Nine Wall Street charts you should see before the big Fed meeting

Today marks the conclusion of a two-day meeting of the US Federal Reserve, accompanied by a raft of Fed projections and a press conference appearance by chair Janet Yellen.

Today marks the conclusion of a two-day meeting of the US Federal Reserve, accompanied by a raft of Fed projections and a press conference appearance by chair Janet Yellen.

Devoted central banking geeks will remember that the last time the Fed released its updated summary of economic projections—also known as SEP—that staid PDF caused a bit of a kerfuffle. (The short version was that one key chart suggested that some on the Fed actually were expecting to raise interest rates by the end of 2014.)

Nobody expects any large-scale changes when the Fed releases its monetary policy decision tomorrow. (Rates won’t rise. The taper will continue at around $10 billion a month. The text should acknowledge ongoing improvement in the labor market.) So the main action will likely be in that summary of economic projections.

All of Wall Street’s banks have churned out their previews. Here are some of their most telling charts, accompanied by excerpts from the banks’ commentaries.

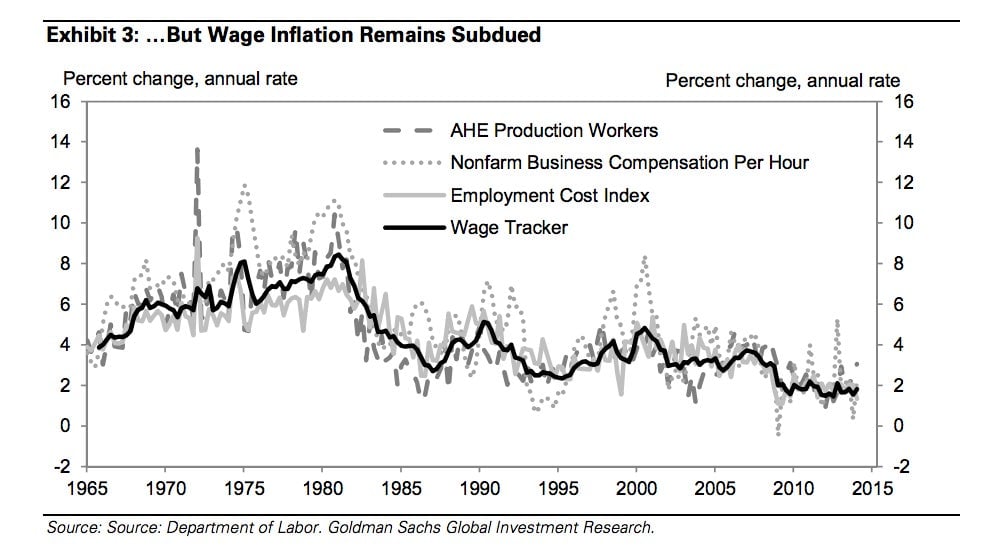

Goldman Sachs

“The Fed’s overall thinking on the inflation outlook has probably not changed in any significant way, as the committee already built in a gradual acceleration, inflation is still running well below its 2.0% target, and wage measures have remained subdued. Our wage tracker—which aggregates three main wage indicators into a single factor—remains well below normal rates at around 2%.”

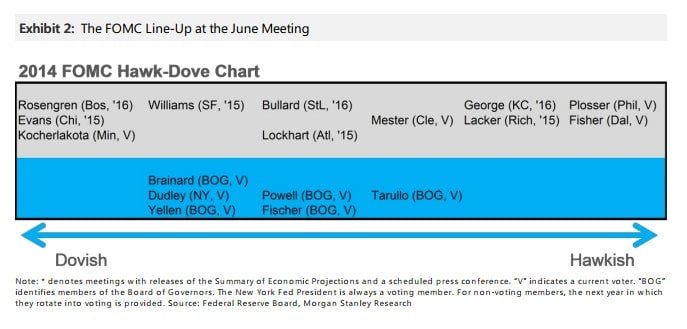

Morgan Stanley

“On Thursday, 5 June, the Senate confirmed Lael Brainard and Jerome Powell to the Federal Reserve Board, and Stanley Fischer as Vice Chair (having previously been confirmed to the Board, but not appointed as Vice Chair). All three newcomers will immediately have a vote at the June meeting and bring the full roster up to 17 participants. The June meeting will also be the first time that new Cleveland Fed President Loretta Mester (Pianalto’s replacement) will participate and vote. We’ve added the new members to where we think they stand on the Hawk/Dove spectrum.”

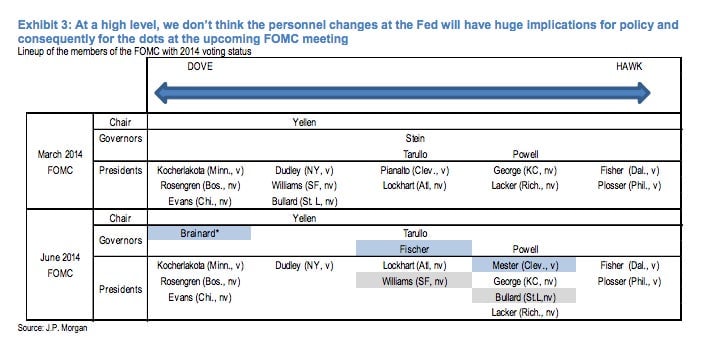

JPMorgan

“At a high level we don’t think this will have huge implications for policy, or even for the dots. Like Stein, Fischer shares a macroeconomic worldview that will fit in comfortably at the Fed’s Board building. And like Stein, he may have somewhat higher concerns about financial market imbalances than others who sit on the Board. Mester, too, may not be all that different from Pianalto. While she worked for Charles Plosser, we suspect she isn’t quite as hawkish as the Philly Fed chief. Like Fischer, however, she has been quite open-minded about integrating financial stability into monetary policy-making. In any event, we see neither debuting with some wildcat dot that’s off the plot.”

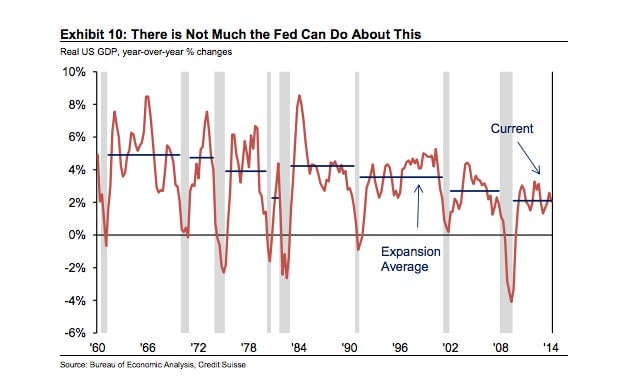

Credit Suisse

“The larger issue for the Fed to consider—that transcends monetary policy itself—is the question of the evolution of potential GDP, not just in the US but in most developed and emerging economies. Much of the data on productivity, capital accumulation, and labor force dynamics speak to the idea that potential growth has slowed materially, and may not recover for some time.”

