This morning, Reuters’ Eric Burroughs tweeted this chart that notes how hard it has become for energy companies to borrow money.

This is both an effect of lower oil prices and possibly a hint that an economy-wide dip in equipment investment will continue.

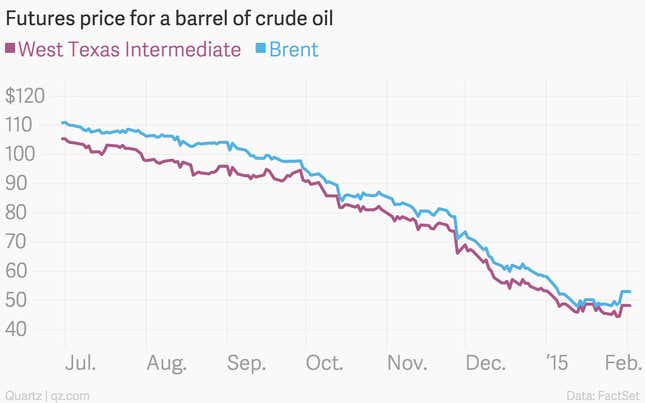

A recent rally excluded, oil prices have been falling for months.

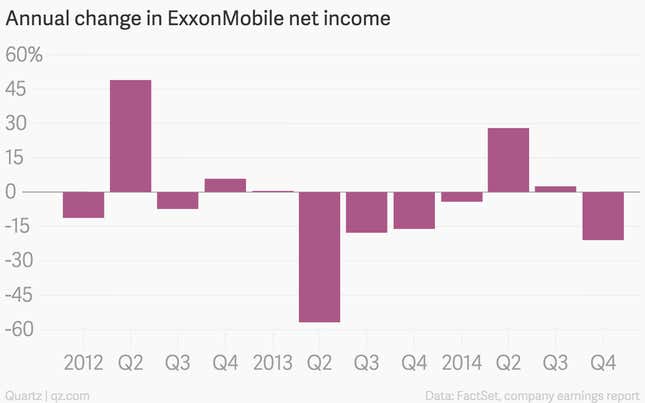

Lower oil prices mean leaner profits for oil companies (as well as layoffs and other consequences for the oil industry).

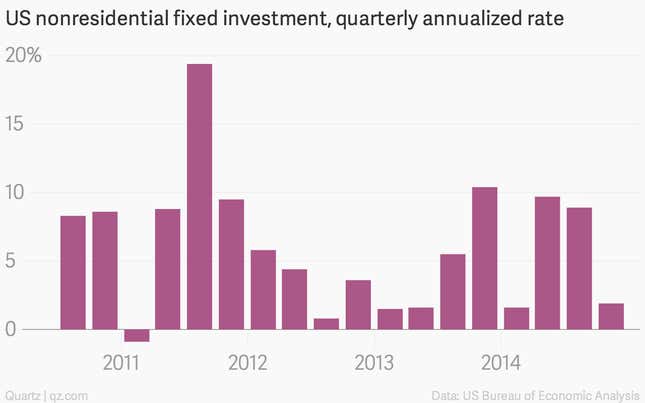

Less profit means less money left over, not just for debt payments, but also for investment. Last quarter saw big dips in both US corporate investment generally…

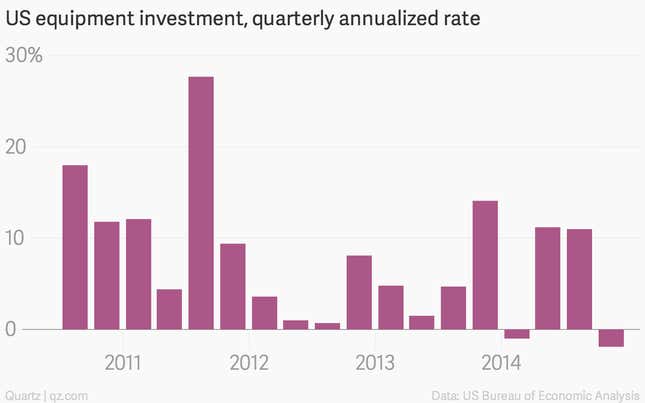

…and equipment specifically.

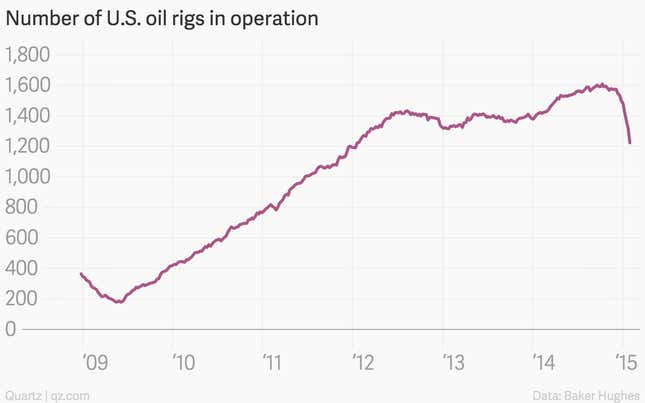

Just look at the sudden, steep drop in the number of North American oil rigs.

It’s a tenuous connection for sure, but it hints at the some of the consequences of cheap oil.