BYD—which stands for Build Your Dreams—is a Chinese electric-car maker with big ambitions. Warren Buffett likes it a lot, and according to FactSet his firm, Berkshire Hathaway, owns 25% of its Hong Kong-listed shares. Unfortunately for him, neither analysts nor Chinese car buyers are as enamored of it, despite China’s considerable government support for green vehicles.

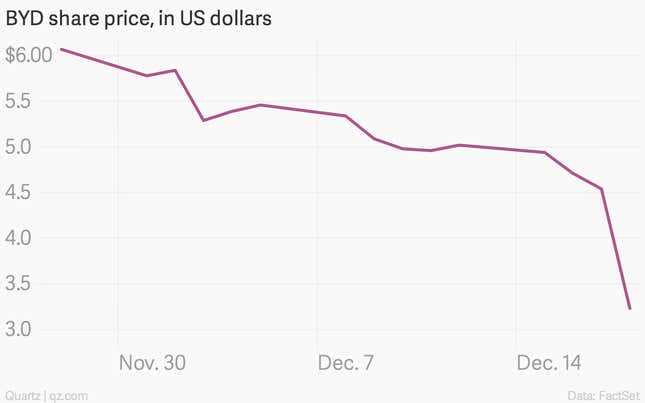

Bloomberg reported that investment bank Macquarie Capital dropped its price target on the stock, which is now falling off a cliff.

Taking a longer view, this one’s been a pretty rough ride for Buffett, who took a stake in BYD back in 2008. Before this week’s slump, he had already watched the stock fall around 30% from this year’s peak in March, and quite a bit further from when he valued Berkshire’s stake at $1.2 billion in its 2010 letter to investors (Berkshire held a 9.9% stake at the time).