Spotify’s $8.4 billion valuation gives artists another reason to hate it

On April 10, the news broke that Spotify was close to raising $400 million from private investors, in a deal that would value the Swedish streaming music company at $8.4 billion.

On April 10, the news broke that Spotify was close to raising $400 million from private investors, in a deal that would value the Swedish streaming music company at $8.4 billion.

As with any privately-held tech startup, there are obviously many caveats embedded into that valuation. At the very least, the new investors—which, according to the Wall Street Journal (paywall), include Goldman Sachs and Abu Dhabi’s sovereign wealth fund—probably got preferential terms that mean they get their money back in a sale before anyone else does. That would minimize the risk for those investors relative to common stockholders, and inflate the company’s valuation.

Nevertheless, the fundraising is still pretty significant, for the music industry and beyond.

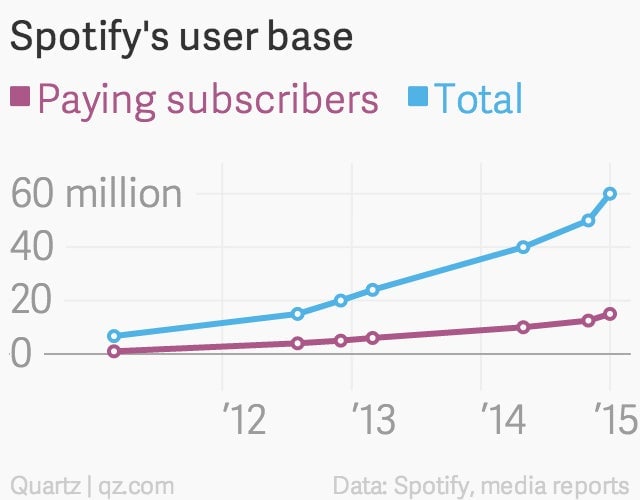

There has been a lot of talk lately about how huge valuations for tech startups help them attract both customers and talented recruits. For Spotify, however, a high valuation could reinforce negative perceptions about the company (regardless of whether those perceptions are fair) among artists who supply it with content. This could embolden them to demand more in royalties and pull stunts like Taylor Swift did last year.

There are quite a few risks facing Spotify at the moment, but perhaps none more so than discontent among its suppliers (record labels and artists). The company is facing new, cashed up competitors like Apple and Google, which don’t need to make any money from music, and could choose to pay more in royalties to get a leg up. That, coupled with moves by Tidal, the new service owned by Jay-Z and a coalition of high profile artists, suggests the next war in streaming music could be a costly one fought over exclusivity.

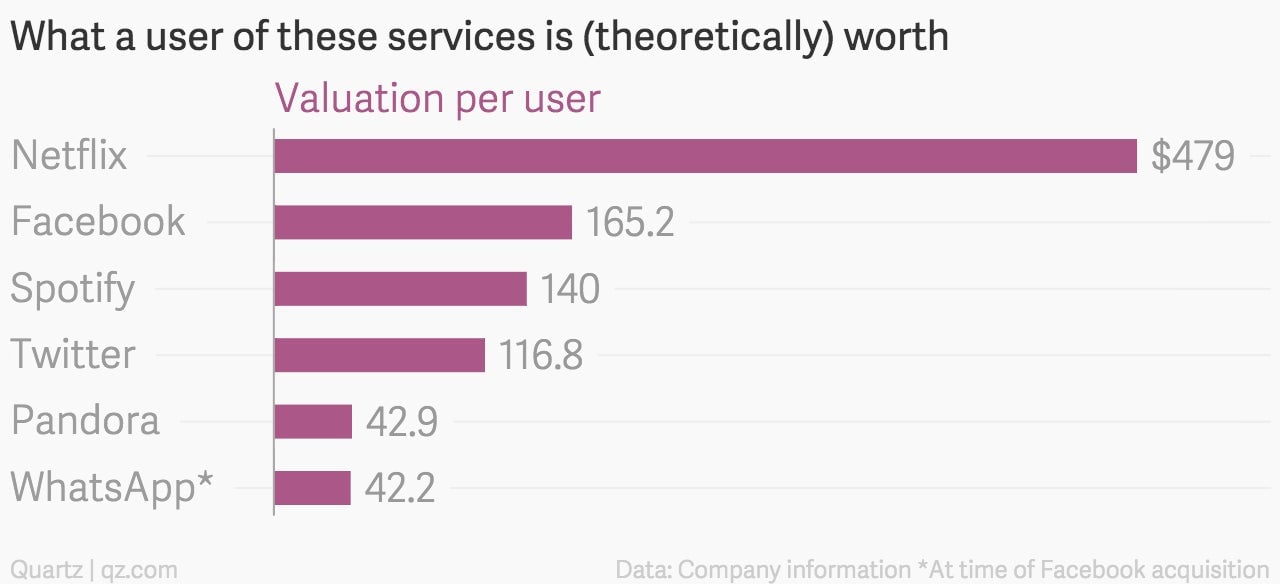

Whether Spotify chooses to use the funds it is raising to fight for exclusive music, or instead to expand into new attractive markets, remains to be seen. What is clear though, is that Spotify is not valued excessively, at least on a per user basis.

Obviously there are many differences in the companies listed in the above chart.

But comparing Spotify to Netflix could be instructive. Netflix’s valuation per user is way above the annual cost of a subscription to that service, which probably reflects a belief that its user base will ramp up dramatically in the near future.

As for Spotify, a $140-per-user valuation is also more than the cost of an annual Spotify subscription ($120). But if bullish projections about the future of streaming music prove accurate, and if Spotify is able to maintain its dominant position in that industry in the face of the threat from Apple and others, it could also grow much, much bigger than it is today.

That would imply that its newest investors are getting a bargain.

If Spotify can continue to grow and eventually exit through a successful IPO (or trade sale), the other big beneficiaries would be the major record labels, which hold a significant amount of equity in the company.

But any windfall the labels get won’t flow back to artists and songwriters, who are traditionally only paid in royalties. Needless to say, that won’t go down well.