All the conflicting things Lufthansa’s CEO needs to communicate in a crisis

There is a lot of advice out there for executives thrust into the spotlight during the immediate aftermath of a tragedy. No matter the toll it is taking on you personally, don’t follow the example of former BP boss Tony Hayward and complain that you want your life back. No matter how little information you might have to offer, don’t make defensive, contradictory statements like Malaysia Airlines officials did after one of their company’s planes vanished mysteriously last year.

There is a lot of advice out there for executives thrust into the spotlight during the immediate aftermath of a tragedy. No matter the toll it is taking on you personally, don’t follow the example of former BP boss Tony Hayward and complain that you want your life back. No matter how little information you might have to offer, don’t make defensive, contradictory statements like Malaysia Airlines officials did after one of their company’s planes vanished mysteriously last year.

But the qualities we expect from corporate leaders managing in a crisis—honesty, transparency, accountability, empathy—don’t always square with other demands on them, like maintaining the confidence of investors (measured most bluntly by share price) and of employees (which often means voicing unwavering admiration for them).

Carsten Spohr, the CEO of Lufthansa, is now addressing this difficult balance, after 150 passengers died in a crash on a flight operated by the company’s Germanwings subsidiary. The pressure amped up considerably as evidence emerged suggesting the co-pilot crashed the plane deliberately.

Questions are already being asked about the airline’s lack of a policy requiring two people to be in the cockpit at all times, and about Spohr’s quick dismissal of the idea that such a policy should be implemented. “I don’t see any need to change our procedures,” he said at a press conference today, before allowing that “we will get together with the various experts in the Lufthansa group airlines, in the authorities, with our German government to see if our procedures can be refined. But I think we should not now jump into short-notice activities.”

But so far, Spohr’s handling of the crisis seems to follow the better examples of how to manage amidst tragedy. Speaking on behalf of the company’s nearly 119,000 employees, Spohr said that everyone at Lufthansa is “speechless,” “shocked,” and “dismayed” by what happened. He affirmed that his ”confidence in the selection of our pilots, in the training of our pilots, in the qualification of our pilots, and the work of our pilots has not been touched by this single tragedy.”

While offering unqualified support of staff may be warranted now, as we learn more about the pilot at the time of the crash, the disconnect between a public show of confidence in all staff and private reservations about an employee who may have crashed a plane on purpose must also be addressed. The tests will keep coming, and any mistakes will be punished severely, both by the markets and in the court of public opinion.

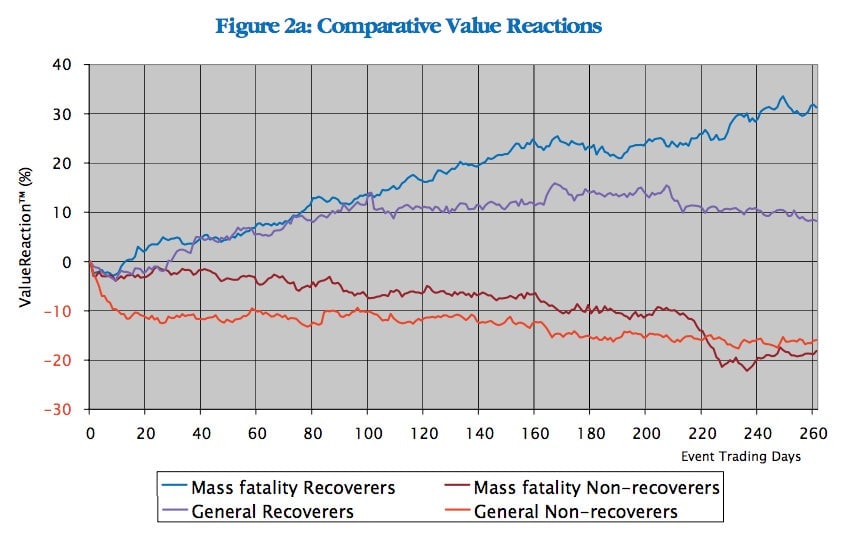

Indeed, there is a macabre field of research on how markets react to company crises, measuring how a management’s response to tragedy is reflected in the long-term value of a firm. Research by Oxford Metrica of “mass fatality events” (pdf) shows that, after an initial decline, within a year of tragedy some companies gain value above what would otherwise be expected if there wasn’t a crisis:

Beyond the obvious moral rationale for good behavior by management, it is clear that the markets respond positively to firms which demonstrate essential human qualities; sensitivity, compassion, honesty and courage. The managerial awareness of what is required, and the courage to act accordingly, sends a strong signal of skill to investors.

Stripping out general market movements, the research claims companies that handle crises well gain 25% in value versus those that don’t, and for crises that involve fatalities, the gap is 50%. “For mass fatality events particularly, the sensitivity and compassion with which the chief executive responds to victims’ families, and the logistical care and efficiency with which response teams carry out their work, become paramount,” the report states.

Lufthansa’s Spohr quickly skipped by a question about the financial impact of the Germanwings crash: “We do not want to make this public, but of course the situation is such that financially we will be able to continue.” Wisely, he kept his remarks focused on the facts of the incident, and on the families and staff affected by it.