The 26 economic charts you shouldn’t have missed in January

Oil and central bank action dominated economic headlines in January, but lots of other chart-able stuff happened this month. (We’ve got your back, Greece.)

ByMelvin Backman and Melvin Backman

Oil and central bank action dominated economic headlines in January, but lots of other chart-able stuff happened this month. (We’ve got your back, Greece.)

Let’s start with oil, though—because it’s hard to overstate the impact of what’s happening there.

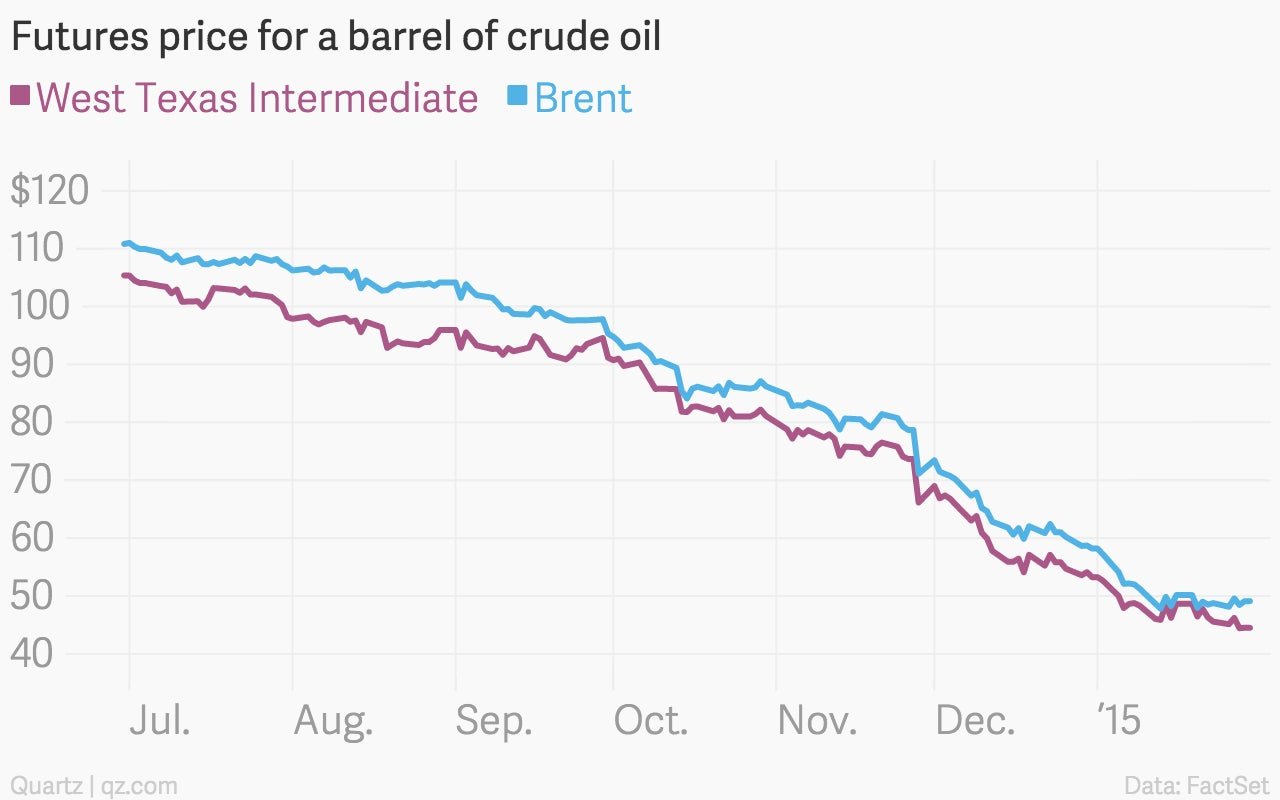

The oil bust continues

Oil prices are still falling

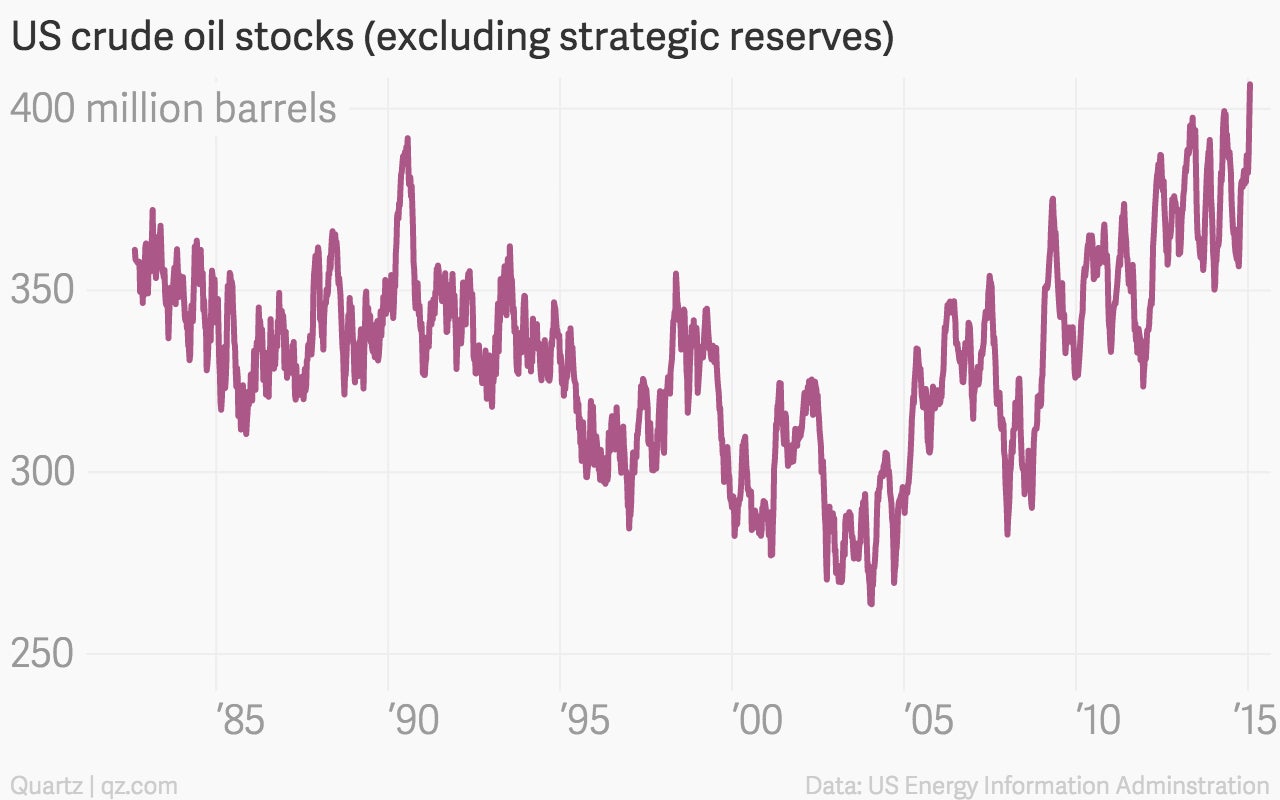

US crude oil inventories hit a record high

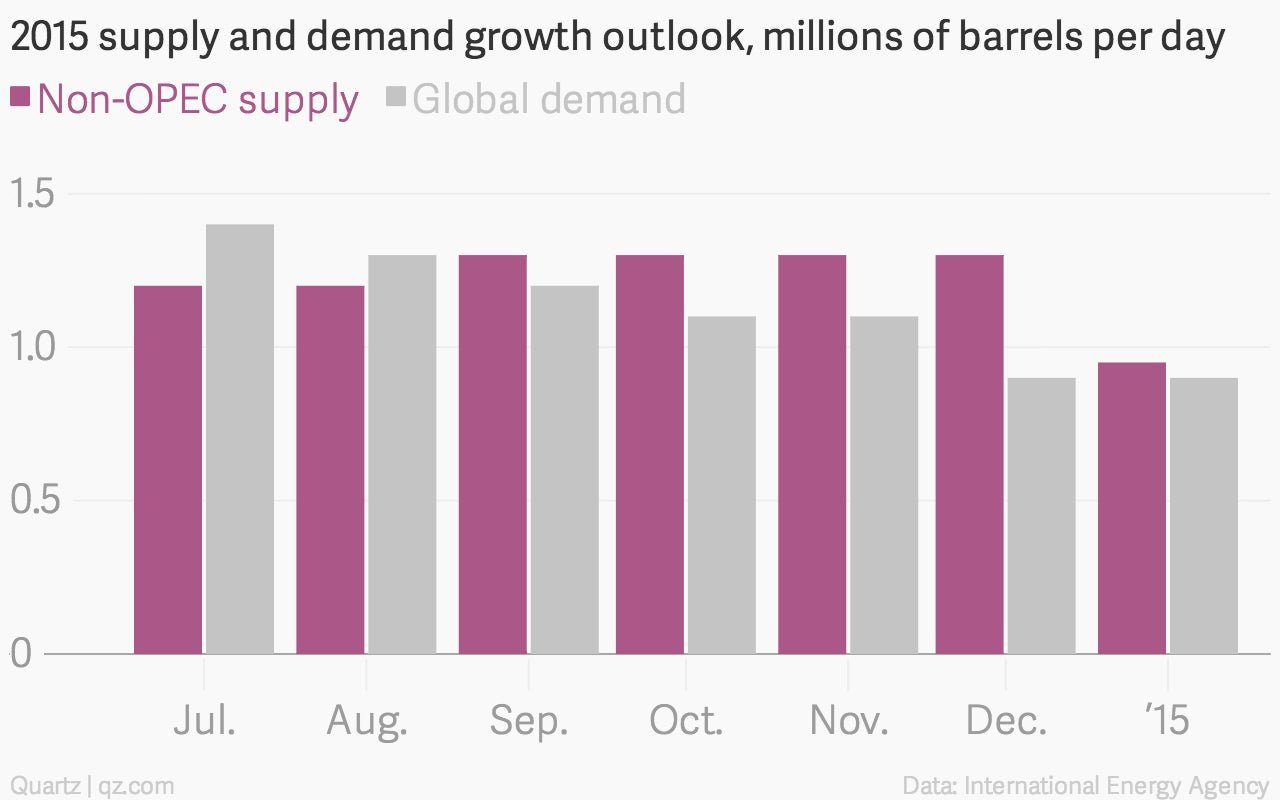

The International Energy Agency cut its 2015 forecast for global oil production.

