Hi Quartz members,

Elon Musk wants to buy Twitter. The billionaire CEO of Tesla and SpaceX bid $43 billion to buy the company and take it private, and on April 21 outlined his financing plans to get the deal done. While Twitter instituted a poison pill defense to make it a lot tougher and more expensive for Musk to execute a hostile takeover, he has nonetheless laid out some plans for Twitter under his control: He wants to promote unfettered free speech with less content moderation, lower the price of the subscription product Twitter Blue, and remove ads for subscribers.

In a text to Twitter board chairman Bret Taylor, disclosed in a filing to the US Securities and Exchange Commission, Musk said that the company “will neither thrive nor serve its societal imperative in its current form” and that he will unlock the company’s “extraordinary potential” by taking it private.

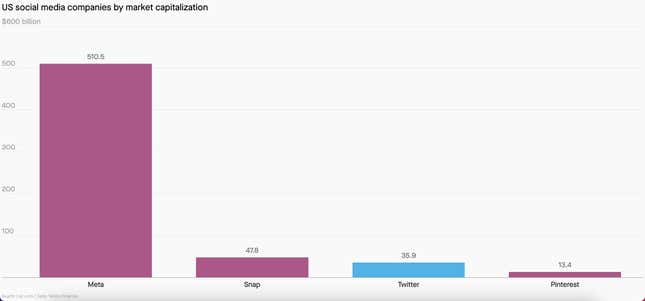

The brazen Musk has one thing right about Twitter. It has always been a company torn between its profit-maximizing business interests and its role as a hub for news-making discourse on the internet. For all its flaws, Twitter is a better product than it is a business. So how can the company bridge that gap?

In this Forecast, we’ll walk through four ideas for improving Twitter’s business—going private, focusing on subscription revenue, leaning into the creator economy, and building a decentralized platform. Let’s dive in.

1. Twitter as a private company

Twitter went public on the New York Stock Exchange in 2013. Since then its stock has fluctuated between $14 and $77 a share, reaching a high during the pandemic. In 2022, it has hovered around $35 a share but shot up to about $47 on the news of Musk’s interest.

Ben Thompson, the writer of the popular newsletter Stratechery, thinks that Twitter should go private—even if that means Musk helming the transformation. In a recent newsletter, Thompson made the case that Twitter has consistently underperformed expectations:

Twitter has, over 19 different funding rounds (including pre-IPO, IPO, and post-IPO), raised $4.4 billion in funding; meanwhile the company has lost a cumulative $861 million in its lifetime as a public company (i.e. excluding pre-IPO losses). During that time the company has held 33 earnings calls; the company reported a profit in only 14 of them.

There are perks to going private: Twitter could operate without the pressure of quarterly financial disclosures and its own investors breathing down its neck. And investor pressure is not unique to Musk—Twitter spent years fending off an activist investor in Elliott Management, which long wanted to oust Jack Dorsey, in large part because he split his time running his other company Square. (Dorsey resigned as CEO in November, Square is now called Block, and potential boss Elon Musk has many more jobs than Dorsey ever had.)

Thompson’s idea is complicated, but it essentially involves privatizing Twitter and splitting it into two companies. One would control Twitter’s core service and social graph, which he thinks is valuable, and one would control its apps and advertising business, which he considers a “financial failure.” Twitter the service would contract its services to Twitter the apps business, could open up its API to third parties, and then (in theory) could prove its worth in the open market.

Not only does Thompson think that going private would improve Twitter’s business, he thinks it’ll settle questions about how much content moderation users and advertisers really want on the platform.

2. Twitter as a subscription service

“I can’t believe this website is free” is a common refrain on Twitter, a nod to the bizarre and sometimes hilarious activity on the platform. But as of last year, not all of Twitter is free. Users can pay $2.99 per month for Twitter Blue, a subscription product that lets them delay tweets by 30 seconds (in my opinion, its best feature), customize the user interface, and (maybe one day) edit tweets on the platform.

While it’s probably too soon to evaluate—Twitter Blue only launched in the US in November—subscription revenue could be a boon to Twitter, which depends almost entirely on advertising. Some super users of the app—myself included—would gladly pay to improve our experience on the app.

But right now the offerings are paltry. Through an edit button or other features, Blue will need to prove its worth to Twitter users, either by adding value for a fee or subtracting value from the free version of the platform, which would surely anger many users. (If TweetDeck was lumped into Twitter Blue, I’d pay even more.)

