One of the biggest market stories of the year has been the precipitous drop in oil prices. Here are a few charts that illustrate some of the drop’s effects on markets and economies across the world.

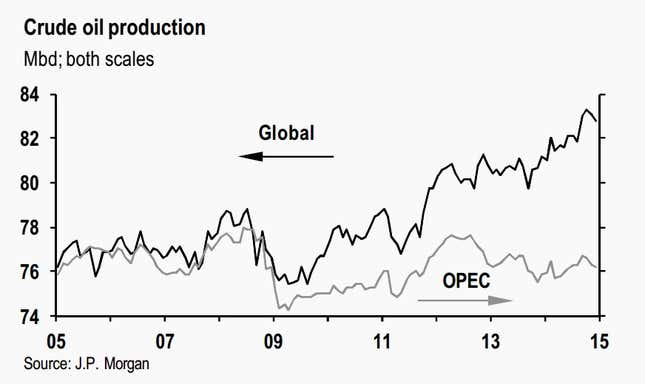

The world is producing a lot more oil

Armed conflicts enveloping Syria, Iraq, and other parts of the Middle East in the last few years haven’t been enough to offset stalling global economies—especially with non-OPEC nations stepping up their oil production. That’s part of what made it such a big deal when the bloc decided not to cut production last month.

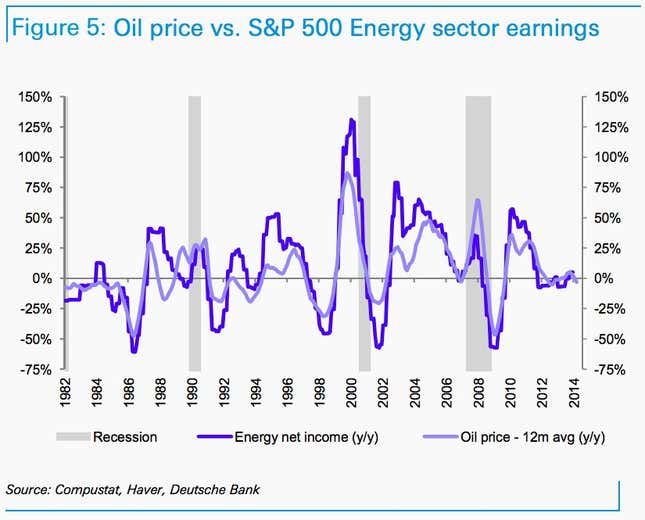

Energy company profits track closely with oil prices…

It costs money to get oil out of the ground, and when the prices that can be commanded by energy companies drops below a certain point, profits suffer.

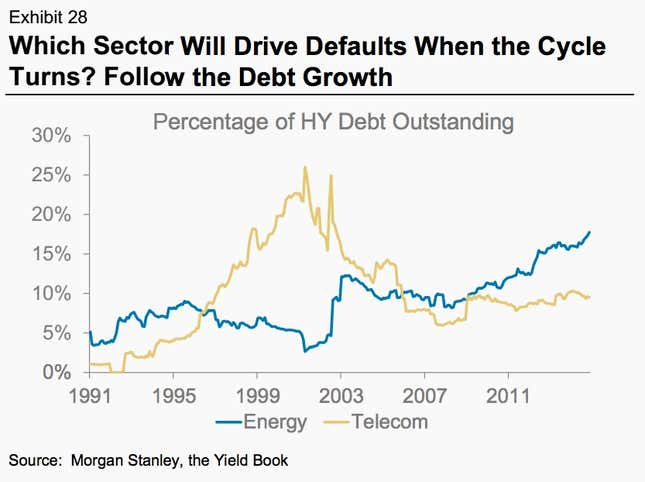

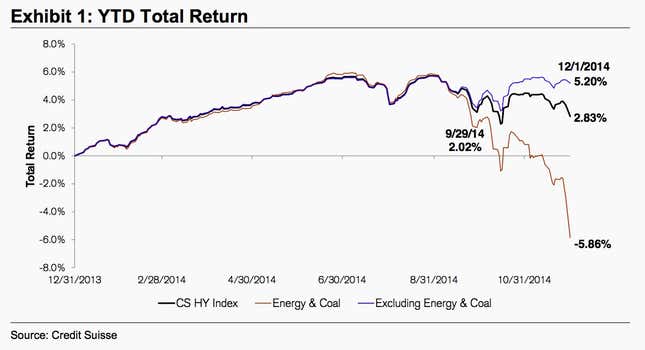

…as do their share of defaults in the junk bond market.

