To support its stagnating economy, Russia will let the ruble slide

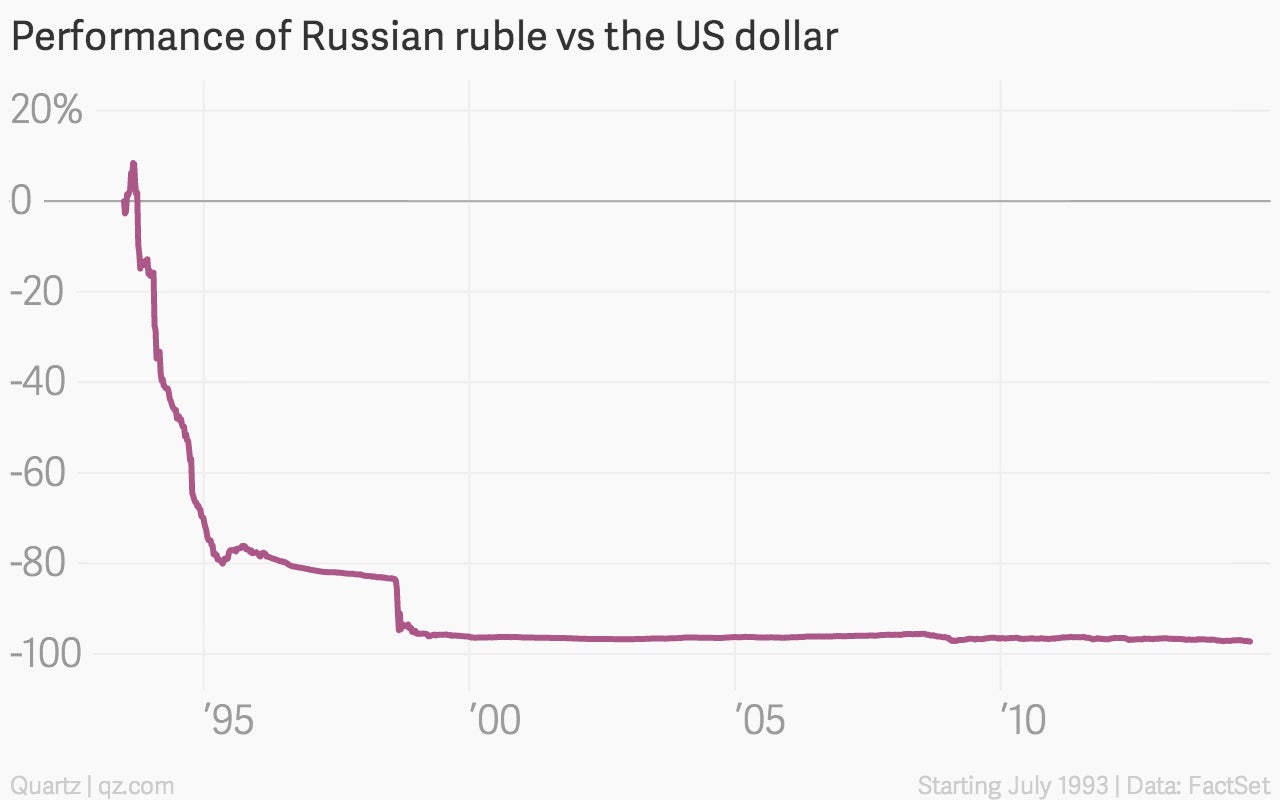

The ruble set yet another all-time low against the dollar today, plumbing fresh depths since the Soviet ruble was withdrawn in 1993:

The ruble set yet another all-time low against the dollar today, plumbing fresh depths since the Soviet ruble was withdrawn in 1993:

