Internet related stocks just got smoked again. And just as happened a few weeks ago, for no obvious reason.

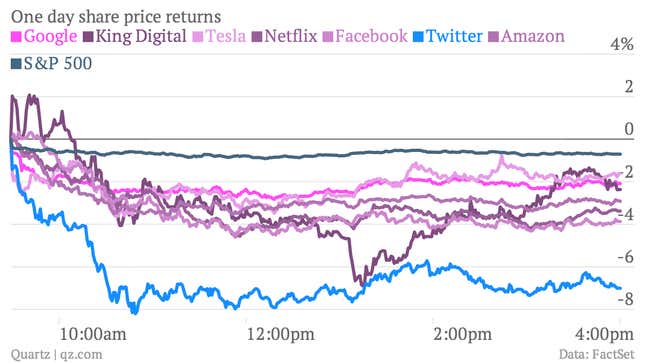

The whole market declined today, but the most savage reaction was in so-called “momentum” stocks: fast-growing companies with very high valuations relative to their actual earnings—mainly in the internet sector, such as Twitter (down nearly 8% today) but also elsewhere, such as Tesla. Even established tech companies like Google (down about 2%) fell quite sharply.

The Wall Street Journal is pinning today’s market reaction on surprisingly bearish comments from a top Wall Street strategist, Jeffrey Saut from Raymond James, who thinks the broader market rally is due for a breather. Bloomberg notes that Citigroup analysts are worried about a “severe pullback” in the market.

Don’t forget, the market is not far away from record highs (the Dow recently pierced the 17,000 threshold and stocks have nearly tripled since their financial crisis nadir). When stocks take a hit, the riskiest ones—which are often also the most exciting and fastest growing—tend to bear the brunt of it.