Moving on to low-flation…

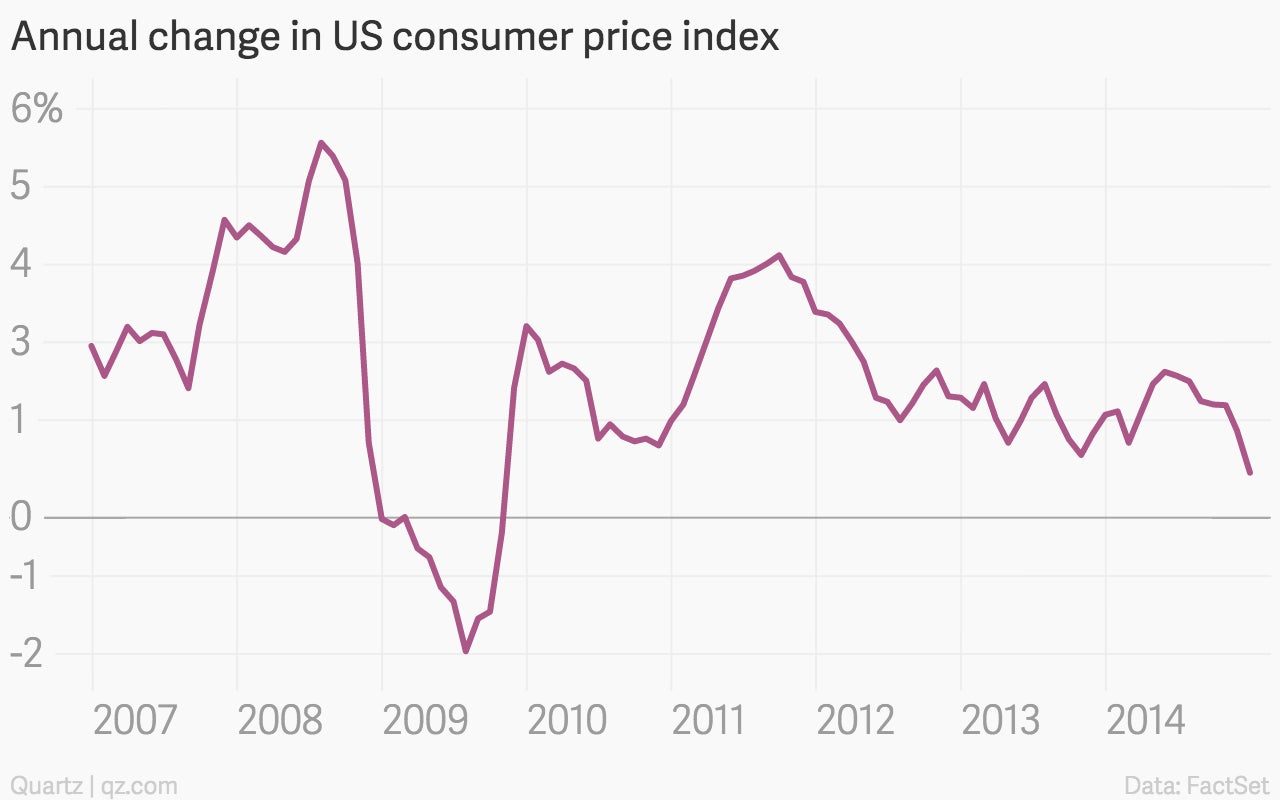

US inflation is falling

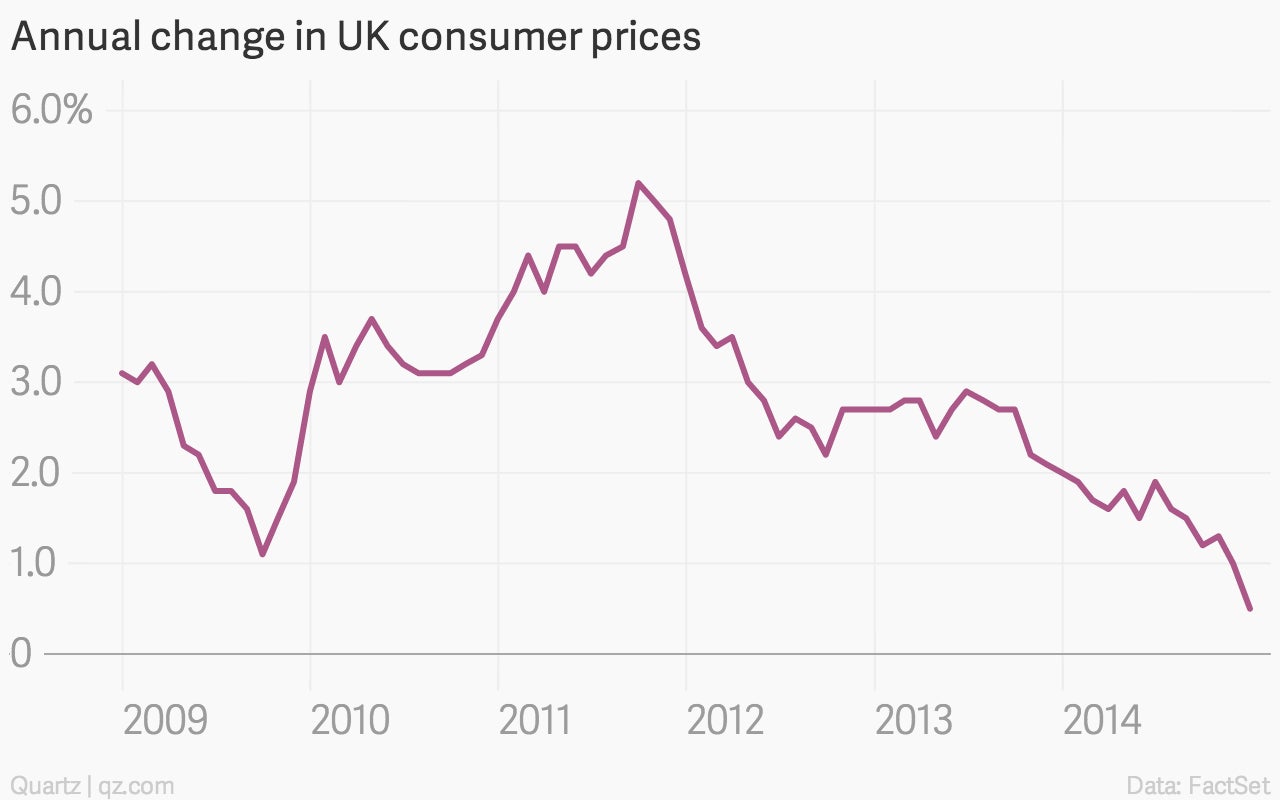

UK inflation is falling

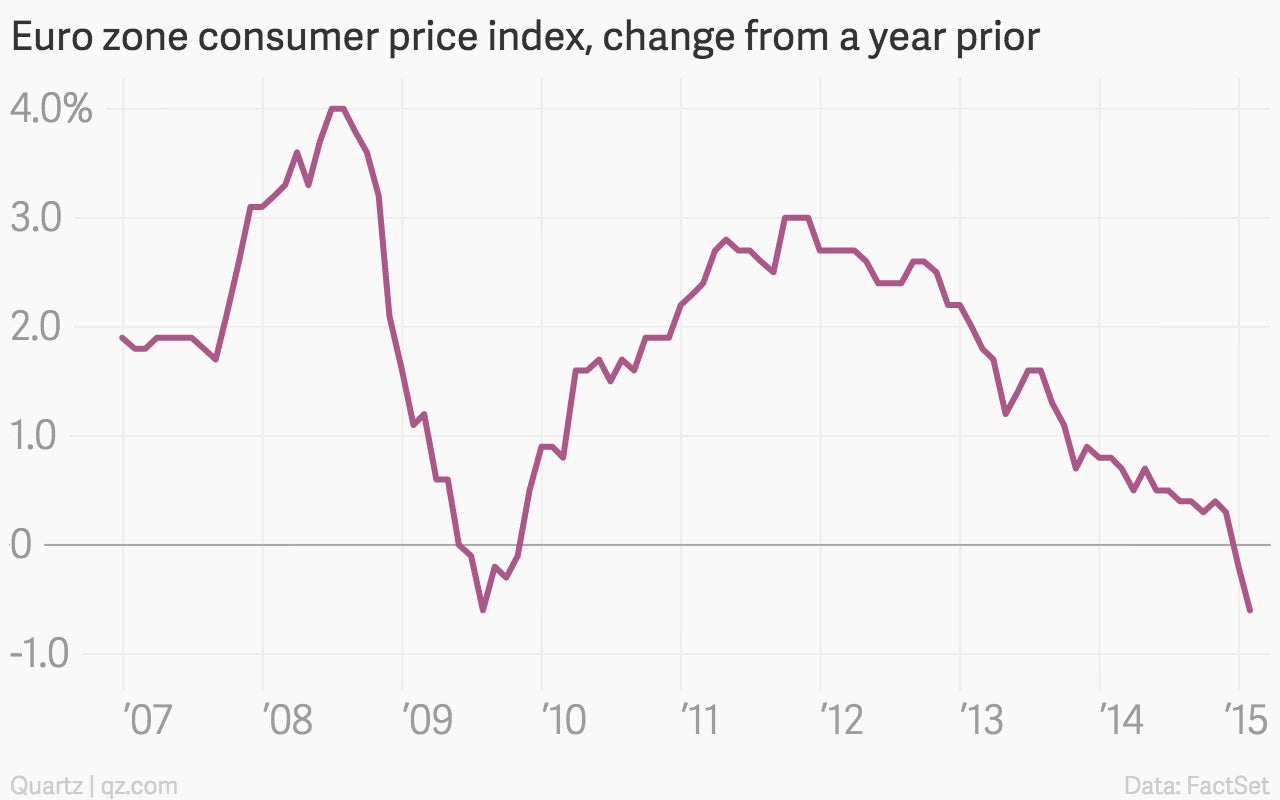

The euro zone fell deeper into deflation

In the zone

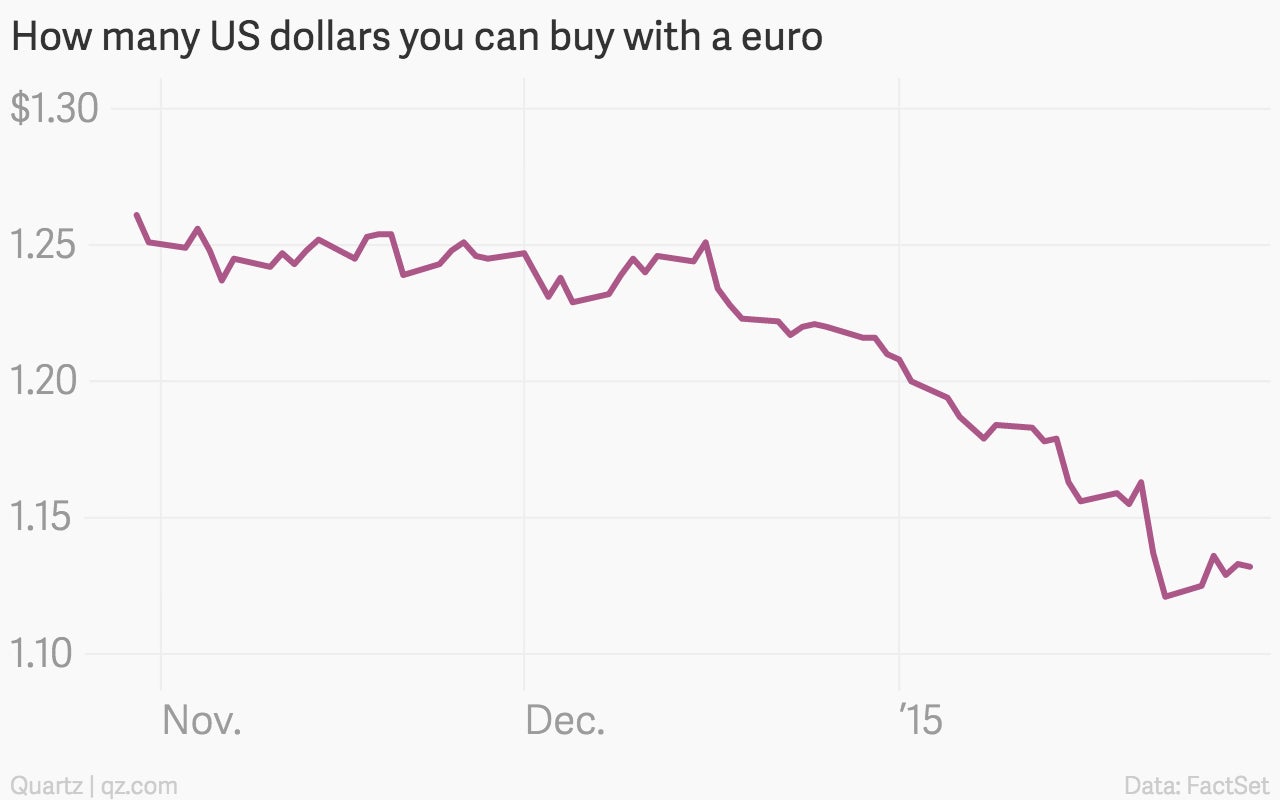

