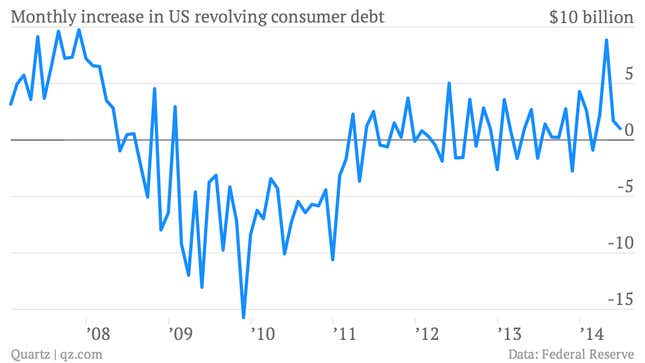

They had a bit of a relapse in April, when Americans credit-card debt surged by nearly $9 billion. That was the biggest jump in card usage since the Great Recession, and a major break with post-crisis behavior. Since then credit-card debt growth as been much more modest. In May it rose by a bit less than $2 billion and we just learned that in June (pdf) the increase was only $1 billion.

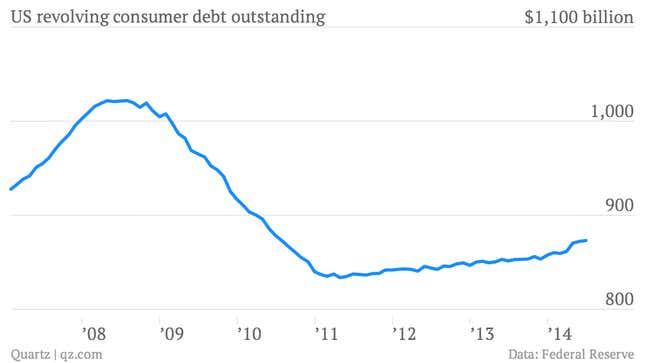

The financial crisis prompted a major rethink on credit cards from financial institutions, consumers and regulators. Banks started cutting the amount of credit they extended—in part because of risk aversion related to economic malaise and in part because of new regulations. Meanwhile, consumers also seemed to rethink the amount of borrowing they wanted to do. (Again, some of this was involuntary as regulations made it tougher for people of fringe credit-worthiness, such as college students, to get a credit card.) Anyway, the result is that growth in credit-card debt has been incredibly flat over the past few years, which is one of the most underappreciated economic changes of the post-crisis era.