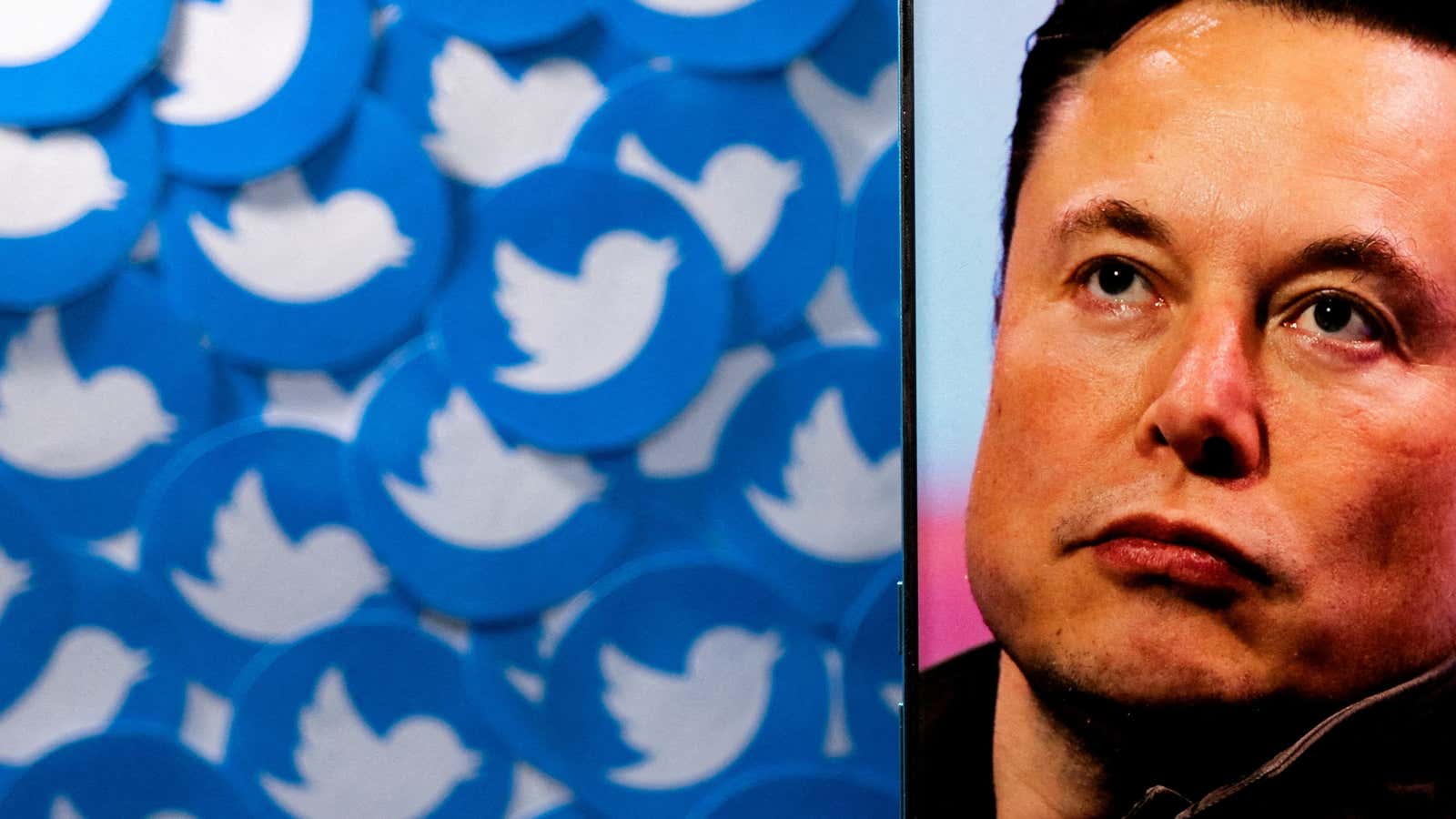

On May 17, Twitter filed new documents with the US Securities and Exchange Commission, which included a detailed timeline of its sale to Elon Musk. This history, a retrospective by Twitter’s lawyers, shows how each side operated during deliberations that hardly seemed likely until the deal was announced on April 25.

The disclosures show Twitter carefully evaluating Musk’s proposal while navigating the caprices of the market, Musk’s unpredictable behavior, and a stream of critical tweets from the company’s would-be buyer.