Energy companies took advantage of low rates to borrow heavily.

But low oil prices, along with the coal industry’s struggles, are now giving junk bond investors headaches.

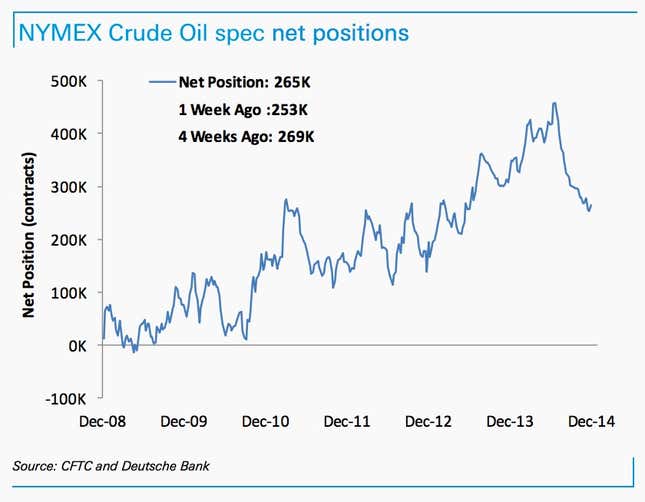

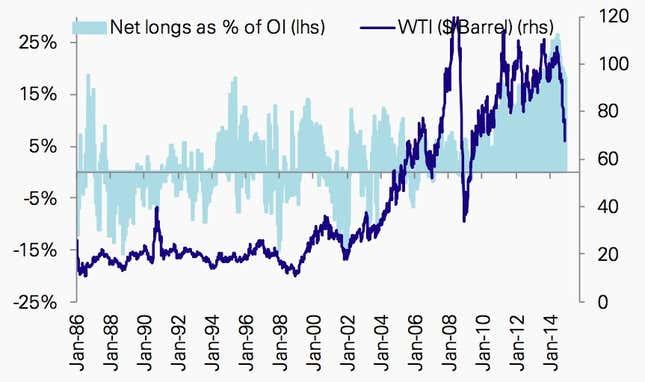

Some futures traders are still holding out hope that prices will bounce back

Look for that to change as prices continue to sink

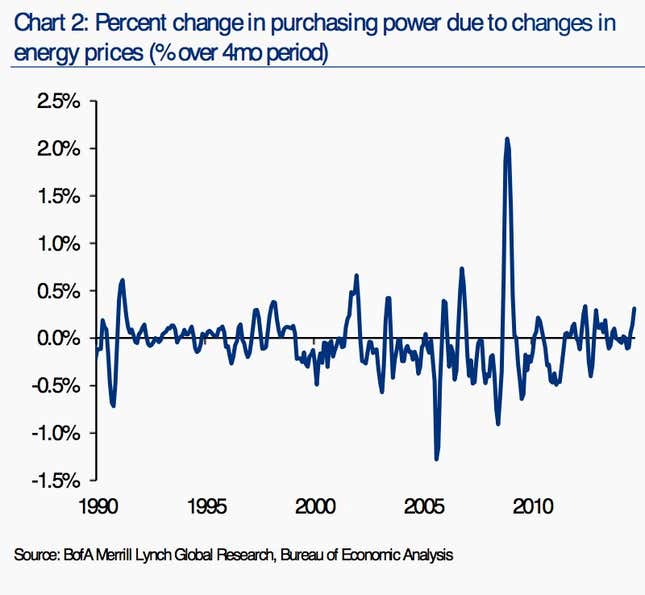

Low gas prices give the US economy a boost…

At the pump, cheaper oil means consumers have a little more spending power.

