Today, Israeli drug maker Teva announced that it wants to buy fellow generic manufacturer Mylan, worth $40 billion, in what would be the tenth largest pharma deal of all time. The hostile takeover bid, aimed at beefing up Teva’s generic drugs business, comes just weeks after Mylan announced it was attempting to buy Perrigo for around $30 billion.

The buying spree by global drug companies is being driven in part by big companies’ depleting drug pipelines and less fruitful investments in drug discoveries. Drug companies are also facing greater competition from new drugs, and a race to the bottom on corporate tax rates. High stock prices, low interest rates, and a healthy market for corporate debt haven’t hurt.

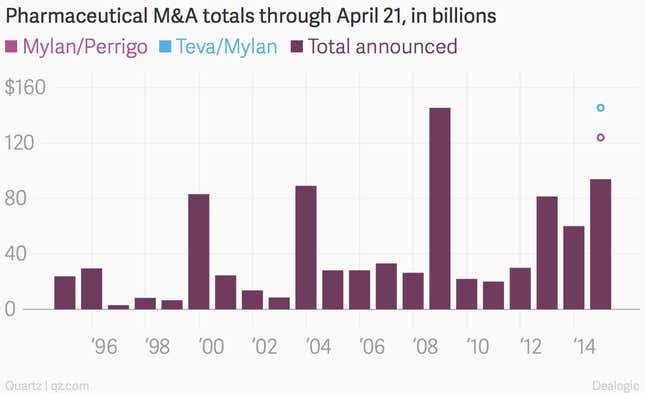

There have been more mergers and acquisitions announced in the pharmaceutical industry from Jan. 1 to April 21 of this year than during the same period of any year over the last decade, according to finance software company Dealogic. 2009, the year of the largest pharma buyout on record, Pfizer’s $111.7 billion purchase of Warner-Lambert, is the only year that’s come close.

The below chart shows 2015’s year-to-date M&A total under two scenarios, and compares those with the Jan. 1 to April 21 period of years past. The first shows the total if Mylan’s deal for Perrigo goes through (pink dot), and the second if Teva’s bid for Mylan’s does (blue dot). One deal would likely prevent the other:

Unlike 2009, this year’s total hasn’t been driven by a few outsized deals. So far this year, only Abbvie’s $20.9 billion deal for Pharmacyclics, and either of the Mylan deals that may go through, would crack the top 20 biggest pharma deals of all time.

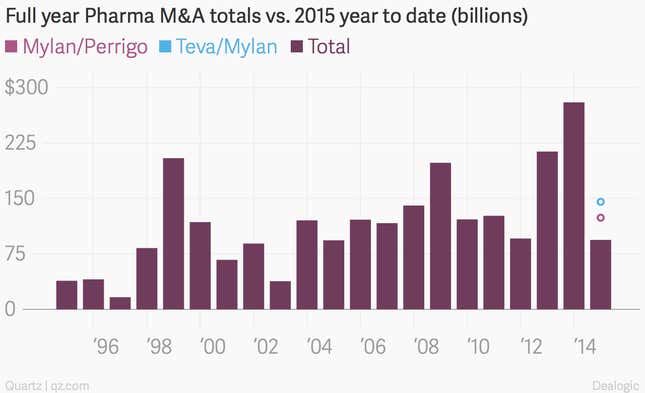

Drug companies are following the growth spurt in M&A overall, which has skyrocketed in recent years due the growing economy and extremely cheap debt. If Teva’s deal goes through, there will have been more M&A activity in the past four months than in all but four full years of the past decade: