Remember when Brazil complained about currency wars?

In the autumn of 2010, finance minister Guido Mantega made headlines by decrying the Federal Reserve’s efforts jolt the US economy out of its malaise by creating new money, and using it to buy bonds. Mantega saw it as the start of an “international currency war.” He argued the Fed was unfairly weakening the US dollar—and by extension strengthening the Brazilian real—which made his country’s exports less competitive in the global market.

That was then, and this is now. The US dollar is surging, along with the relatively robust US economy. Brazil’s real is outright freefall, as the economy staggers. It has collapsed by nearly 30% against the dollar over the past year, amid an economic slowdown, and a riptide of capital looking to exit the country.

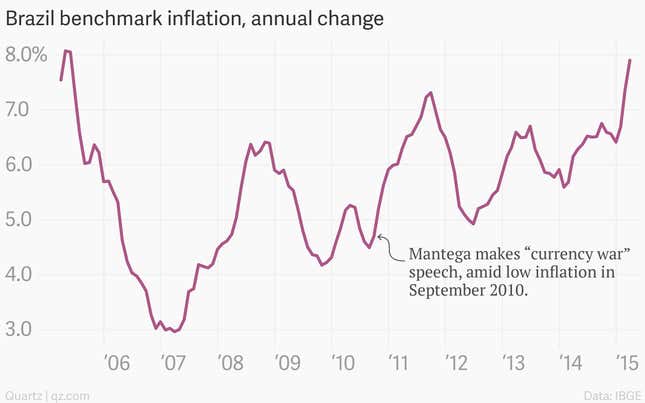

The decline of the currency has reignited inflationary pressures; the latest figures show prices up 7.9% over the last year. (That’s the fastest clip in roughly a decade.)

Surging along with prices is public discontent. A series of massive public demonstrations in recent days has shaken the government of Dilma Rousseff and her left-wing Worker’s Party, which has held power in Brazil since 2002. Such a long stretch with the reins always raises risks of unsavory dealings, a fact underscored by the slow-motion explosion of a bribery scandal involving Brazil’s national oil giant Petrobras that threatens to envelope the Rousseff presidency.

Given such headaches, Brazil’s leadership might look back fondly on the now-distant period when the country’s currency was too strong.