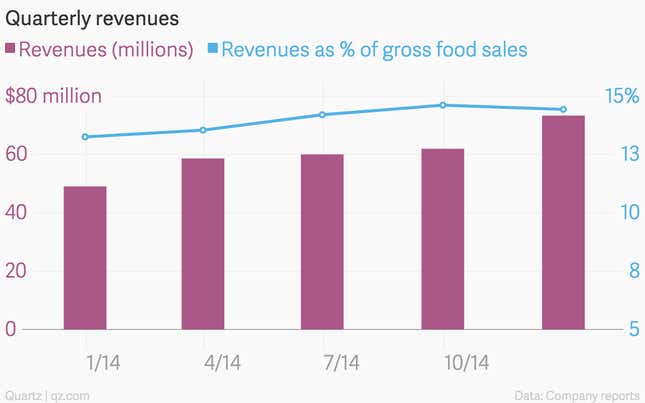

Along with the news that fourth-quarter revenue increased by 50% year-over-year while profits have quadrupled, GrubHub announced today that it has acquired Boston-based delivery service DiningIn and California-based Restaurants on the Run.

The acquisitions confirm that GrubHub, heretofore known primarily as an online food-ordering company, also wants to focus on being an online food delivery company.

Soon, instead of simply connecting customers with restaurants on its online platform and letting the restaurants handle the delivery process after orders are placed, GrubHub will be dispatching its own couriers to deliver meals. It’s already been experimenting with this system in Chicago, Los Angeles, and San Francisco, according to Fortune, which reports that GrubHub plans to take a smaller share of each transaction from restaurants than other delivery service companies do.

GrubHub’s average commission on the $508 million in orders placed via its platform last quarter was about 14.5%, a percentage point higher than in 2013. The service charges slightly higher commissions to restaurants that want to appear higher in its online listings.

According to Fortune, that margin also sets a baseline for the company’s delivery aspirations:

Not only is this significantly lower than the 20-30% that many restaurants are charged by current delivery groups (including DiningIn and Restaurants on the Run), but GrubHub only plans to charge customers whatever nominal fee is needed to make the delivery break-even (or nothing at all, depending on if it can offset that difference with increased deliveries).

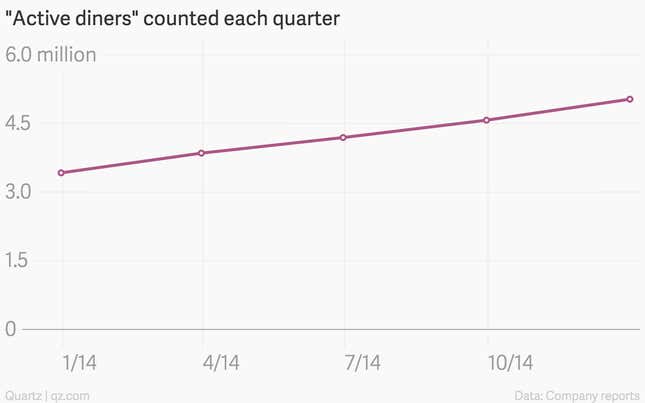

And that could go a long way toward keeping this trend line on track: