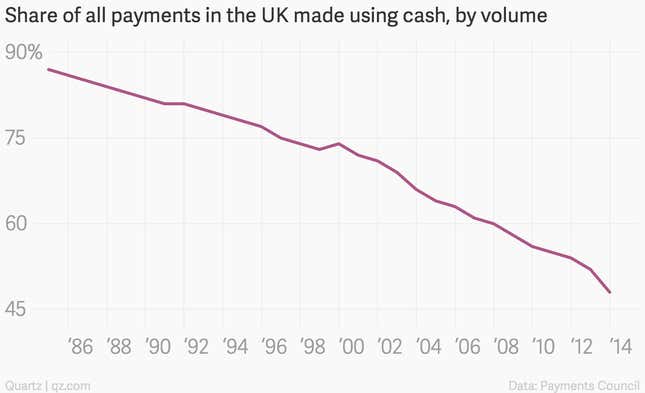

For the first time, the number of non-cash payments in the UK has exceeded those made with physical currency.

Cash still makes up 48% of all payments made by consumers and businesses in the UK, but the steady decline in the use of coins and banknotes accelerated last year—at the fastest pace in nearly 30 years, according to the UK Payments Council.

The trend underscores the massive, worldwide shift away from cash and toward online payments and debit cards.

Earlier this month, Denmark’s government floated a plan to allow retailers, restaurants, and gas stations to stop taking physical currency all together. The idea is that getting rid of cash will help choke off untaxed, underground markets, and remove “considerable administrative and financial burdens” from the Danish economy, according to Bjarne Corydon, Denmark’s finance minister.

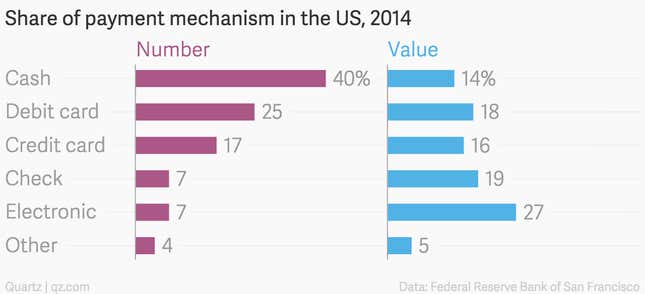

In the US, companies like Google, PayPal, and MasterCard, among others, are locked in a battle to lure more customers away from cash and onto online and mobile platforms. But as in most places, many consumers still prefer physical currency for smaller purchases like a cup of coffee or a pack of gum.

Cash remains even more commonplace in the UK, where it is still used in more than half of all transactions, according to the Payments Council. That’s why 90% of Brits withdraw cash from an ATM at least once a month, and why the number of free-to-use cash machines in the UK keeps rising. According to the Payments Council, the number of cash machines grew 5% last year, pushing the total number above the 50,000 mark.