The European Central Bank finally unveiled its stimulus program, pushing the euro lower

Bond yields fell after the news, though they’ve been doing that for a while

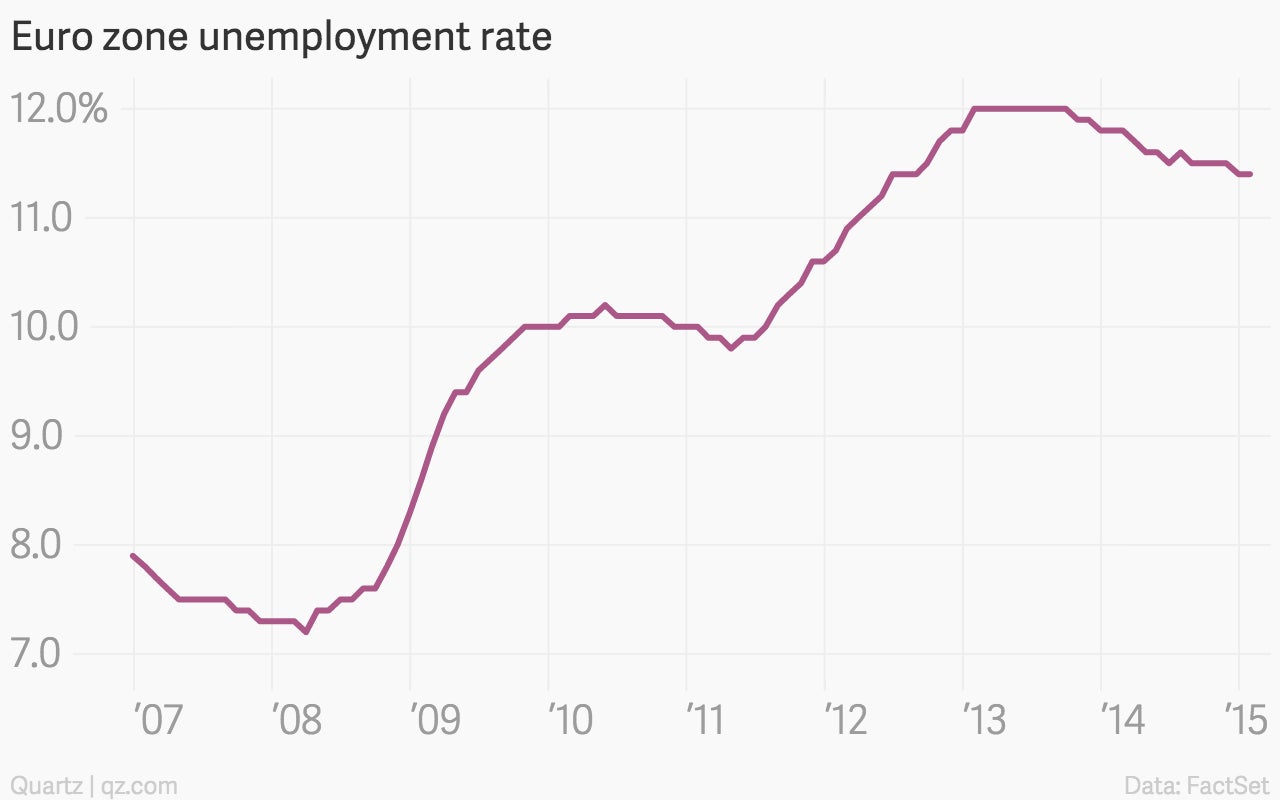

The continent could use it, considering how unemployment has remained pretty high

