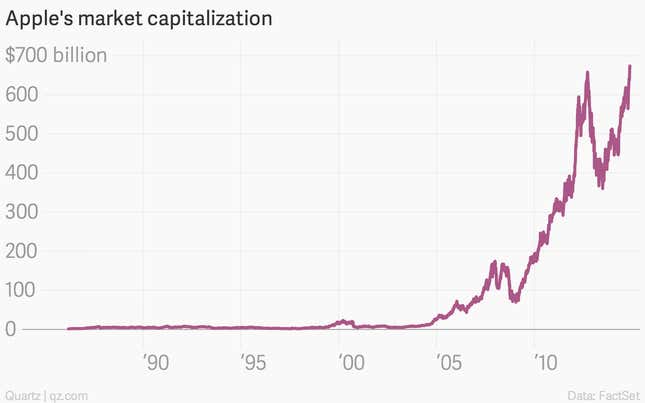

From one perspective, Apple’s valuation seems downright absurd. It’s fluttering above $670 billion today.

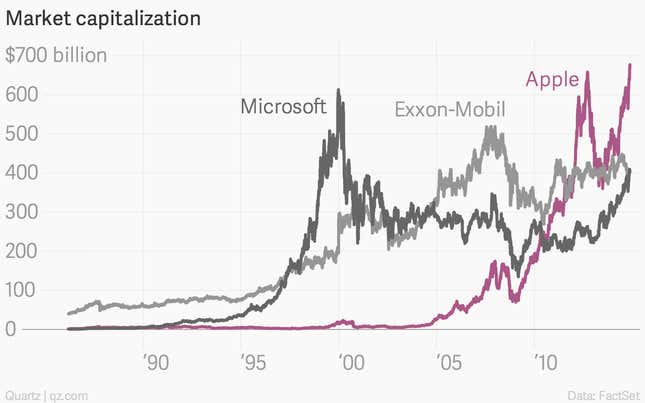

By market cap, Apple is the world’s most valuable company. Microsoft is running a not-so-close second, with a valuation of roughly $409 billion, after recently overtaking Exxon-Mobil.

With so much distance between the front-runner and everyone else, the Apple valuation seems pretty nuts. Then you look at the business. Recent quarters have shown that Apple can still generate impressive year-over-year growth despite the substantial baseline numbers. (For instance, revenue rose 12% to $42 billion during Apple’s September quarter.) And the company is predicting a giant Christmas season.

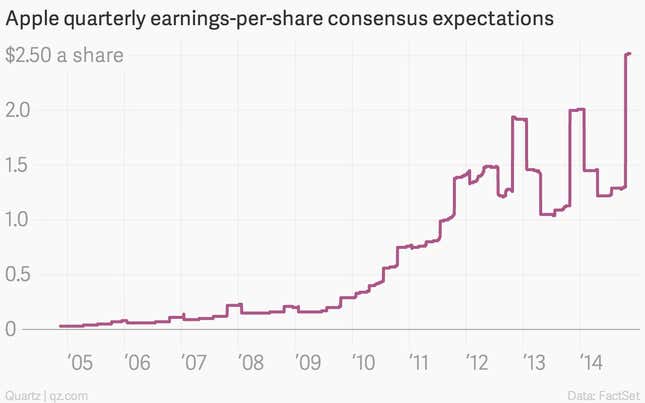

Those company revenue forecasts have driven quarterly profit expectations sharply higher. The average earnings projection on Wall Street jumped to more than $2.50 after Apple’s most recent quarterly report.

And those higher earnings expectations form a firm foundation for Apple’s recent stock price run-up.

At more than $115 apiece, Apple shares are up more than 40% this year, outpacing the 11% gain in the S&P 500. But they’re trading at only 15 times analysts’ earnings expectations for Apple over the next 12 months. This “forward price-to-earnings ratio” is a favorite investor gauge of valuation. A price-to-earnings multiple of 15 is typically considered “fairly valued.” Not a bargain. But not too expensive either.