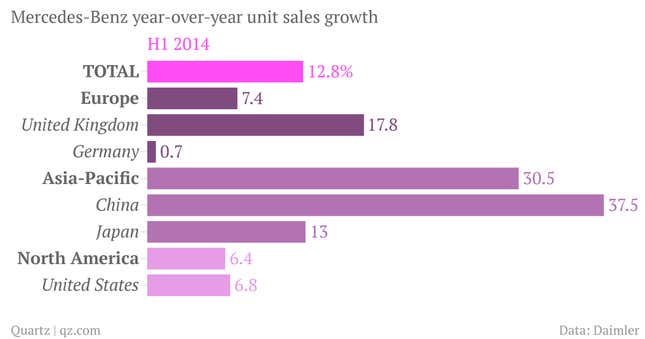

Mercedes-Benz just reported the best six months of sales in its history, with deliveries through June up 13%, to more than 783,000 units. Although sales in its German home market were flat over the period, buyers in the company’s other key markets turned up in droves:

What’s particularly clear is that despite Chinese officialdom’s crackdown on luxury purchases by party bureaucrats, there are plenty of other buyers there keen on a Merc. China accounts for around 17% of Mercedes-Benz’s total unit sales, making it the company’s second-largest market, after the US (worth 19% of total sales).

Meanwhile, Audi reported its best-ever month of sales in China today, selling twice as many units as Mercedes in the first half of the year, although growth was half as fast (a mere 18% year-over-year). As in so many other luxury industries, German carmakers’ fortunes rely increasingly on Chinese consumers’ taste for the finer things.

But there are also plenty of encouraging developments in the West. Audi saw sales grow by 14% in the first half in America, just beating the not-too-shabby growth recorded by luxury market leader BMW.

And although times are tougher for carmakers in Europe, it’s the middle-of-the-road brands that have been hit hardest; bargain and luxury models are still motoring ahead. The UK’s passenger car market expanded by 10% in the first half of the year, industry figures showed today, with the German luxury trio of Audi, BMW, and Mercedes-Benz all growing faster than the overall average.

The ultimate expression of the German auto giants’ bullishness, perhaps, is the recent unveiling of a new model in Mercedes’ top-of-the-line S-Class family. The “Pullman” will go on sale next year and run a cool $1 million, twice as much as its Rolls-Royce equivalent.