What follows is a timeline of events about the social media company’s pending $44 billion sale to Elon Musk as told by Twitter and summarized by Quartz.

March 2022

The company refers to Musk as an “active user of the Twitter platform,” avoiding any mention of his role CEO of Tesla and SpaceX, his 94 million followers, or his settlement with the US Securities and Exchange Commission to accept a “Twitter sitter” so he isn’t manipulating the market with his tweets.

In March, Musk tweeted about “Twitter’s business…functionality, and…content moderation policies” and polled his followers on whether or not they thought Twitter’s moderation embodied the principles of “free speech.”

March 26, 2022

Musk spoke with Twitter co-founder Jack Dorsey, a current board member and former CEO, about “the future direction of social media, including the benefits of open social protocols.” (Twitter is funding an independent social media protocol called Bluesky with the interoperability of email.)

Musk also discussed joining the Twitter board with Egon Durban, co-CEO of the private equity firm Silver Lake, a Twitter board member who Musk had worked with in the past. On the call with Durban, Musk also disclosed he purchased a “significant stake” of more than 5% of Twitter stock. Musk surpassed 5% ownership in Twitter on March 14 but did not report it to the SEC until April 4, likely violating securities laws in the process.

March 27

During a call with Twitter board chair Bret Taylor and CEO Parag Agrawal, Musk discussed joining the Twitter board and other arrangements—taking Twitter private or starting a rival social media service. Starting a rival service would have been an odd move for Musk who, while publicly disagreeing about how Twitter is run, had just bought a significant portion of its stock. Musk discussed these options in two other meetings with board members in the coming days.

April 2

Twitter’s Nominating and Corporate Governance Committee recommended that the board invite Musk on as a member considering his interest in Twitter’s business, its ownership stake, his “active use of the Twitter platform,” and his “technical expertise” and perspectives.

April 3

The Twitter board considered the nominating committee’s recommendation and the “potential for adverse impacts on stockholder value” if Musk took the company private or started a rival service, and decided to offer him a board seat. (Two conflicts of interest were disclosed: Dorsey said that he and Musk are “friends” and Durban said he had worked on “unrelated matters” with Musk in the past.)

But Twitter’s offer came with strings attached: Musk would need to agree to “standstill” provisions that would limit his ability to speak publicly about Twitter or make unsolicited offers to buy the company without the board’s approval.

April 4

Musk refused to limit his public statements about Twitter and publicly disclosed that he owned about 9.2% of Twitter stock. Musk agreed to a cap on how much Twitter stock he could amass—no more than 15% without board approval.

But this arrangement would come with strings attached. As an officer of a public company, Musk faced legal restrictions on what he could say publically as a board member whether he signed the agreement or not. This might have spelled trouble for Musk, a keyboard warrior whose tweets have repeatedly gotten him into trouble with the SEC.

April 5

Twitter announced that Musk is joining the Twitter board.

That same day, Musk called Dorsey, who said he feels that Twitter would be better off as a private company. As Dorsey’s board seat expires in the coming months, Musk invited Dorsey to stay on and Dorsey declined.

This appears to be the turning point. Beforehand, Musk was ostensibly considering a board seat, but a conversation with Dorsey may have led Musk to reject the board seat and take Twitter private.

April 9

Musk rejected the board seat and told the board he would instead make an offer to take Twitter private.

April 12

Twitter’s board met with its lawyers as well as financial advisors and discussed the potential impact of Musk’s offer or a decision to decline it. The board, for the first time, discussed a shareholder rights plan—better known as a poison pill defense—which would make Musk’s shares worthless and make it nearly impossible for him to execute a hostile takeover of the company.

April 13

Musk sent his acquisition offer to Taylor, seeking to buy the company at $54.20 per share—about $44 billion. Here’s the text of that letter:

Bret Taylor

Chairman of the Board,

I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy.

However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company.

As a result, I am offering to buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter and a 38% premium over the day before my investment was publicly announced. My offer is my best and final offer and if it is not accepted, I would need to reconsider my position as a shareholder.

Twitter has extraordinary potential. I will unlock it.

Elon Musk

April 14

After announcing his offer, Twitter said, Musk tweeted comments that “led the Twitter board to believe Musk might commence an unsolicited tender offer.” One tweet just said, “Love me tender.”

Some unnamed companies expressed interest in buying or financing the purchase of Twitter, but none submitted formal proposals to do so.

April 15

Twitter adopts the poison pill, buying it time to consider Musk’s proposal.