Jasmine Enberg, a principal analyst for social media at the market research firm Insider Intelligence, says that Twitter will need to squeeze more revenue out of its highly engaged users. “The problem is that most consumers still prefer to view ads in exchange for free content rather than subscribe to a digital service,” she said, “and making Twitter subscription-only would change the entire framework for the service.”

One place to experiment: Better filtering tools that go beyond keywords and blocking to tailor feeds by topic and tone.

3. Twitter as a creator-focused platform

When you think about “creators” or “influencers” you probably think about YouTube, Instagram, or TikTok. But Twitter—whose creators are more so journalists, comedians, politicians, CEOs, and crypto bros—is becoming more of a creator-focused platform too. Slowly.

In recent years, it bought the newsletter service Revue to compete with Substack, introduced tipping, and added the Clubhouse-like audio experience Spaces. It also now allows people to wall off some of their feed for paying subscribers (“Super Followers”).

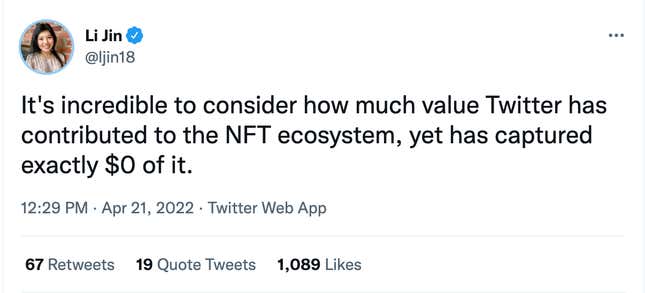

But Li Jin, a general partner at the venture capital firms Atelier Ventures and Variant, thinks that Twitter could go further. “When I think of the landscape of various platforms, I think there are ones that capture too much value and therefore stifle their ecosystems” like Apple’s App Store, she says. “And then there are platforms that capture too little value,” like Twitter.

Jin thinks the key to unlocking that value is making Twitter a much friendlier place for creators and for Twitter to take a small cut whenever there are user payments to those creators. The new creator tools like tipping, newsletters, and Super Follows so far feel like “an appendage to the core Twitter experience,” she says. If Twitter wants to become a creator-first platform it needs to make these features feel natural and organic.

4. Twitter as a decentralized platform

So far we’ve mentioned two product ideas and going private. The last idea is the most radical—and the least fully baked. What if Twitter wasn’t just a social media company, but became the protocol through which other social apps operated? What if, somehow, maybe, this involved crypto, too?

Dorsey believed in the idea of a “decentralized” social networking protocol enough that Twitter funded something called BlueSky, which it spun off into its own company.

Think of BlueSky as more like email, where people can communicate with each other no matter whether they use Google’s Gmail, Yahoo, AOL, or another email client. In other words, there’s interoperability. While talk of internet decentralization largely centers on blockchain technology, it’s not yet clear whether BlueSky will depend on blockchains.

It’s a cool idea, crypto or not, but it’s not obvious what problem it solves for Twitter as a company. Twitter arguably got where it is by privatizing the original decentralized social networking protocol, Really Simple Syndication, or RSS. Inventing a new open protocol seems as likely to destroy Twitter’s financial value as enhance it. At best, it’s a hedge against the possibility that social media’s future leaves Twitter behind.

Keep learning

- Jack Dorsey tweets about Elon Musk’s takeover bid (Quartz)

- A brief history of Elon Musk and Twitter (Quartz)

- Elon Musk’s Twitter bid isn’t about free speech (Quartz)

- Elon got his money (Bloomberg)

- Back to the future of Twitter (Stratechery)

- The next big social media platform (Quartz)

📣 Sound off

Which would you prioritize if you ran Twitter?

Last week, 40% of you said a basket of currencies was the most likely alternative to the dollar. Sometimes the boring answer is also the correct one.

Have a great week,

—Scott Nover, emerging industries reporter (and unrepentant Twitter addict)

One ₿ thing

One recent example of Twitter’s inability to monetize its influence is from the crypto world. “It’s incredible to consider how much value Twitter has contributed to the NFT ecosystem, yet has captured exactly $0 of it,” Jin tweeted.

Twitter plays a central role in the NFT space, but does nothing to make money from the booming industry, which blossomed into a $41 billion market in 2021. Of course, there’s a risk of going too far: A platform that focuses too much on capturing value risks alienating users and sending them elsewhere.