As with all big banks these days, it takes a lot of time and effort to parse Barclays’ latest earnings report (pdf). The first number chief executive Antony Jenkins cites in today’s statement is the “adjusted” pre-tax profit of the bank’s “core” operations, which jumped 14% in the first quarter, to £2.1 billion ($3.2 billion). It was “our best quarterly performance in several years,” Jenkins said.

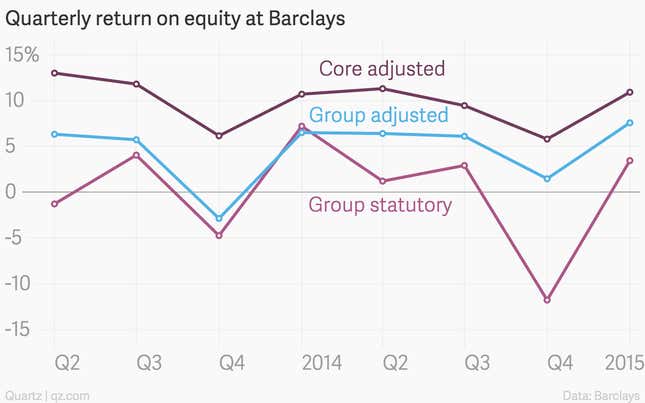

It takes some accounting gymnastics to produce this number—the actual pre-tax profit for the bank as a whole, according to accepted accounting principles, was £1.3 billion in the quarter, a drop of 26% from the same period last year:

There are plenty of valid reasons for Barclays to tweak the numbers like this. It has hived off a slew of unwanted assets into a ”non-core” division—otherwise known as a “bad bank“—that it will run down in the coming years. Thus, the group’s ”core” operation gives investors a feel for what the bank will become when it finally sheds these loss-making legacy assets, worth a hefty £467 billion of the bank’s total £1.3 trillion in assets as of the end of March.

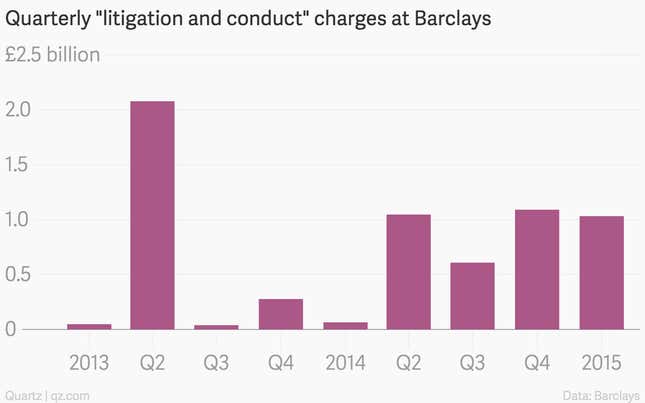

Other adjustments to the bank’s results are harder to justify. The “adjusted” earnings that Barclays gives top billing does not include £950 million in provisions for future litigation costs—the bank added £800 million in the first quarter to its kitty for a looming settlement on its part in manipulating foreign-exchange markets. In total, it has now set aside more than £2 billion to pay for its currency shenanigans, with a settlement expected in the coming months. Last year, American and European regulators slapped $4.3 billion worth of fines on six banks for rigging the forex markets; by refusing to join in that settlement, the penalty Barclays faces could be steeper than that of its rivals.

As we have written recently, some analysts believe that chunky charges for legal troubles have become a new way of life for big banks. That’s certainly the impression you get from looking at the consistently large “litigation and conduct” charges that Barclays has announced in recent quarters:

So, how is Barclays actually doing? Its shares are down following its latest earnings report, but not by much. Your assessment of the bank’s health depends on whether you think its legal problems will soon pass and it will be able to offload a pile of toxic assets in a timely manner.

Strip out these arguably one-off factors from the company’s accounts, and you see a growing, profitable bank that recorded a decent return on equity of just under 11% in the first quarter.

Add them back and you get a bank haunted by its past, weighed down by dud loans and tangled up in endless legal troubles. By this measure, the bank earned a pitiful return on equity of just over 3% in its latest quarter, which is hardly a performance to be happy about.