…but that’s a mixed blessing at home…

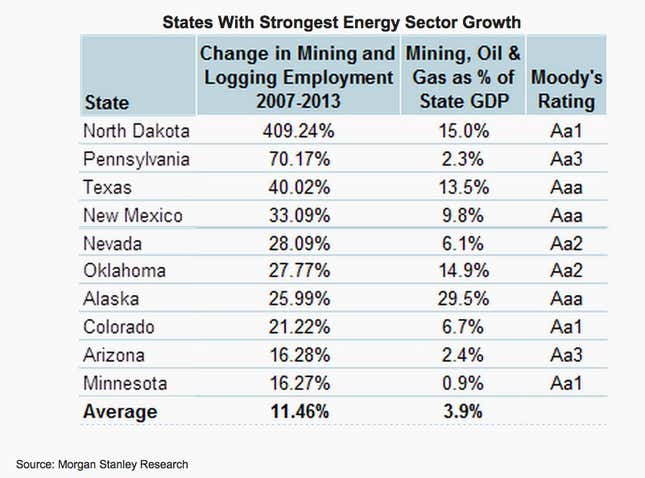

Expensive oil had been good for employment, especially in North Dakota.

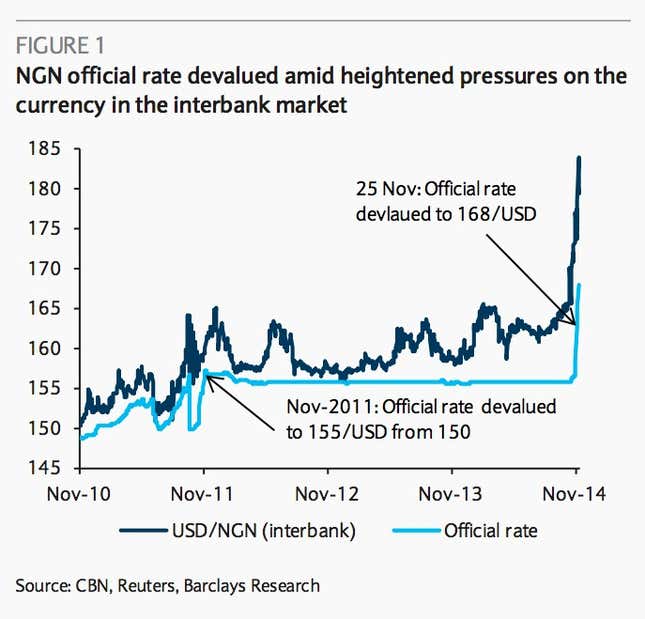

… and abroad.

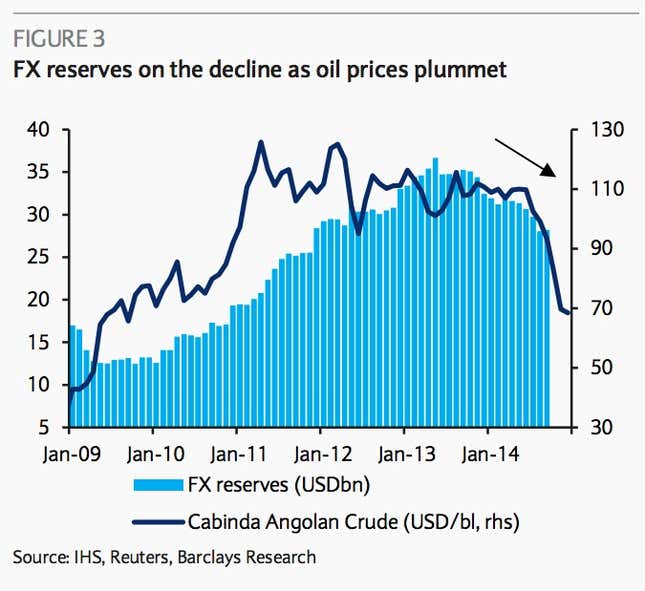

In Angola, lower oil prices are draining the National Bank of Angola of foreign currency. As a result, its own currency is weakening and inflation is rising.

A similar dynamic is playing out in Nigeria for the naira.