April 17

Taylor spoke with Twitter’s largest institutional shareholders, each of whom encouraged him to “seriously consider” the deal.

April 19

Twitter executives presented the company’s current business plans and financial projections, as an alternative to Musk’s offer.

April 21

Musk announced that he secured $46.5 billion in financing for the acquisition, the first real assurance that Musk would be able to buy the company.

April 23

Musk told Taylor that his offer was his “best and final” and said he would be willing to take his proposal to shareholders. Musk could have overcome the poison pill through a proxy battle, convincing shareholders to oust the Twitter board, and install a more sympathetic one to his offer.

April 24

The Twitter board discussed Musk’s offer in the context of the broader stock market, which dropped precipitously after Musk’s offer. But because of the $54.20 proposal, Twitter stock stayed fairly stable with the expectation that the deal would close. Weeks later, Musk seems to have buyer’s remorse and wants to renegotiate at a lower price. While there’s no indication Twitter will re-negotiate, the stock has fallen to about $37 per share.

Musk sent the following letter to Bret Taylor, the board chair of Twitter, urging him to accept the offer.

Bret Taylor

Chairman of the Board,

Thank you for the conversation yesterday.

We remain committed to our transaction with Twitter at $54.20 and appreciate your contact on the matter. As we discussed, $54.20 has been and will remain my best and final offer, period. This is binary – my offer will either be accepted or I will exit my position. At the time my $54.20 offer was made, it represented a 54% premium to Twitter’s share price prior to the day before my investment in Twitter began, and a 38% premium to the day before my investment in Twitter was announced. Since that time, the attractiveness of my proposal has only increased given the market’s continued correction. Had your stock traded inline with comparable social media companies, my offer would represent approximately 90% and 70% premiums to those times.

While I strongly believe that you should recommend my offer to shareholders based upon its superior value to the value of Twitter without my offer and my equity position, I recognize that you may elect not to do so. As such, I have attached a merger agreement that is “seller friendly” and that does not require you to recommend in favor of my offer. This will provide all shareholders a voice, and allow for a democratic decision consistent with Twitter’s ethos. With your cooperation, we can negotiate changes that you require to be able to announce a transaction before the market opens tomorrow that the shareholders can then vote on. I would respect the outcome of that vote if the shareholders prefer the management plan to my $54.20, and exit my position entirely if that is the outcome of the vote.

In order to provide further value and choice to shareholders (within the legal boundaries of a private, unlisted company), we are willing to explore options that allow existing shareholders (including convertible securities and other related instruments) to invest all or a portion of their proceeds into the proposed transaction. Any such rollover transaction would be structured as a separate negotiated transaction consistent with laws and regulations and not be a public offer, and would not affect the proposed $54.20 cash offer transaction.

My strong preference continues to be a negotiated transaction with you at $54.20 per share. I look forward to the board’s response to my proposal.

Elon Musk

If dumped his 9.2% stake in Twitter as noted in the letter, it would likely have driven down the company’s stock price.

April 25

In meetings, Twitter advisors Goldman Sachs and J.P. Morgan call the deal “fair from a financial point of view,” giving Twitter their sign-off.

Having decided to accept the deal, Twitter negotiates the terms of the agreement with Musk, which includes a few important provisions: (1) Musk has to “perform” the obligations of the contract, meaning Twitter can compel him to complete the purchase on the agreed-upon terms; (2) there’s a $1 billion termination fee Musk would have to pay if he violates the contract and Twitter wants to get out of the deal; and (3) it limits Musk’s public statements, saying he cannot disparage the company or its officials while the deal is closing.

Musk has since publicly criticized (if not disparaged) Twitter and its specific employees numerous times since signing the deal.

On May 13, Musk tweeted the deal is “on hold” as he confirms the share of fake accounts and bods on the Twitter.

Legally, there’s no putting the deal “on hold” even if Musk is considering pulling out. Twitter can go to court, if necessary, to complete the deal or extract a $1 billion penalty from Musk. If Twitter chooses to remove the obligation, there’s no penalty for pulling out of the deal.

Later that day, Twitter and Musk agree to the terms of the deal and announce it publicly.

May 4

Musk secures $6.25 billion in investment from third parties because Musk could not buy Twitter without selling large portions of his Tesla stock. Investors included venture capital firm Andreessen Horowitz, the crypto exchange Binance, and Oracle CEO Larry Ellison.