst at the market intelligence firm Rystad Energy, said in a note.

But by Nov. 29, the oil price was already rebounding—a sign that many traders think their peers overreacted, and are betting that omicron won’t prove too devastating.

“Omicron caused a market panic that elicited memories of the April 2020 price plunge, but now that the calculators are out and fundamentals being assessed, the price drop is being met with a flurry of cool-headed and more calculated buying,” Dickson said. “New lockdowns have been a salient threat to oil demand and prices, but pricing this [negative] has been on the back-burner until suddenly the kitchen was on fire, or at least perceived to be on fire.”

How OPEC will respond to the omicron variant

In spite of the new variant, US officials are sticking with their plan to release oil from the Strategic Petroleum Reserve (SPR), in a bid to tamp down high gasoline prices. That means the market will already be saturated by Dec. 2, when the Organization of Petroleum Exporting Countries will meet to consider whether to forge ahead with a planned increase in its monthly production quota.

OPEC countries are usually keen to pump out more oil, but throughout the pandemic have had to carefully avoid sending the price back into freefall. OPEC officials from Russia and Saudi Arabia said on Nov. 29 they weren’t especially worried about omicron. But with the added pressure of the SPR release, Dickson said there’s a good chance the group will vote to pause or curb its quota increase, and give itself another few weeks to see how the world responds to the new variant.