It’s been a week since Russia banned food imports from the US, EU, Norway, Canada, and Australia in retaliation for the sanctions imposed by those countries. Markets have been on edge since then, as the violence escalates in eastern Ukraine.

But investors also know that Russia will need to find new sources of food to replace the billions of dollars worth of imports that it has banned. Thus, the companies at home and abroad that are unaffected by the sanctions stand to benefit. The share prices of some of these firms have shot up in recent days, the flip side of the pain felt by producers in Europe and other countries now hit by Moscow’s import embargo.

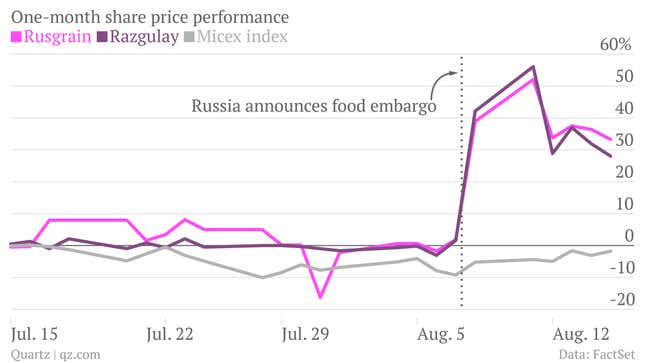

Naturally, local food firms will be expected to fill the gap created by the embargo, at least in the short term. That’s why agribusiness groups like Razgulay and Rusgrain are way up over the past week:

Russia already imports more than $1 billion in food from Turkey, with companies like dairy group Pinar Sut and meat processors Pinar Et and Banvit looking to boost sales as a result of the ban:

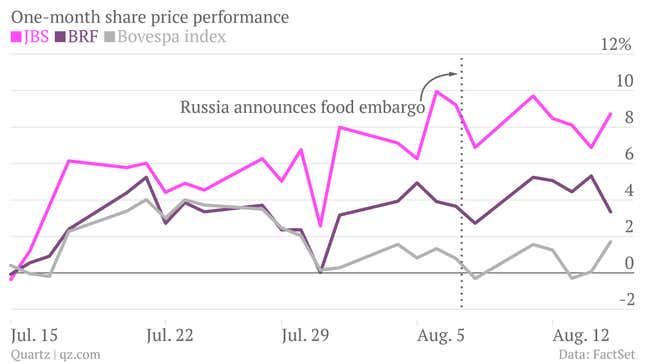

Brazilian meat producers reckon that they can triple exports to Russia, mainly the poultry that Russia currently gets from the US. Although the shares of producers like BRF and JBS haven’t jumped like some other firms, they are still outperforming the broader local market:

Switzerland escaped Moscow’s censure, making it a key source of cheeses that Russians can no longer get from the rest of Europe. This turned around the flagging shares of Emmi, a Lucerne-based dairy group: