Now the market is ok with the Syriza win in Greece

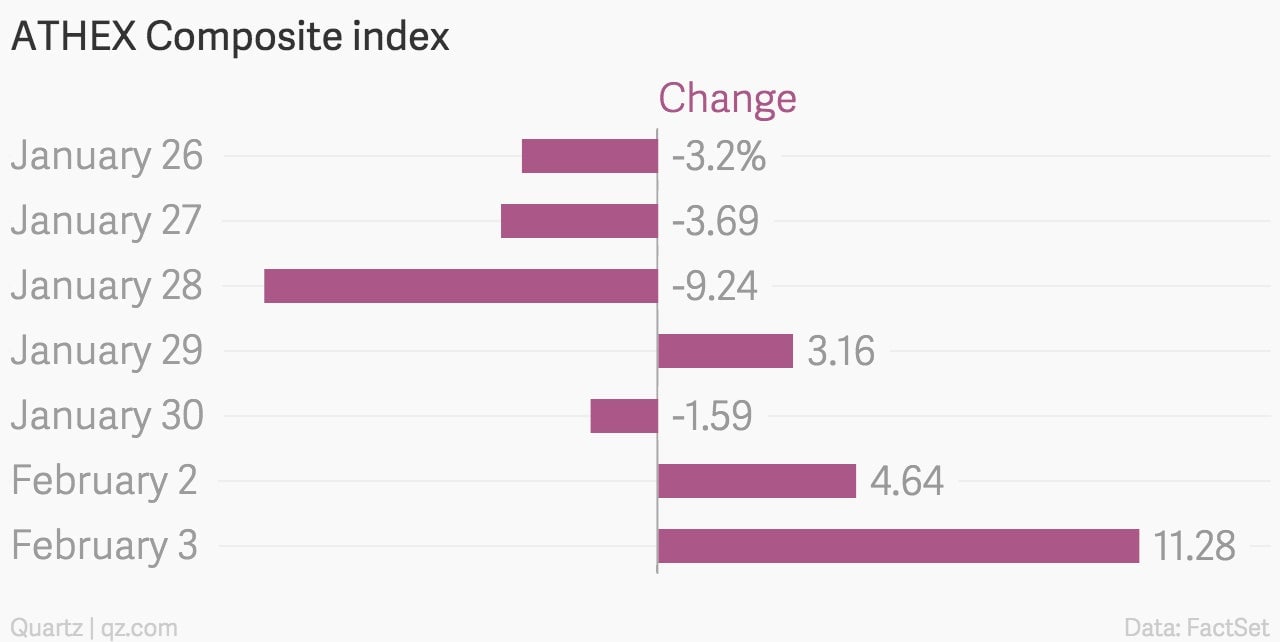

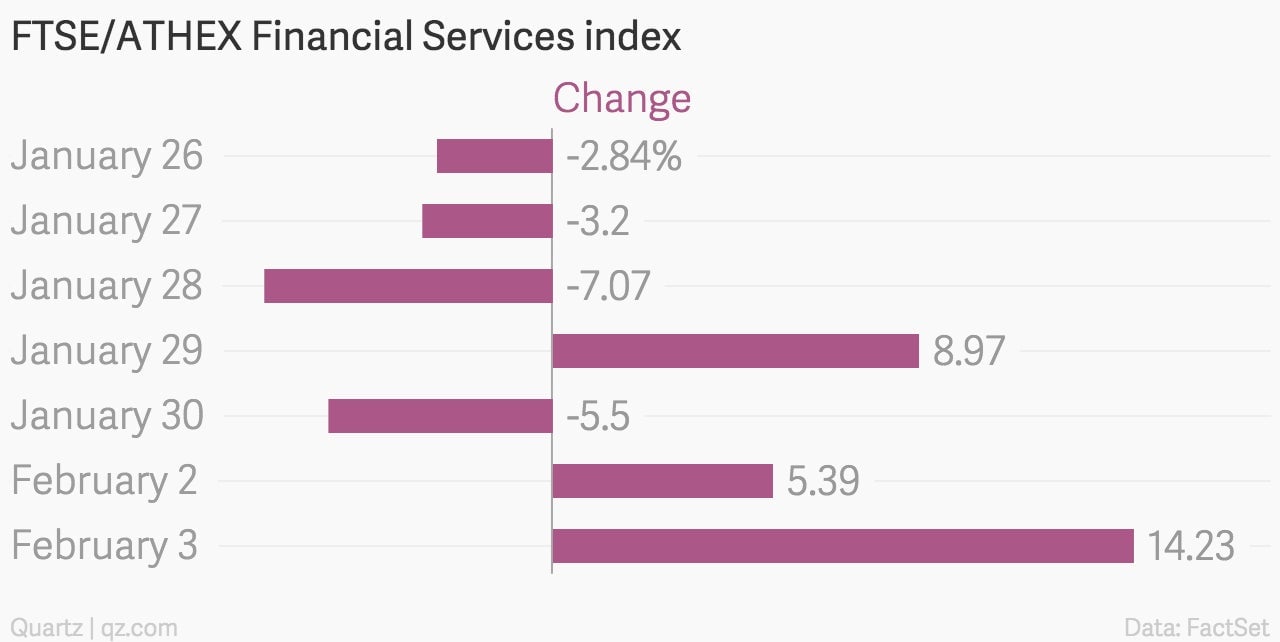

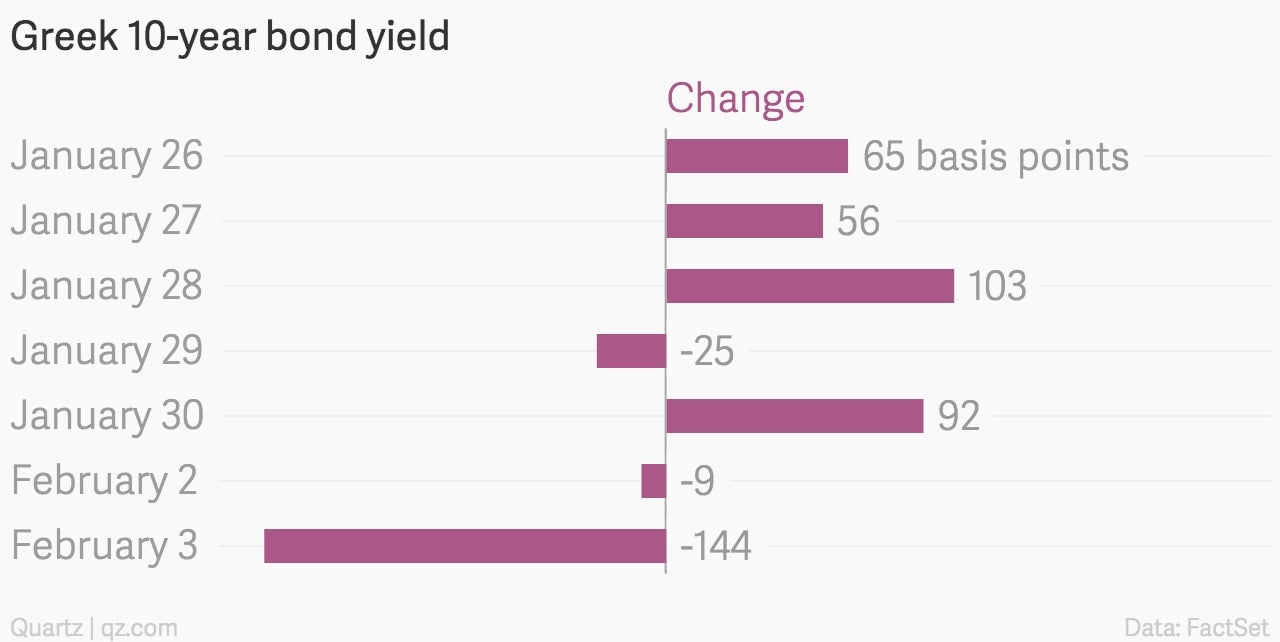

At first the market was totally cool with the anti-austerity Syriza party taking over Greece’s government. Then it began to freak out when—lo and behold—newly installed prime minister Alexis Tsipras formed an anti-austerity government. But now that Tsipras & Co. have actually laid out their plans for restructuring Greece’s debt (again), the market has calmed down a bit. So it’s been a volatile couple of weeks.

