Is this the beginning of the end for China’s bull market?

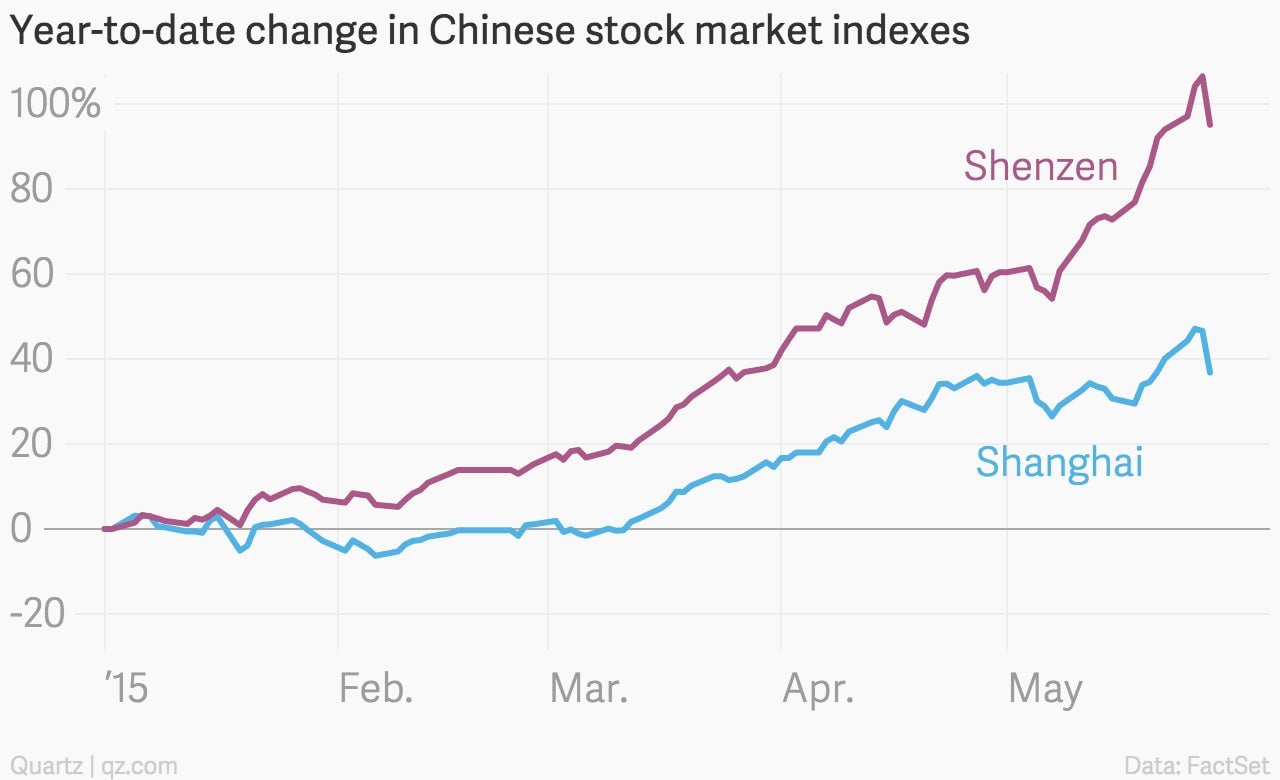

The Chinese stock markets’ long bull run finally went into reverse today—the Shanghai Composite index fell 6.5% and Shenzhen dropped 5.5%:

The Chinese stock markets’ long bull run finally went into reverse today—the Shanghai Composite index fell 6.5% and Shenzhen dropped 5.5%:

