Prosper Marketplace, America’s second-biggest peer-to-peer lending company after LendingClub, just received an influx of cash that values the rapidly-growing business at $1.9 billion.

But the money didn’t come from tech-savvy venture capitalists betting on the next big thing. Instead, the bulk of the $165 million in funding came from mega banks like Credit Suisse, JP Morgan Chase, and BBVA, which are all keenly attuned to how peer-to-peer lenders have been slowly siphoning off lending that once came from traditional banks.

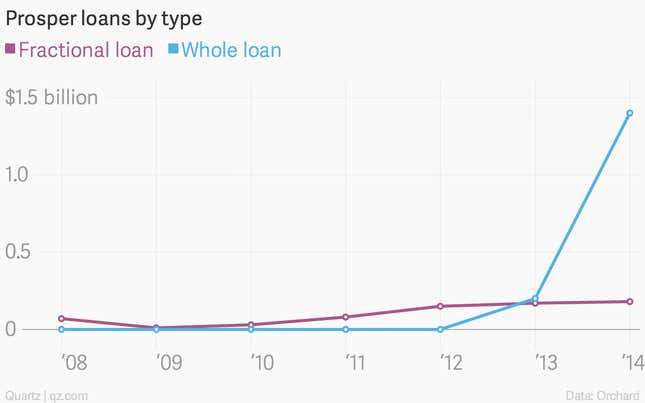

Prosper has also realized how important traditional banks are to its own business: While peer-to-peer lending was originally conceived as a way to use technology to match up individual borrowers and lenders, a flood of institutional money from banks and hedge funds in recent years now dwarfs the amount of funds provided by individuals.

Two billion dollars out of the $3 billion in personal loans Prosper has issued since 2006 came in just the last year—and the bulk of the money lent to borrowers is now coming from Wall Street lenders. Institutions tend to buy entire loans; individuals tend to buy fractional parts of loans.

The influx of Wall Street money has also created an imbalance in the market: lenders can’t find enough people to borrow their money.

Bringing on these mega banks as investors could help Prosper attract more customers and grow faster in order to take on its biggest competitor, LendingClub, and eventually go public.

“They are strategic investors for us,” Prosper CEO Aaron Vermut told Quartz, explaining how the banks and asset managers can help steer their wealthy customers toward online marketplace lending.

“We are building a company with good visibility, predictability, and data,” Vermut said. “Once I feel like we have that down, then we can go public.”