There is a big body of academic research, mostly based on surveys and studies, indicating that women are better than men at investing because they are more patient, make fewer off-the-cuff decisions, and exhibit more self-control.

Here’s some proof that the theory holds true in real life as well.

It comes from Betterment, a financial advisory firm that uses computer algorithms to help people automate their investments. Using data from its own customer base, the company found that female customers were more likely to stay the course and keep a long-term mindset than their male counterparts.

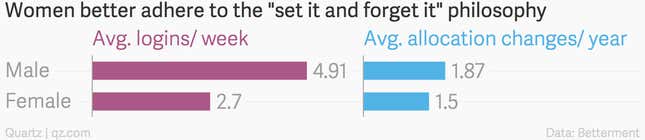

A proxy for this is how often women check their Betterment accounts (about half as many times a week than men) and how often they change their retirement and other investment portfolio allocations (about 25% fewer times a year).

Betterment, which began five years ago and manages $2 billion in assets for 90,000 customers (about a quarter of whom are women), declined to release a gender-based breakdown on portfolio performance. Sam Swift, Betterment’s data scientist and a Carnegie Mellon organizational behavior PhD, explains that this is because the site is “geared toward long-term investing, so it would be misleading to only share a few years of data.”

The idea behind Betterment—and other ”robo-adviser” firms that believe computer algorithms can do better than humans at investing and rebalancing for tax impacts—is that the less meddling people do, the better their investments will perform over the long term.

“Most tech startups try to find ways to bring people to their website as much as possible,” Swift tells Quartz. “But for us the challenge is how to keep people engaged with their investments once a quarter or so, without checking so much they end up hurting themselves.”

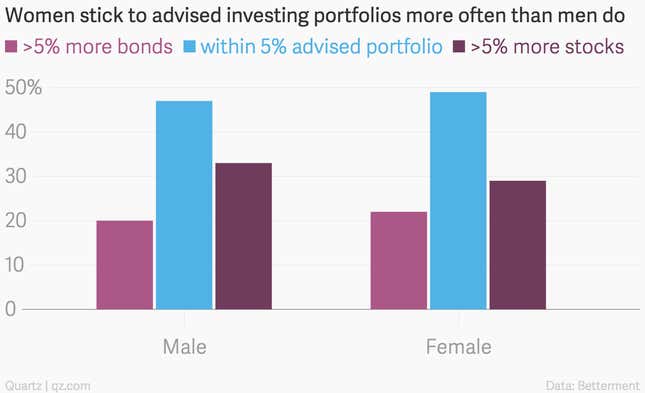

If this philosophy is right, then the portfolios of Betterment’s female customers should be in pretty good shape. The company finds that women deviate less from the firm’s algorithmic-based advice, which is tailored to each customer’s specified savings and performance goals, risk tolerance levels, and investment time horizons.

Note that when women deviate from the advised portfolio, they are more likely to favor adding bonds, while the men are more likely to load up on stocks, suggesting a bigger risk appetite.