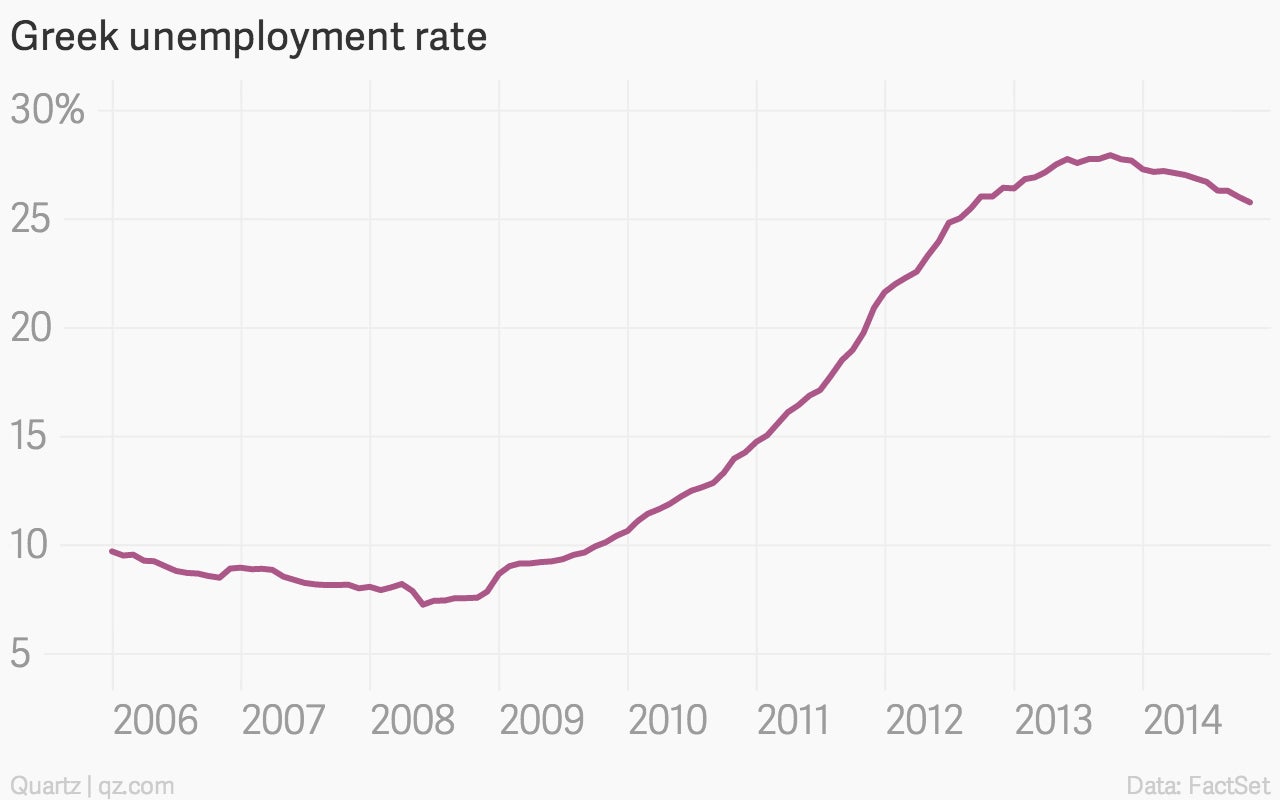

But it’s nothing compared with Greece

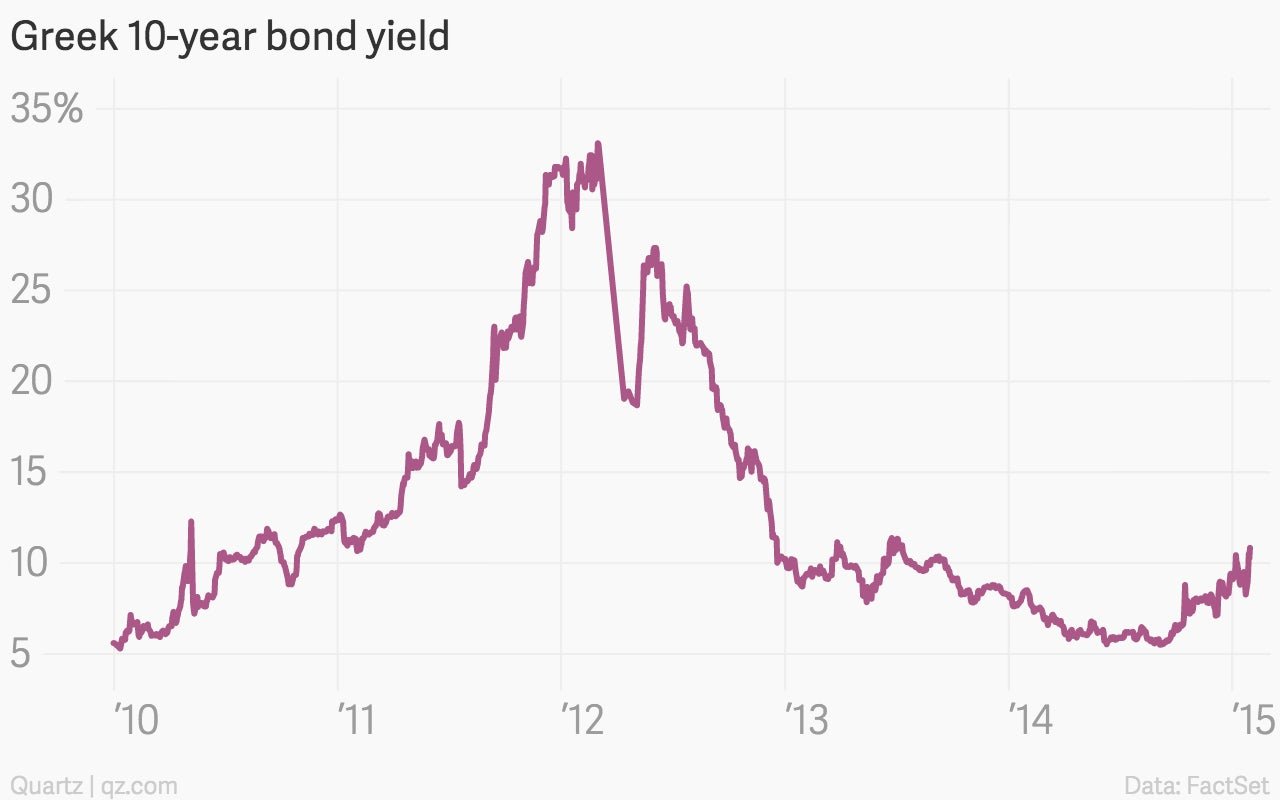

Where government bond yields rose this week after the anti-austerity Syriza party formed a new government