At first the market was totally cool with the anti-austerity Syriza party taking over Greece’s government. Then it began to freak out when—lo and behold—newly installed prime minister Alexis Tsipras formed an anti-austerity government. But now that Tsipras & Co. have actually laid out their plans for restructuring Greece’s debt (again), the market has calmed down a bit. So it’s been a volatile couple of weeks.

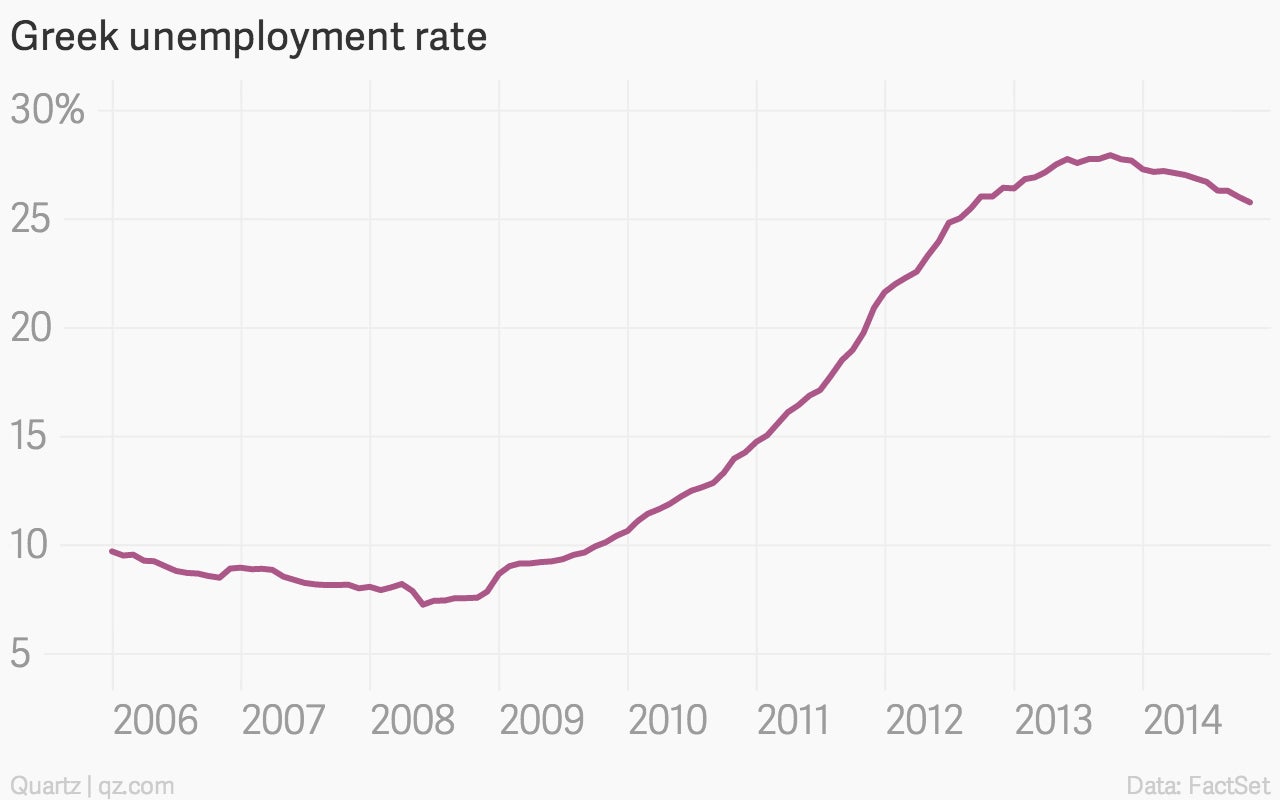

Nobody really knows for sure what’s going to happen in Greece. Quartz itself is divided: Tim Fernholz thinks Syriza is going to get its way, and Kabir Chibber does not. Two more charts to remind you of the stakes: Greece’s unemployment rate…

…and Greece’s GDP growth.