Venture capital investor Bill Gurley—whose money is in companies like Uber, Zillow and OpenTable—offered the Wall Street Journal a warning yesterday about his industry:

One, the average burn rate at the average venture-backed company in Silicon Valley is at an all-time high since ’99 and maybe in many industries higher than in ’99. And two, more humans in Silicon Valley are working for money-losing companies than have been in 15 years, and that’s a form of discounted risk.

In ’01 or ’09, you just wouldn’t go take a job at a company that’s burning $4 million a month. Today everyone does it without thinking.

On its face, this is quite something to admit—and it is more fodder for the argument that we are in the midst of another tech stock bubble, if the multibillion-dollar acquisitions of companies like WhatsApp, Occulus Rift, and, this week, Minecraft, weren’t enough.

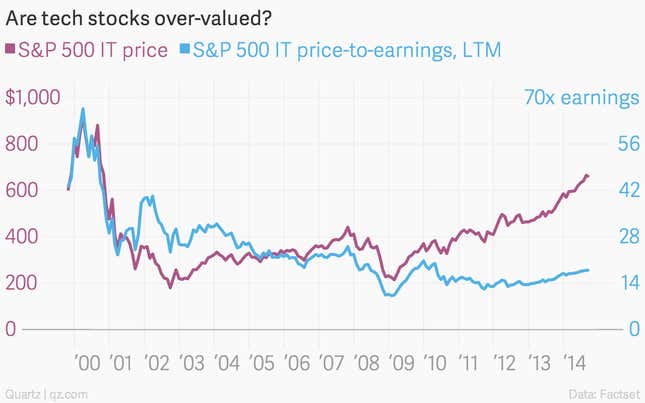

But there’s something of a disconnect when we’re talking about the maturing tech sector. This bubble is different than the last one, in that it seems concentrated in private equity. The biggest tech firms in the country—or at least the 66 biggest, publicly traded US tech firms on an index maintained by Standard & Poors, which includes Apple, Facebook, Microsoft, Google, Yahoo, and EBay—aren’t as overvalued as they were the last time the bubble popped:

Even as the big tech stocks have increased, they have traded at relatively reasonable valuations, at least compared with the heady days of the last tech bubble. This suggests that public stockholders, in the event of a market correction, won’t get burned too badly. The companies could lose value in the event of a correction, but the stock owners would still own a piece of a profitable concern.

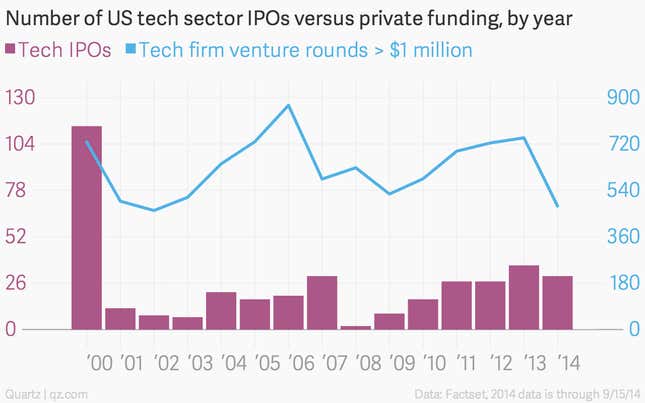

What troubles Gurley are the closely held companies, many of which have remained private in the hopes of an eventual IPO or a takeover by one of the more mature firms. Since the last bubble, the volume of IPOs receded, but private fundraising rounds have remained frequent:

We don’t have a way to verify Gurley’s claims about the burn rates and employment at these privately funded start-ups, but as a venture capitalist with active investments who is presumably familiar with deal flow in the sector, he is a credible source. The companies he was fretting about exist at the pleasure of their deep-pocketed investors, but they won’t exist for long if the people giving venture firms their cash—limited partners like institutional investors—lose faith in their ability to generate profits from IPOs and acquisitions. That faith by all rights ought to be diminishing; as Diane Mulcahy of the Kauffman Foundation pointed out, venture capital just isn’t providing very much in the way of returns anymore.

But as long as the bull market continues, the animal spirits will have investors chasing the next Google—or at least the next Google acquisition. A change in the markets, however, will mean less confidence in future IPOs and acquisitions, and could leave a whole swath of money-losing, privately owned tech startups out to dry.