Meanwhile, central banking was looking pretty de-centralized…

Switzerland cuts its benchmark interest rate twice in a month’s time

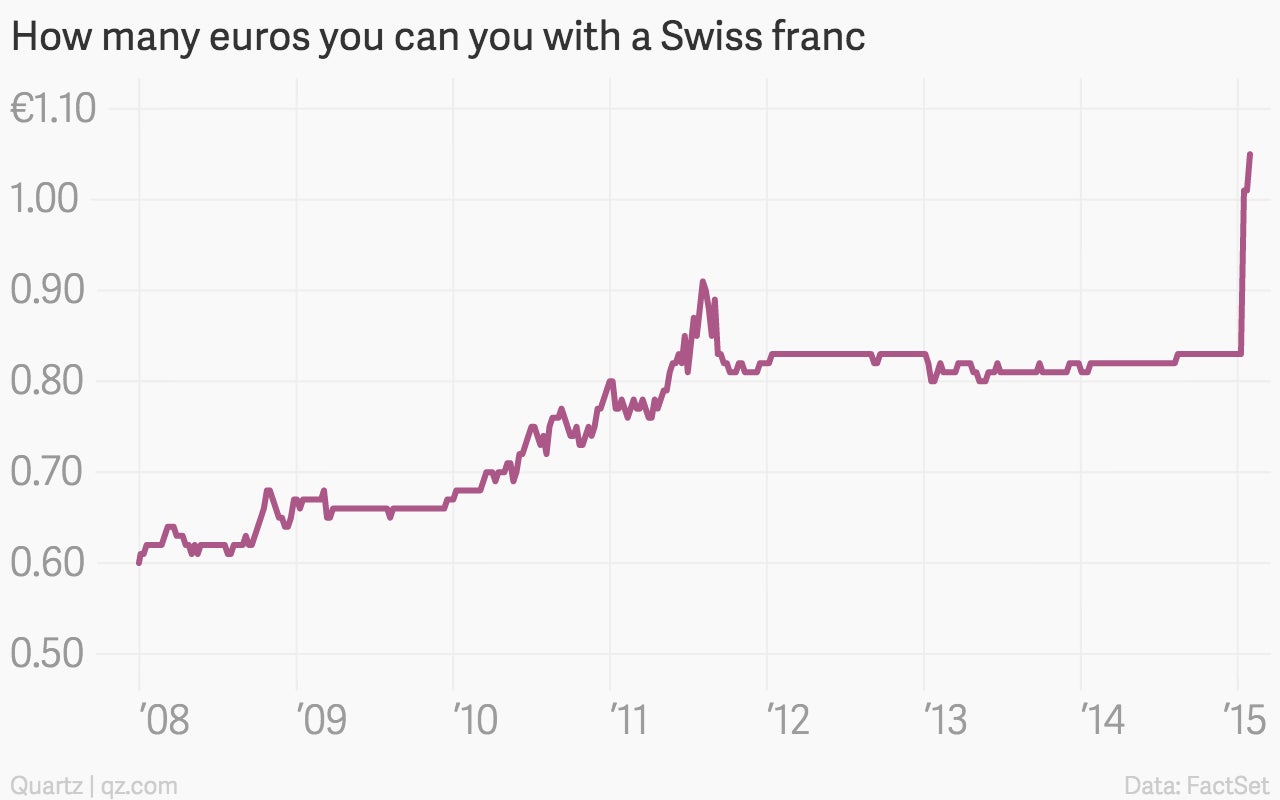

It also de-pegged the franc from the euro

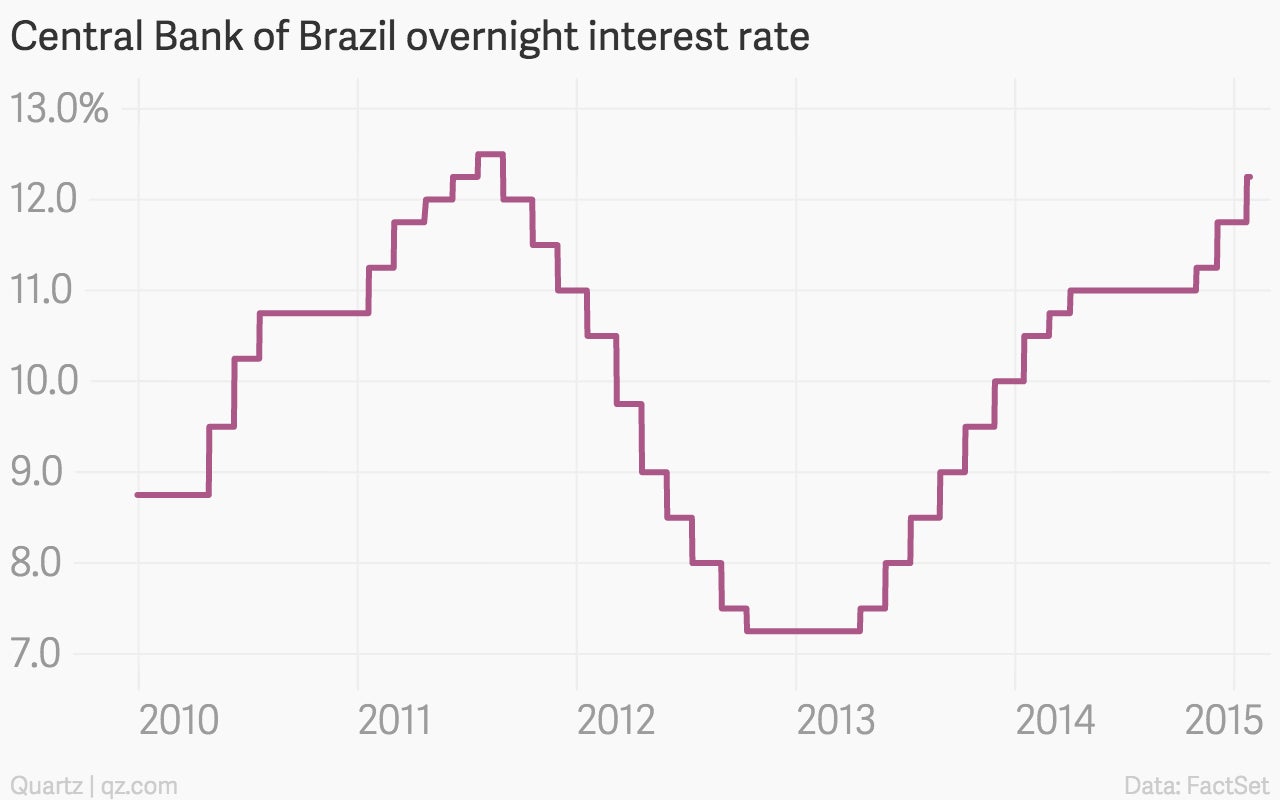

The Central Bank of Brazil, meanwhile, hiked rates

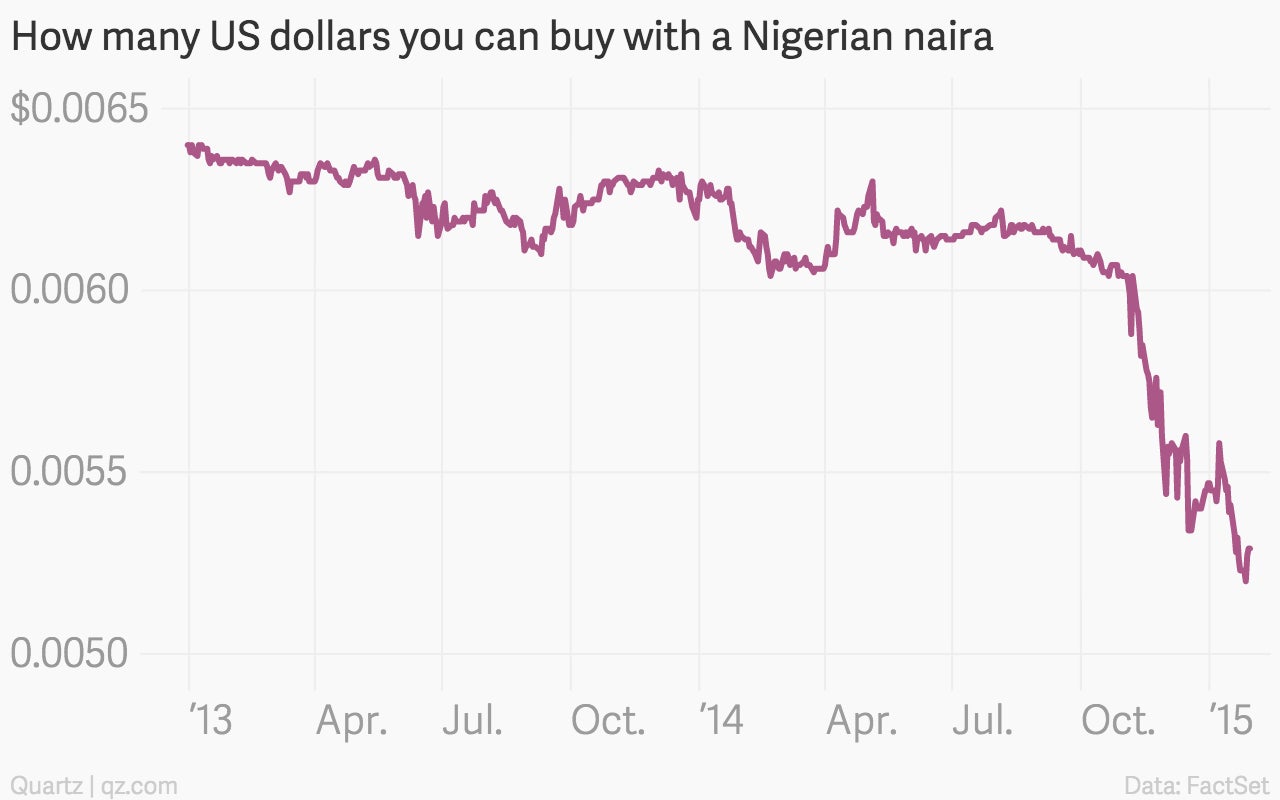

