Russian stocks are incredibly cheap—for a reason

The fallout from the latest round of EU and US sanctions against Russia is spreading to stocks.

Russian equities have been under pressure ever since the West ratcheted up its response to the ongoing violence in eastern Ukraine and the downing of a Malaysia Airlines passenger plane. Now index providers are considering cutting out key Russian stocks from their benchmarks, further isolating Russian companies from international capital markets.

MSCI, which maintains indexes upon which $9 trillion in investments are linked, is creating new composite indexes that exclude Russia for investors squeamish about exposure to the country under sanctions. VTB, a big Russian bank hit by both American and European restrictions on issuing new equity and long-term debt, may also be excluded from MSCI’s Russia Index, the index provider said. Another big index manager, S&P Dow Jones, is consulting with clients about whether it should exclude Russian stocks from its indexes.

Hundreds of billions of dollars are passively tied to the indexes maintained by the likes of MSCI and S&P Dow Jones, so whenever they reshuffle their lineups it makes news. Removing Russian shares from equity benchmarks is yet another blow for the country in the eyes of international investors.

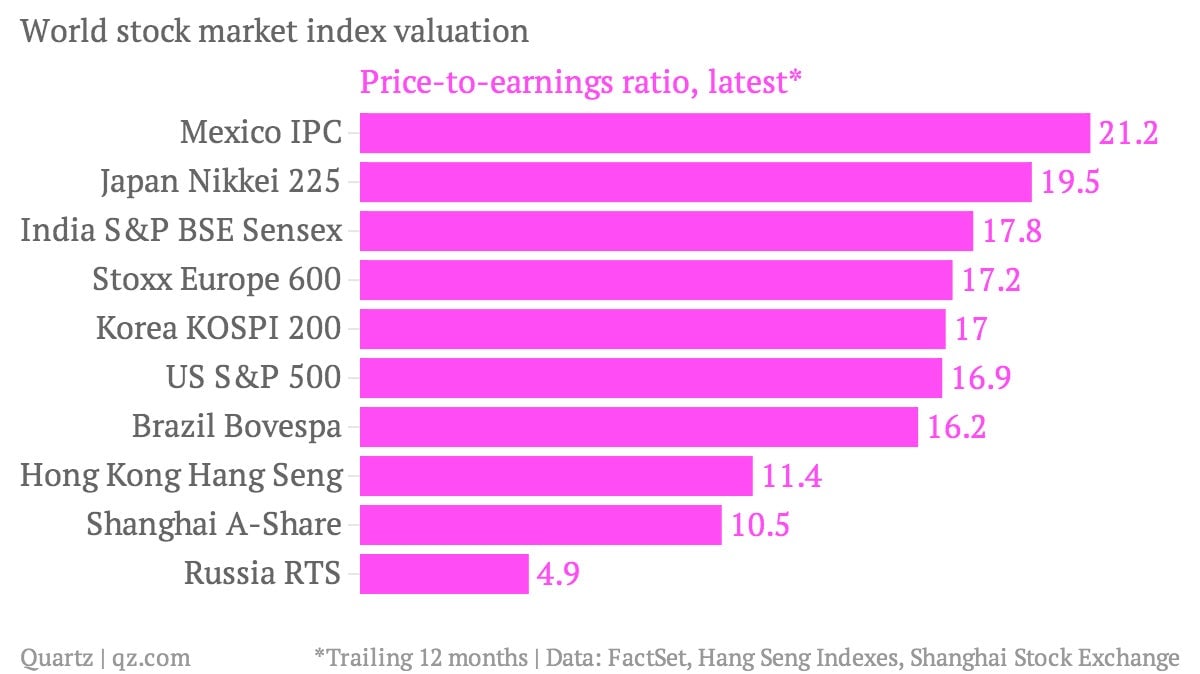

But as we have written before, only the bravest investors have been dealing in Russian stocks over the past few months, given the unquantifiable geopolitical risks that come from unpredictable Western sanctions and related Russian retaliation. That’s what’s behind the rock-bottom price-to-earnings ratio of the Russian stock market. By this measure, Russian shares are an unbelievable bargain at just five times earnings. Few other markets even come close:

In any case, the stock market isn’t all that important for Russian firms. These companies’ refinancing needs over the next year or so are ”manageable,” according to a new Moody’s report assessing the impact of sanctions. Although nonfinancial Russian companies have some $100 billion in foreign debt coming due by the end of the next year, they “will generally benefit from large cash buffers and financial assets that can be used to meet refinancing needs,” according to the credit ratings firm. For now, then, the Russian market’s derisory valuation is somewhat embarrassing, perhaps, but not particularly damaging for the companies concerned. Not yet, at least.

Naturally, Russian companies aren’t happy about the sanctions, and the longer the standoff lasts the more that they will feel the pinch as their buffers run down. Moody’s reckons that the Russian economy will shrink by 1% this year and stagnate in 2015, “assuming neither a significant escalation nor a quick resolution to the Ukraine crisis.”