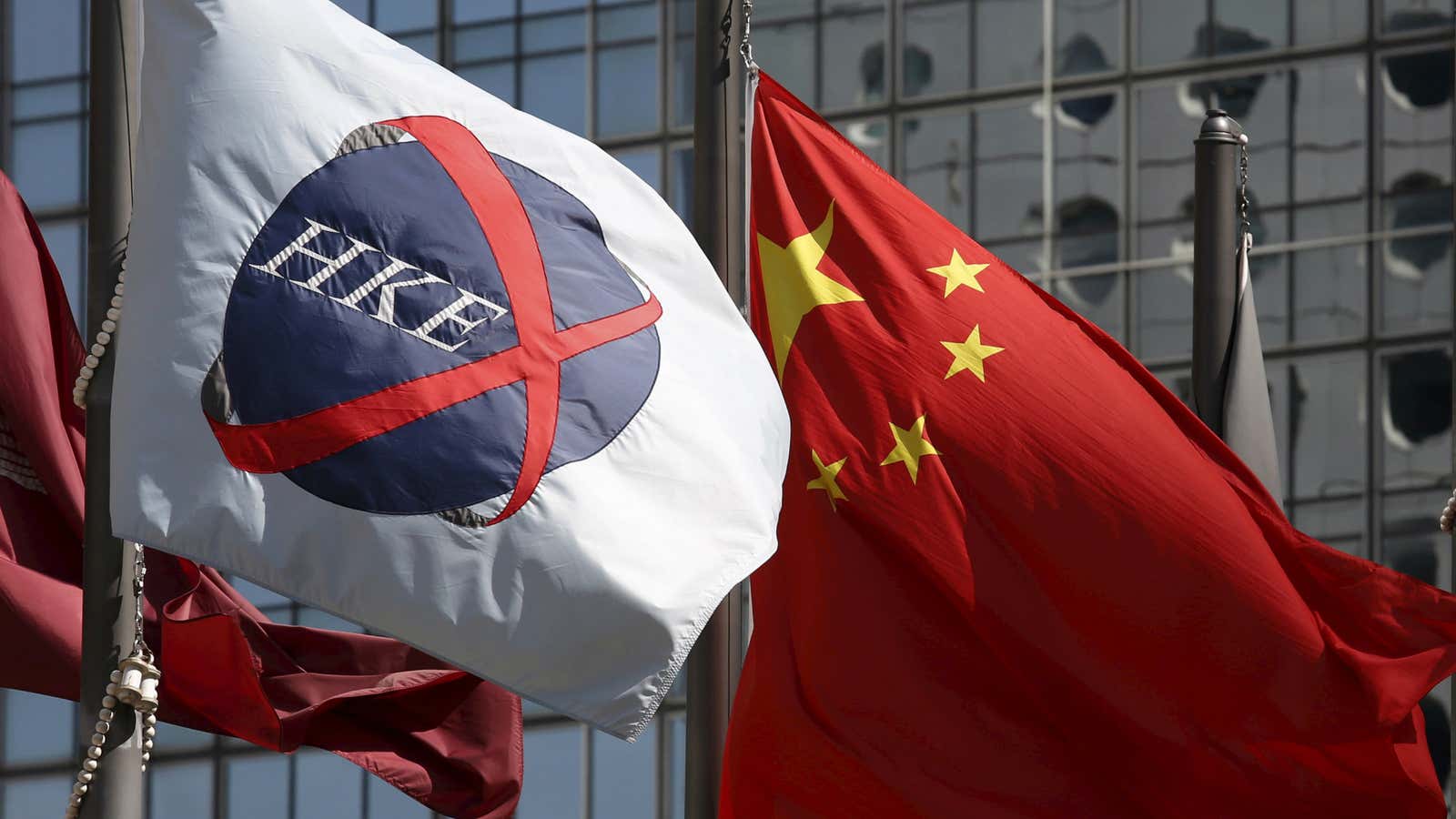

Broker and lender Goldin Financial followed client Hanergy Thin Film Power down sharply on Thursday, plummeting 43% on the Hong Kong Stock Exchange and wiping $14 billion off of its market cap.

The fall comes a day after Hanergy lost $19 billion in market value in just 24 minutes of trading, and suspended its stock pending an announcement that has yet to be made.

On Feb. 18, Hanergy Thin Film Power Group appointed Goldin as its financial adviser on one of its most controversial business arrangements, the supply of most of its products to a related company, Hanergy Holdings. The two companies share the same chairman, who owns a majority stake in both. An announcement to the Hong Kong Stock Exchange on Feb. 18 reads:

The Company has appointed Goldin Financial as its independent financial adviser to advise the Independent Board Committee and the Independent Shareholders to consider the terms of the Master Supply Agreement (including the Annual Caps) and the transactions contemplated thereunder.

Hanergy has had a host of financial advisers since it grew from a small hydropower concern to China’s largest solar company by value. Among them have been ABN Amro, Bank of China, HSBC, and Deloitte. But Goldin’s appointment appears to be the most recent.

The two drops may be unrelated. Goldin Financial’s board said in a statement to the Hong Kong Stock Exchange today that it was not aware of any reason for the sudden stock movement, or any information that should be disclosed.