An Uber IPO might not happen for quite some time but Wall Street firms already are positioning themselves for a piece of the action.

Consider the following:

Goldman Sachs, itself an early investor in Uber through its venture arm, is reportedly raising hundreds of millions of dollars for the app- enabled car service from wealthy clients… for free!

Remember, Goldman offered a similar service for Facebook about five months before the giant social network went public.

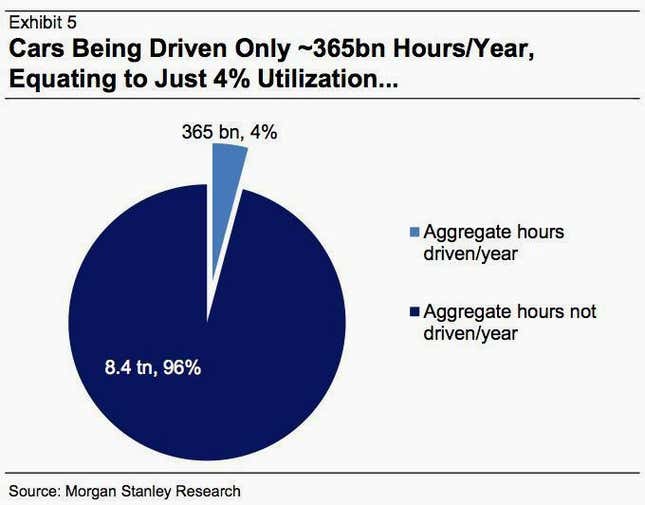

Morgan Stanley’s research department (entirely separate from the investment banking arm that would be involved in underwriting an initial public offering, of course) earlier this year issued a lengthy and highly upbeat report on the global livery/automotive fleet industry, essentially saying that the 1 billion cars on the roads globally, worth $20 trillion, are extremely underused.

It said Uber eventually could have an enormous fleet of self-driving vehicles, available at rates so cheap that the idea of car ownership would, for many people, become obsolete.

It’s important to note that there are Chinese walls that officially separate analysts and bankers inside places like Morgan Stanley. But when a banker is pitching for a role in an IPO, it surely can’t hurt to have analysts inside the same organization who are highly positive about a prospective client’s business. (Eventually those analysts effectively will become arbiters of the company’s stock price once it is trading publicly).

Lastly, Citi yesterday announced that Uber was now a “recommended transportation option” for its 250,000 employees globally. OK, as evidence of a firm ingratiating itself with a prospective client, this one’s a bit flimsy. But if you are seeking to do business with a company, it can’t hurt to be a customer.

It is not clear when, or even if, Uber will go public. It certainly is not starved of capital. The company raised $1.2 billion in fresh funds in June and reportedly is in the process of raising an additional $1 billion, over and above the private placement that Goldman Sachs is handling. Leaked financial documents suggest Uber is growing rapidly. But given the nature of its business (ie. an intermediary) it’s reasonable to assume it is not burning through all of this cash. Even if it was, say due to aggressive expansion, it’s unlikely it would have trouble finding investors in the private markets.

So the only reason for an IPO would be to allow early investors to cash out with a windfall. Or, as Matt Levine wrote this week in Bloomberg View:

The point of an Uber IPO will not be to raise money for Uber. The point of an Uber IPO will be to retroactively justify the private fundraising that Uber is doing now.

And it would leave plenty of underwriting fees and prestige up for grabs on Wall Street.