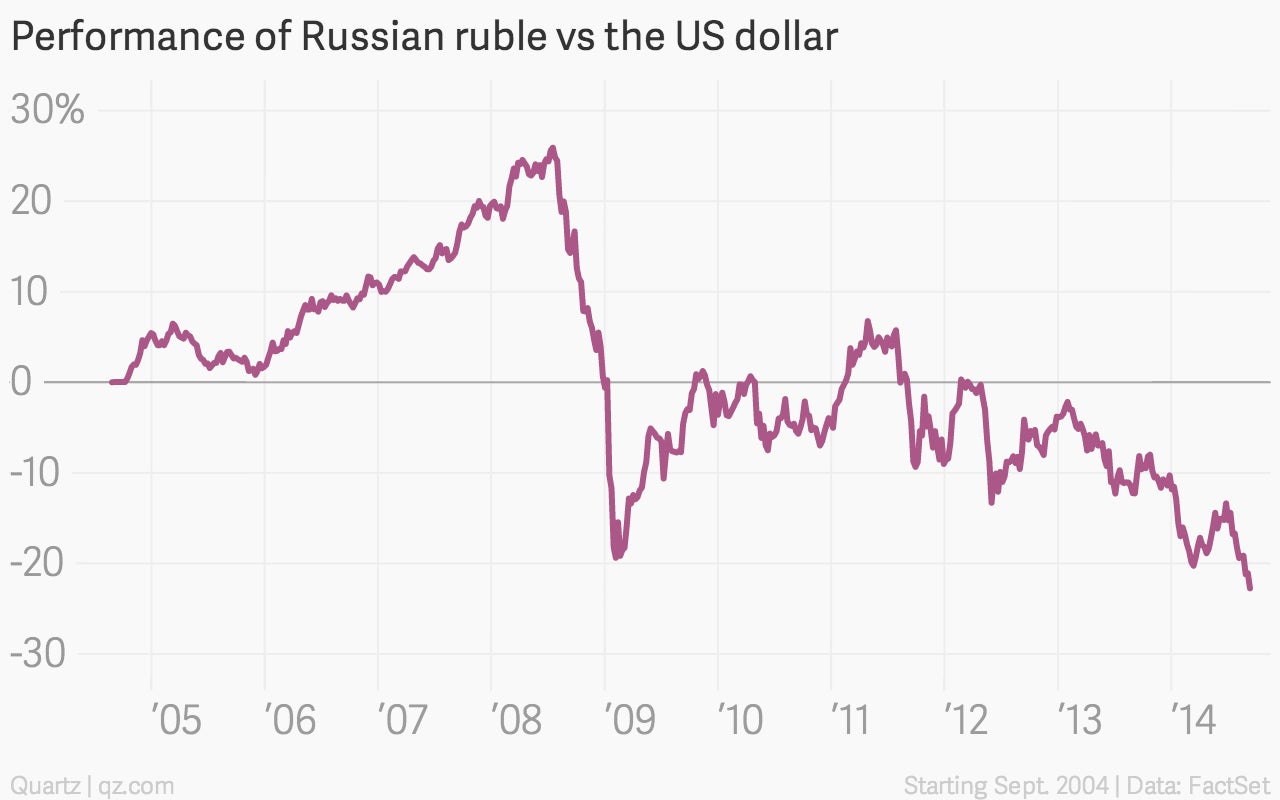

The volatile and crisis-wracked post-communist years skews the full history of the currency, so here’s just the past 10 years:

Only the Argentine peso has performed worse against the dollar this year, according to Bloomberg. To bolster the currency and stem rising inflation, Russia’s central bank has hiked rates three times this year, despite the stagnating economy.

Some analysts expected another hike today, but instead the bank held rates steady. This suggests Moscow is going to let the ruble keep doing down—and it’s not hard to see why.

Inflation is running at around 8%, double the central bank’s target rate. But economic growth is “anaemic,” the bank says, as the West piles more and more sanctions on Russia in response to its perceived role in destabilizing eastern Ukraine.

Russia has retaliated by banning Western food imports, with clothes and used cars reportedly the next items to face retaliatory sanctions by the Kremlin.

Officials are spinning the sanctions as an opportunity to boost Russia’s self-sufficiency, but autarky is rarely a recipe for robust economic growth. As a result, Russia’s stagflation problem is likely to persist.

The central bank thinks that the rise in inflation—made worse by the weakening currency, which makes imported goods more expensive—”is unlikely to be protracted,” but acknowledges that this depends on how quickly the economy adapts to sanctions. It also notes that “oil prices remain high even after a recent decline,” which is a curious way to describe Brent crude recently touching a two-year low.

Unconvinced by the supposed ceasefire in Ukraine, the West is now squeezing Russia’s embattled oil industry, which means that things could get worse—much worse—for the economy and currency before they get better.