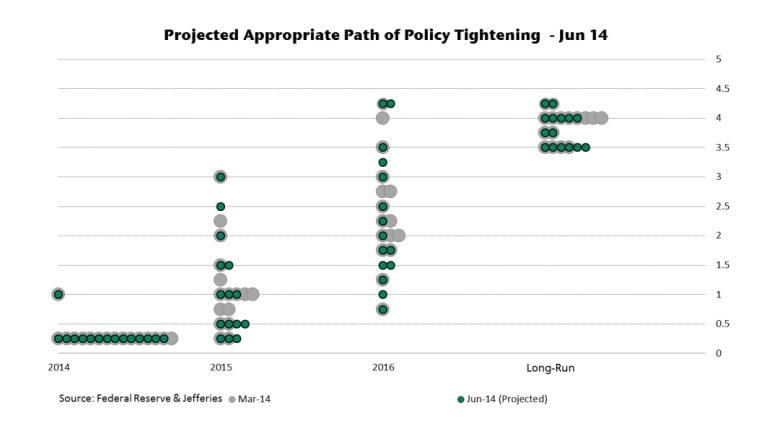

Jefferies

“Based on the ongoing public debate about monetary policy being conducted by FOMC members, there is a significant disparity in policy inclinations at the current juncture. Some policymakers, including James Bullard are getting an itchy trigger finger, while others, including Dennis Lockhart, have been suggesting that the rate ‘lift-off’ should happen later rather than sooner … we think that this policy rift will be reflected in a wider dispersion of fed funds rate forecasts with as many as three projections and dots being lowered and as many as two projections and dots being raised in 2015 and 2016.”

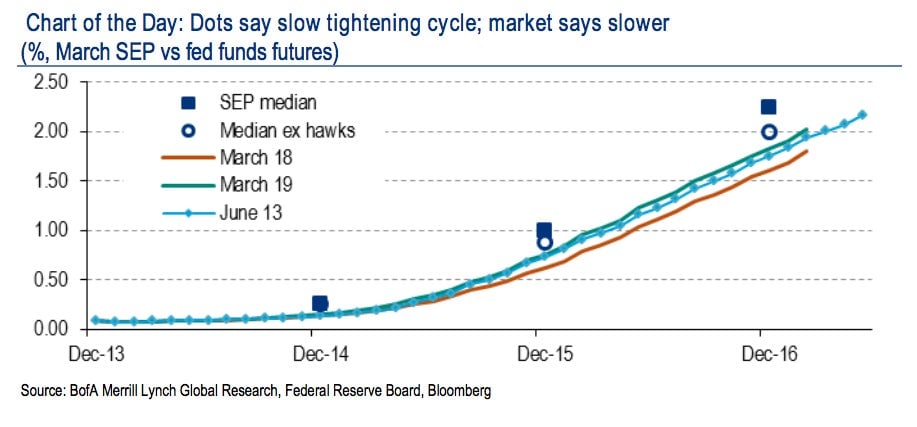

Bank of America Merrill Lynch

“The Chart of the Day shows that market pricing of the fed funds rate path is currently below the median dot — even below the median once the hawks are excluded — suggesting the market has taken on board the Fed’s over-arching message of a patient and gradual exit. That said, as in March, there is once again the risk that the market may read a hawkish message into the dots — despite what is widely expected to be a status quo meeting with yet another small taper of US$10bn and unchanged forward guidance language.”

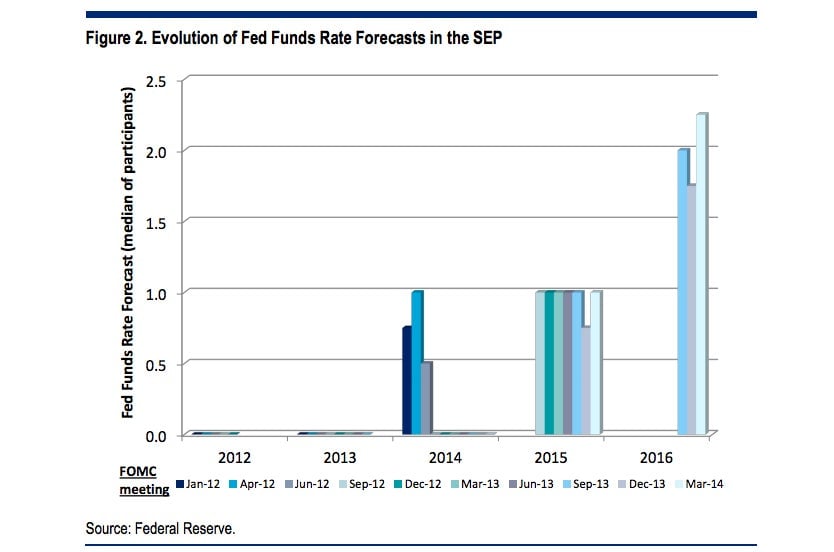

Citigroup

“The FOMC introduced projections of the fed funds rate into the SEP in January 2012 (Figure 2). A steadfast feature of these forecasts since September 2012 is that the median FOMC participant expects a liftoff of the fed funds rate in 2015, with the rate rising to 1 percent that year and to roughly 2 percent by the end of 2016.”

