McDonald’s is acknowledging what anyone who’s followed the company’s performance over the past few months already knows. ”No business has a divine right to succeed,” CEO Steve Easterbrook said in a video the company posted this morning. ”The reality is our recent performance has been poor, the numbers don’t lie.”

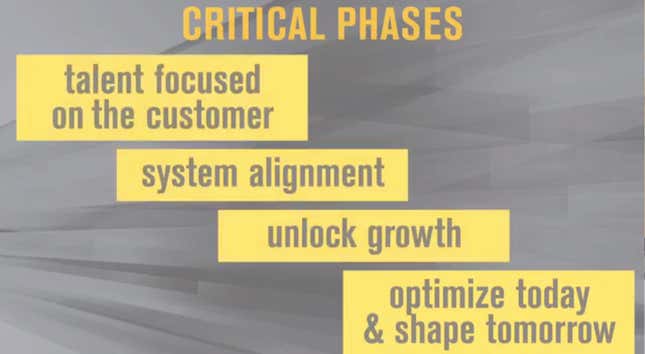

The video is a 20-minute-plus presentation from a very earnest Easterbrook, and is a mix of catchphrases repeated endlessly (“modern progressive burger company,” “closer to our customers” “removing bureaucracy,” “operations excellence,” “focused firepower,” “right people in the right places”) and vague slides. Here’s the overall plan:

And the turnaround priorities:

But eventually Easterbrook got to the specifics.

A big reorganization

The company is moving from a structure organized by geographies to one with just four global segments attempting to become more agile and efficient.

The idea, basically, is that by putting countries with similar profiles together, they’ll be able to learn more easily from each other and change more rapidly. It’ll also allow the company to substantially reduce spending on support staff.

Here are the new segments:

- The US—the single largest segment, accounting for 40% of 2014 income.

- “International lead markets”—Canada, France, Germany, and the UK, all of which have relatively similar economies and growth prospects. Together, they accounted for 40% of 2014 income.

- “High-Growth Markets”—China, Italy, Russia, South Korea, Spain, Switzerland, and the Netherlands, which have greater opportunity for restaurant expansion.

- “Foundational Markets”—everywhere else.

Selling off more restaurants

The company, over the next three years, will move from a structure where about 80% of restaurants are franchises to one where 90% are. That means selling off (or “refranchising”) 3,500 restaurants. That’ll be a substantial influx of cash in its own right, and will allow the company to cut costs across the system.

Cost cuts and layoffs

When you remove layers of bureaucracy, a bunch of middle managers tend to lose their jobs. Here’s Easterbrook:

The G&A support structure for our new segments will be significantly leaner than it is today. As we move more accountability to the local market level, we’ll realize additional savings. A less resource intensive support structure is inherent in a more heavily franchised business model… We’ll be conducting an additional review of our corporate functions in the coming weeks, and reducing G&A as we look to align our support more closely with our new structure.

Translated, he’s saying that the company is going to cut costs a bunch, particularly at headquarters. It’s looking to spend a lot less on core corporate functions, labor, administrative, and managerial costs. According to Easterbrook, cost savings from these cuts and the new structure will total $300 million a year.

He also mentions continued investment in better ingredients and service quality, but the three things above are the big structural moves.

Will this be enough? Easterbrook is a brand new CEO and led a highly successful turnaround in the UK. It’ll be some time before this plan impacts the whole world. But there’s a lot of negative sentiment and years of sluggish growth to turn around.