China’s internet giants are now fighting over millions of shoppers in cities you’ve never heard of

Chinese internet giant Tencent just spent $736 million on a 19.9% stake in 58.com, a Chinese classifieds firm modeled after Craigslist. The splurge underlines a new front in Tencent’s fierce rivalry with Alibaba: The race to capture the country’s next biggest consumer opportunity in the poorer hinterlands.

Chinese internet giant Tencent just spent $736 million on a 19.9% stake in 58.com, a Chinese classifieds firm modeled after Craigslist. The splurge underlines a new front in Tencent’s fierce rivalry with Alibaba: The race to capture the country’s next biggest consumer opportunity in the poorer hinterlands.

58.com, which listed on the New York Stock Exchange last year, depends on small business owners and consumers in China’s second and third-tier cities, as well as bigger cities. As we’ve reported, part of the company’s strategy is co-opting new online shoppers and sellers by offering workshops that train merchants and customers. Ads range from real estate rentals to speed dating events and job postings. The company makes most of its money from merchants who pay for premium memberships to place their classifieds on 58.com. (58’s founder Yao Jinbo chose the company’s name, pronounced wu ba in Chinese, because it sounds like wo fa (我发), “I announce” or “I discover” and is easy to remember.)

Tencent’s stake in 58.com is its second e-commerce investment this year, after acquiring a 15% stake in JD.com, China’s second largest e-commerce firm after Alibaba’s Taobao and Tmall platforms. As we’ve reported, JD.com is already racing with Alibaba to build logistics and delivery infrastructure across the country.

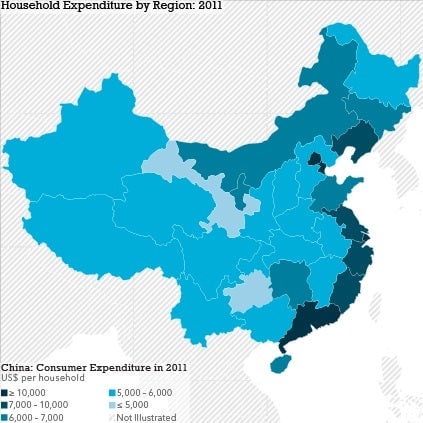

Although China’s coastal regions have long been its wealthiest provinces, its interior regions account for almost two-thirds of the country’s population and an increasingly large share of its economic output. As a result, in 2012, 60% of all retail sales in the country came from outside major coastal cities like Beijing or Shanghai, Alibaba said in its recent IPO paperwork.

Importantly for Tencent, which holds a commanding lead over Alibaba in mobile, some of the country’s biggest increases in mobile internet penetration are in lesser-known cities like Fuzhou and Shenyang.

While incomes and disposable spending may be less in poorer, inland provinces, in aggregate the potential is huge. Disposable income in China’s tier one cities amounted to about 1 trillion yuan, but hundreds of second to fourth-tier cities had a combined disposable income of 8 trillion yuan in 2011, according to the research firm AC Nielson.