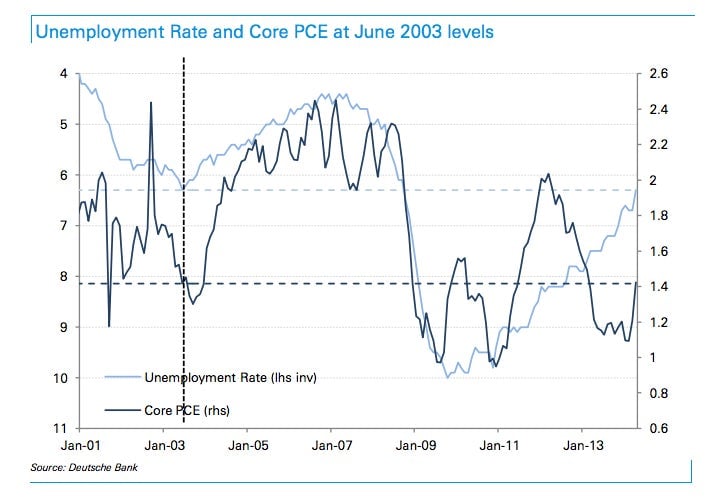

Deutsche Bank

“For the first time since the beginning of the crisis, the two inputs into the Taylor Rule are within the range of the previous (01-07) cycle. The current level of the unemployment rate and core PCE are actually almost exactly equal to the levels observed in June 2003, at the previous cycle trough.”

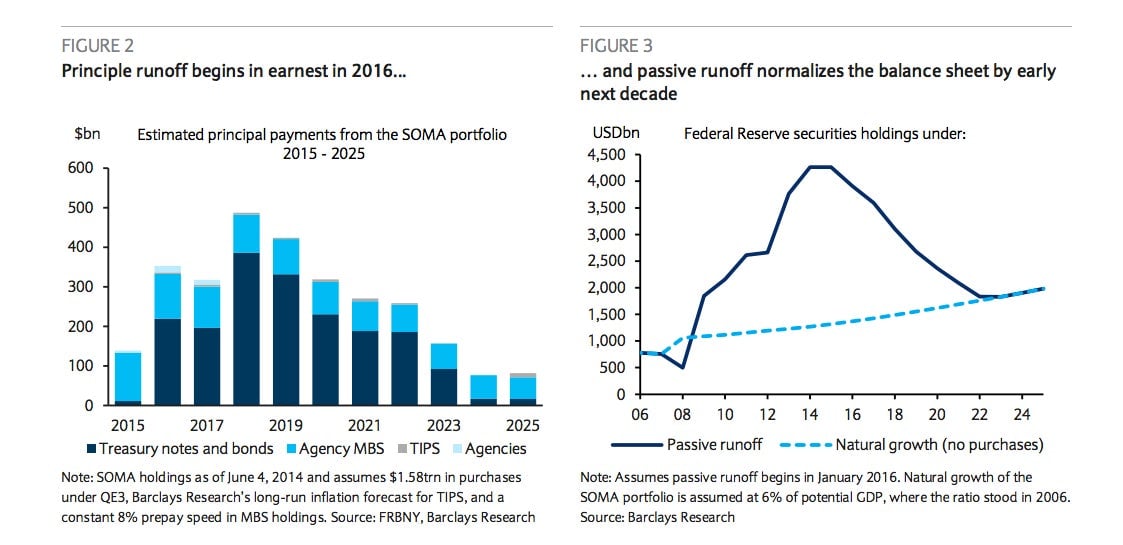

Barclays

“We also expect the committee to review its exit strategy principles. Regional Fed Presidents Dudley (New York) and Williams (San Francisco) have advocated delaying the removal of the reinvestment policy on the balance sheet until after the first rate increase.”