The Nigerian naira fell after the Central Bank of Nigeria left rates alone

Made in China

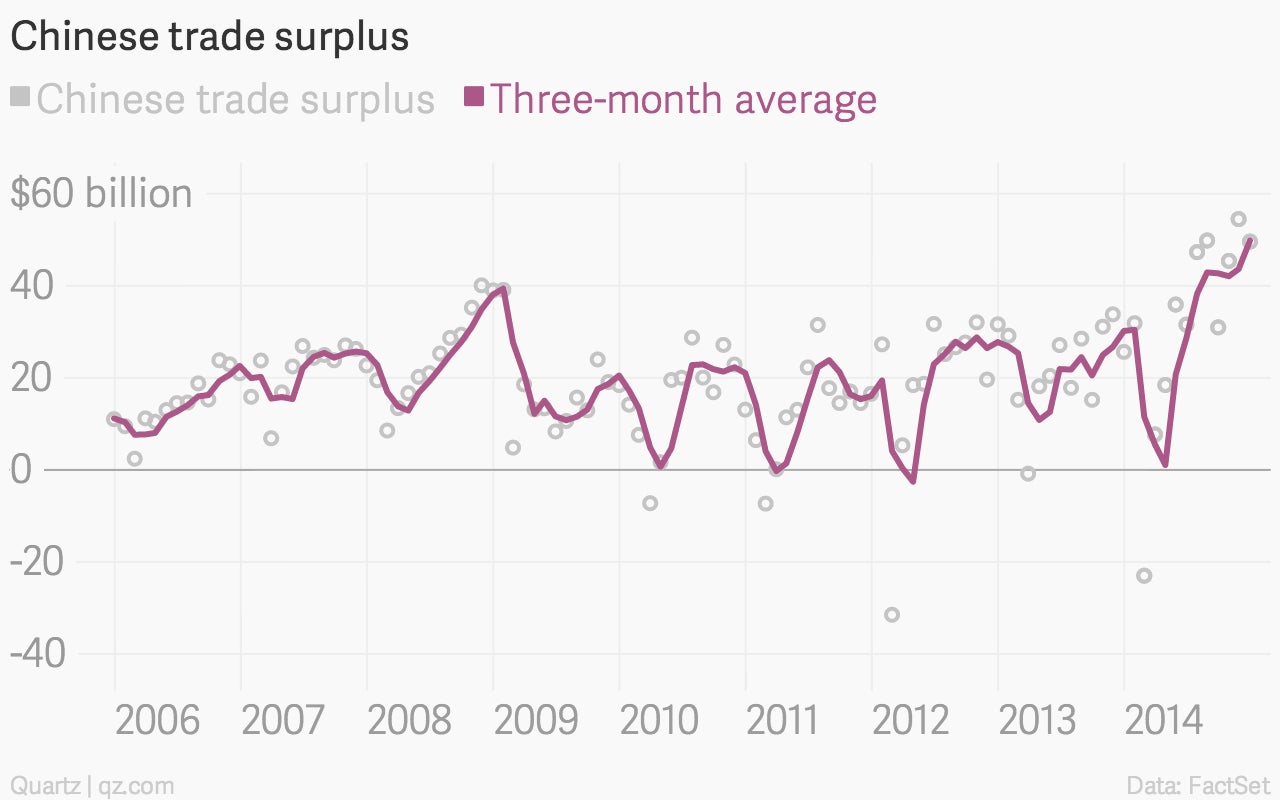

China’s trade surplus grew

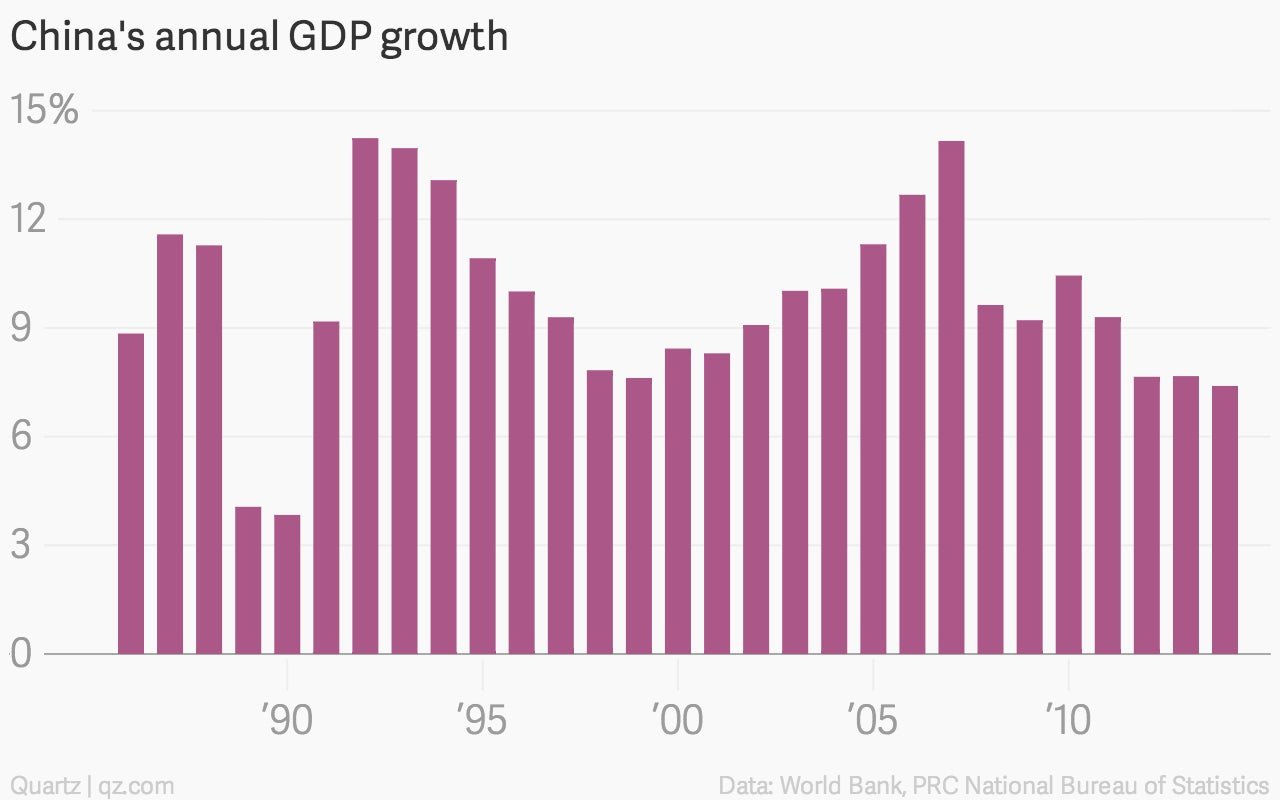

China GDP growth slowed

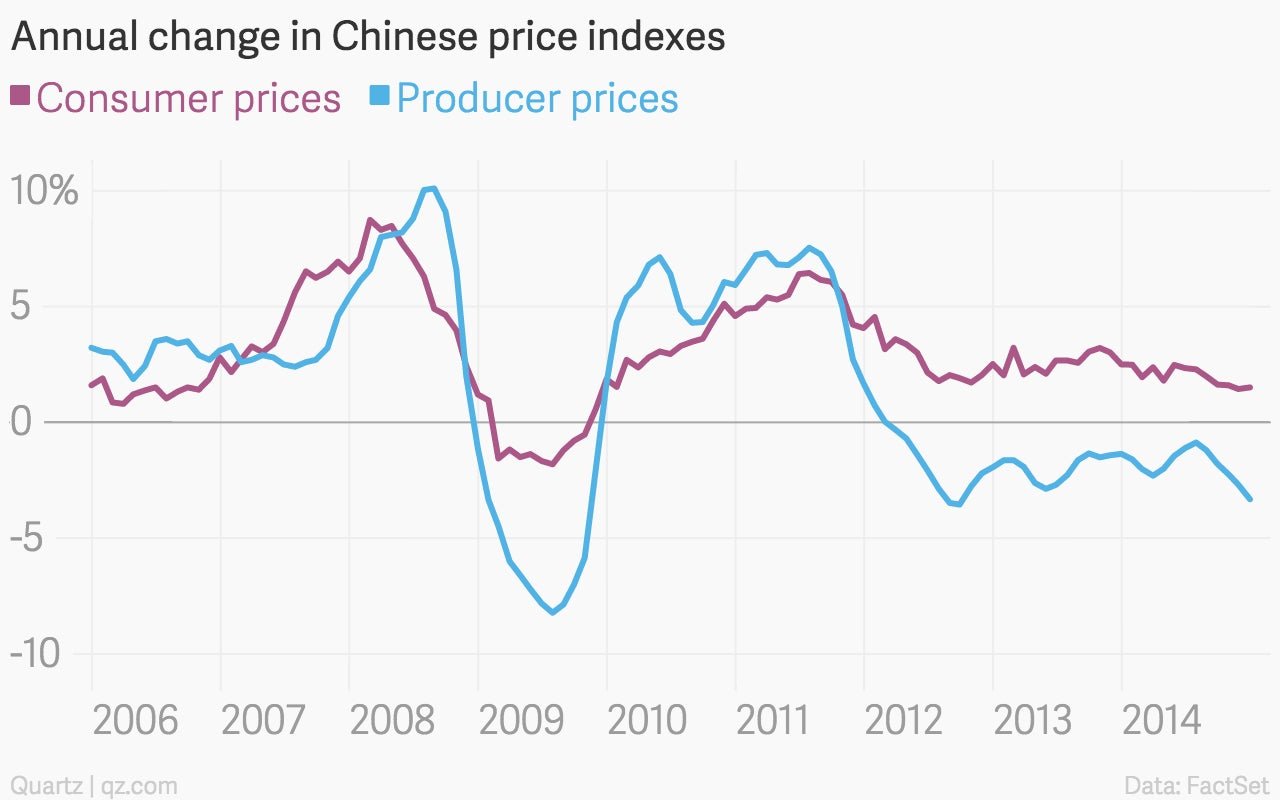

Chinese inflation is stable on the consumer side, but deflation deepened on the producer side

As for the Anglosphere…

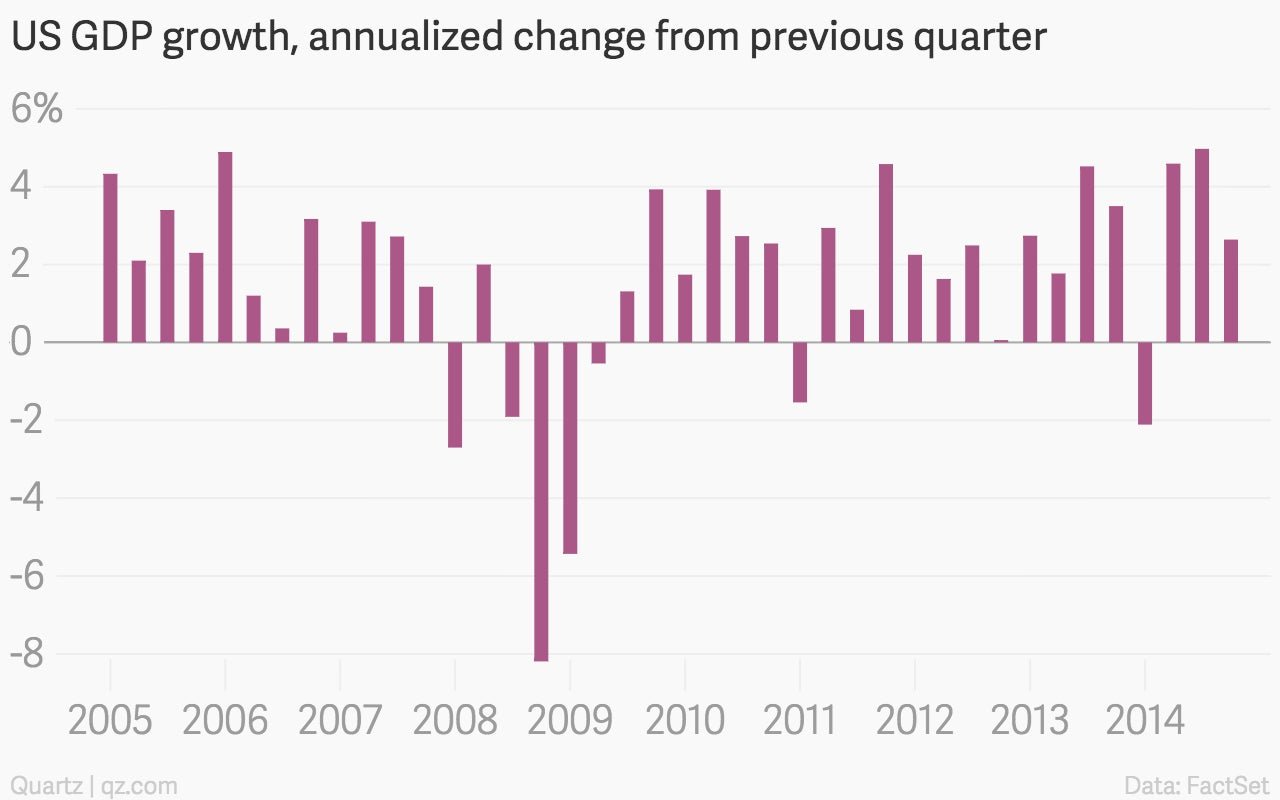

The US economy grew a bit more slowly than expected last quarter

And US wages aren’t getting much of a boost

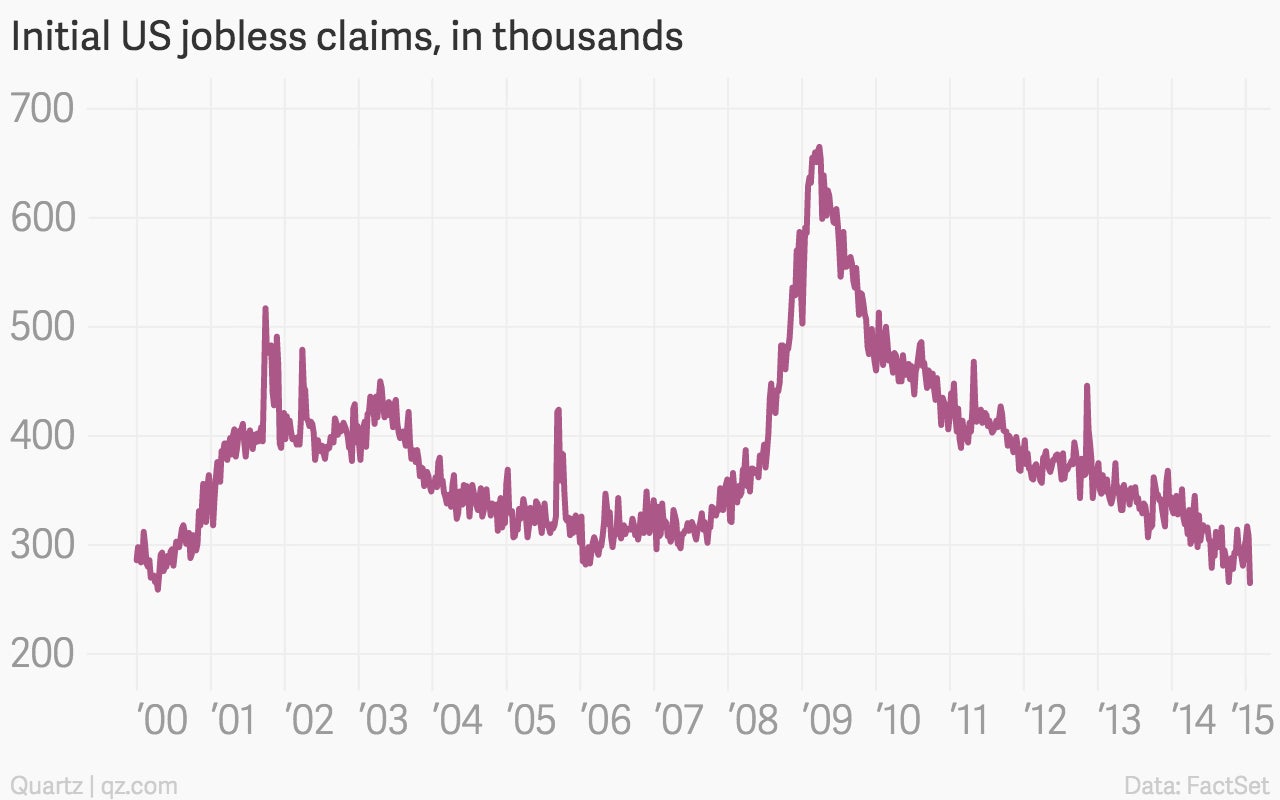

But US jobless claims are way down

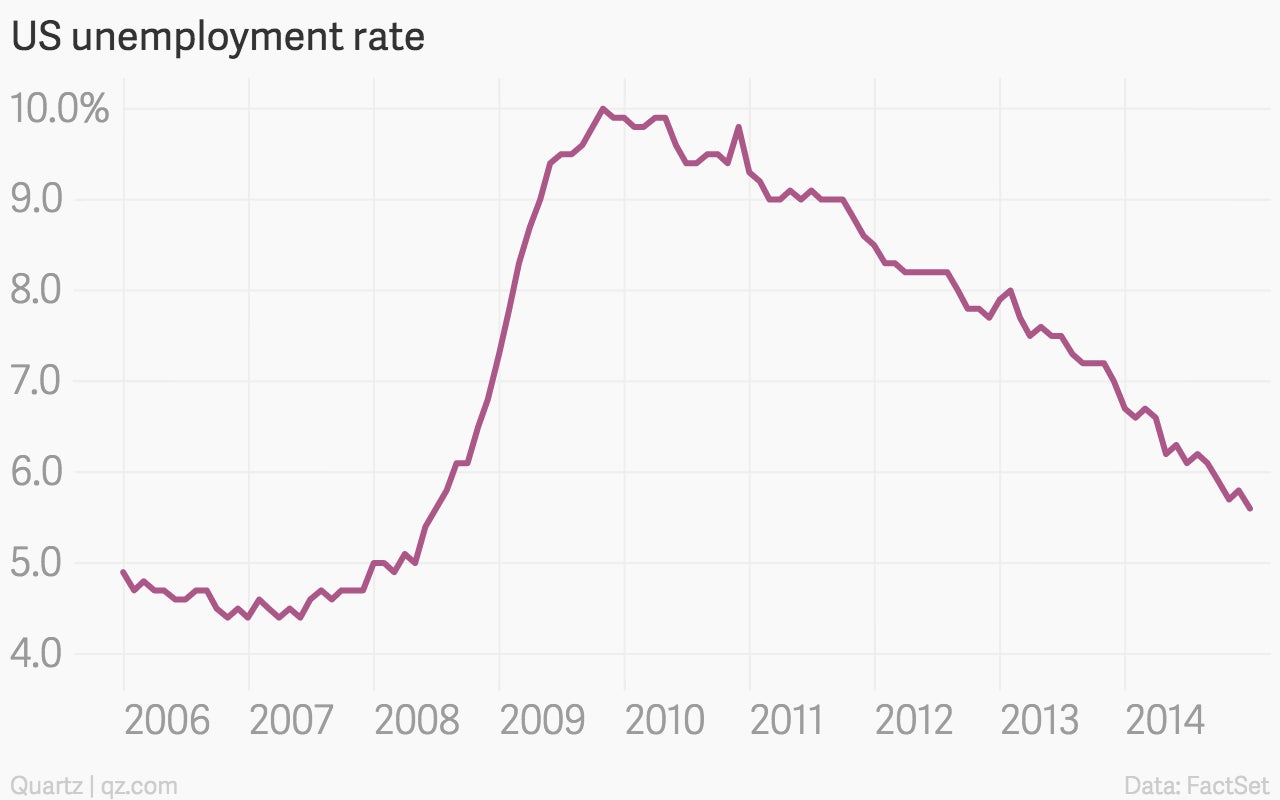