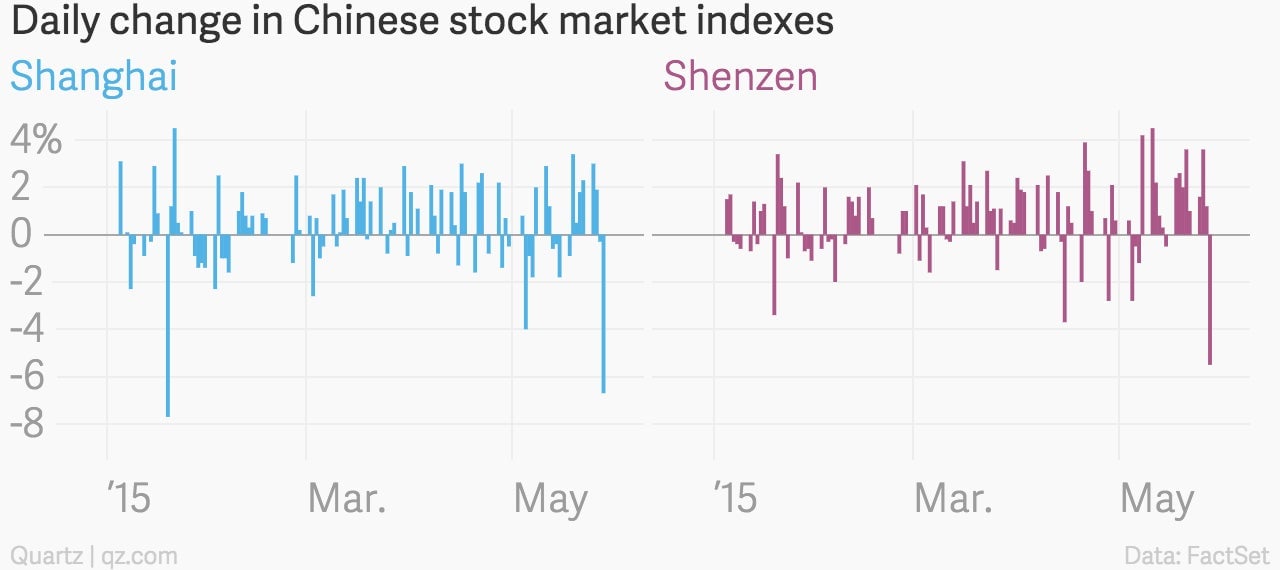

These were the biggest daily falls in many months, on heavy trading volumes:

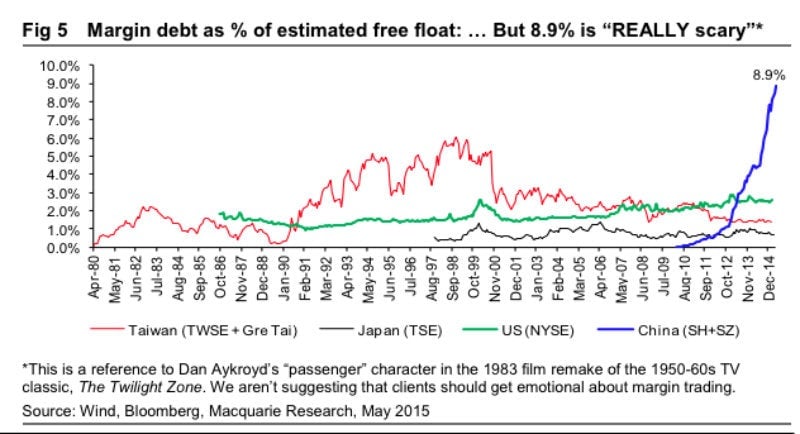

A few explanations for the abrupt selloff are circulating. The first is that a slew of big brokerages tightened restrictions on margin trading (betting on stocks with borrowed money). As we’ve discussed before, recent reforms that loosened the rules on margin trading has been a huge factor driving China’s stock rally.

Leverage can amplify gains, whipping the market ever higher, as Chen Long of investment advisory firm Gavekal has warned repeatedly. Limits on how much investors can borrow to boost their bets could therefore hamper a bull run, as FT Alphaville explains (registration required).

That bring us to another factor behind today’s tumble: rumors that the People’s Bank of China stealthily drained liquidity from the system. Following three rate cuts and two drops in bank reserve requirements since November, signs that the central bank may be powering down its cash machine is sparking fears that the easy money fuelling the rally is drying up. What also hasn’t helped is that an investment arm of China’s ministry of finance sold down its stakes in two big state-owned banks that anchor the Shanghai Composite.

There’s also, simply, the fact that China’s stock prices have nothing to do with the country’s economic performance, which is steadily slowing. Yet with little else to invest in, droves of retail investors have rushed to get in on the stock market bonanza—as many as two-thirds of households that have recently opened accounts haven’t even graduated from high school. It’s a prime opportunity for savvier investors to take profits.