So is US unemployment

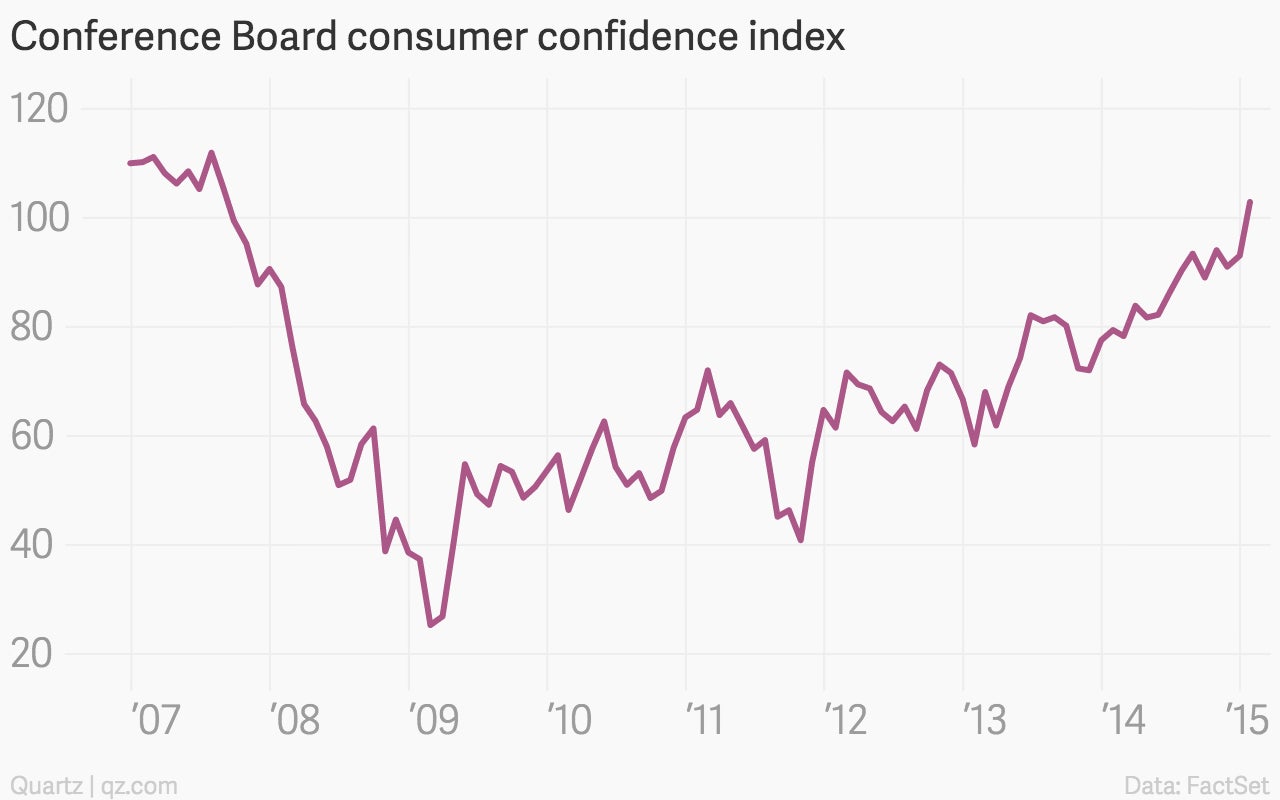

So it makes sense that US consumers are feeling pretty good

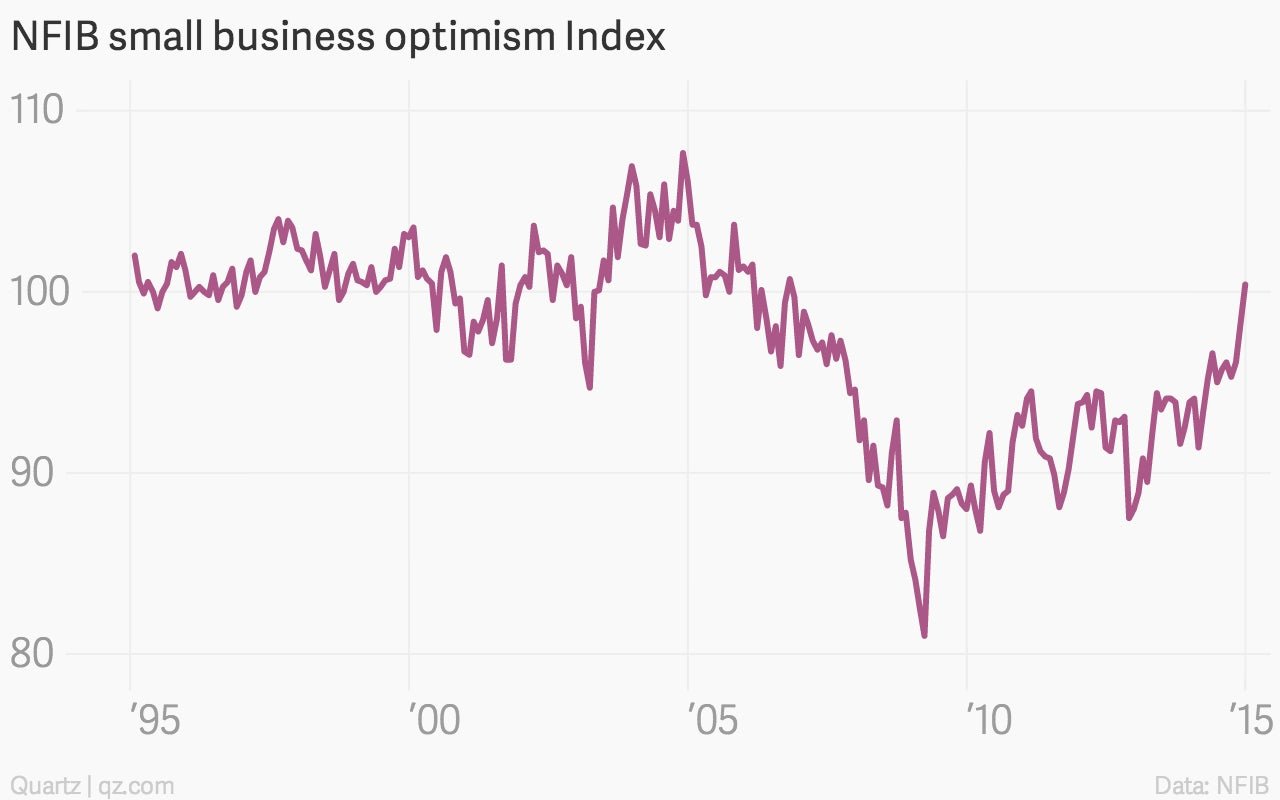

As are US businesses

The British unemployment situation is similarly improving

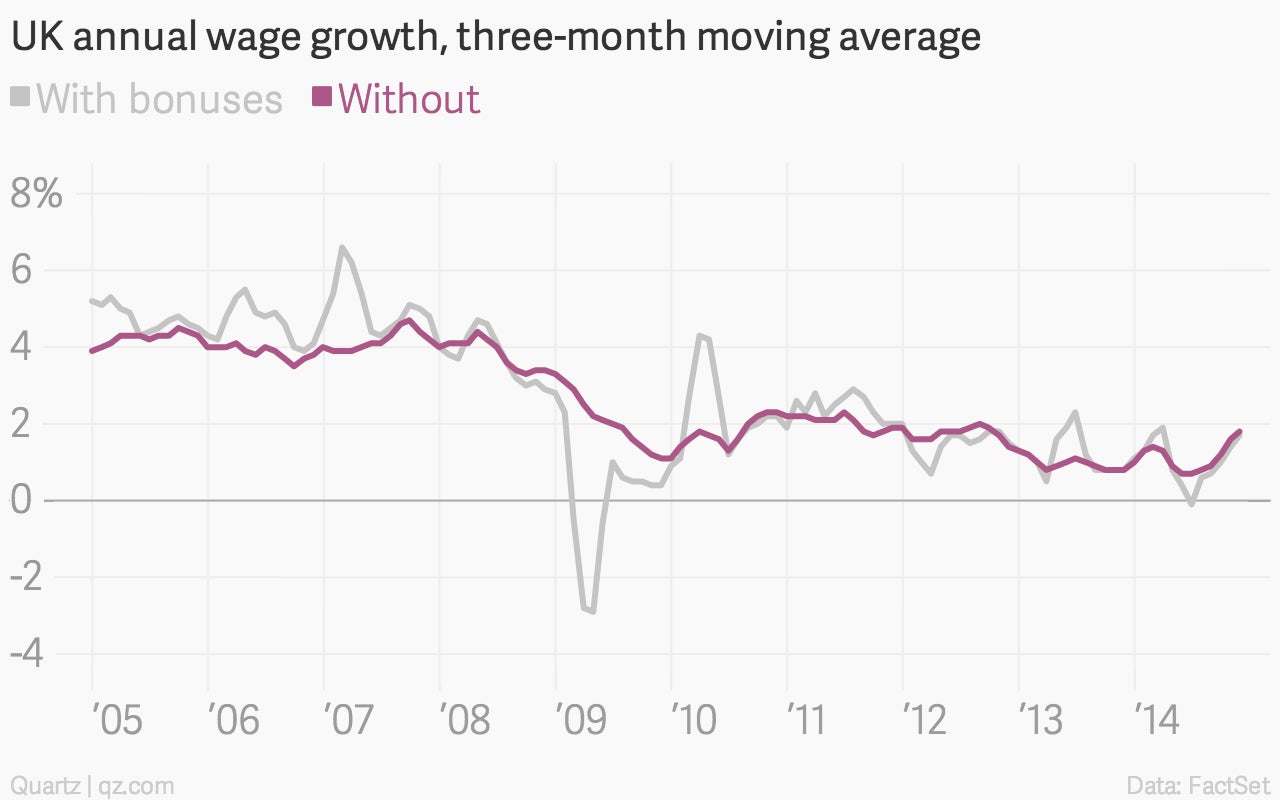

As are British wages