After years on the back foot, Whole Foods is getting aggressive again.

The high end grocery chain announced plans in April to open a second, less expensive store brand. Last week, Whole Foods executives gave further details on the downmarket strategy, including the brand’s name, 365.

“For the last couple of years, we’ve been the hunted,” co-CEO Walter Robb said on a call with analysts. “This turns us back into the hunter.”

The first new stores are expected to roll out in the first half of 2016. Here’s why they’re crucial for Whole Foods.

It’s losing the produce-pricing war

Whole Foods has been working to lower prices on fruits and vegetables for some time as larger competitors get into the organic business and grab shoppers. But it’s gotten to the point where Whole Foods can’t keep up. Even small competitors are winning on price. That’s a major problem because produce is the sort of staple that keeps people coming in.

“Produce has been the area that has produced the greatest elasticity,” Robb said, meaning that customers are most willing to change their behavior around those prices. As a result, competitors cut prices to the bone.

“It’s clear that the market is looking for a new bottom with respect to pricing,” Robb said. “Basically, it’s moving faster than I think we can take Whole Foods.”

365 is an opportunity to start at a lower price point. The company won’t compromise on the quality of items, but is willing to take a bigger hit to margins than it can at its flagship stores.

It doesn’t serve quick weekday shoppers well

Anyone who’s visited an urban Whole Foods at the end of the workday knows it can be a grueling experience. The store loses out on lots of customers that way.

The new stores are meant to deliver the same quality that shoppers expect from Whole Foods, but in a quicker way. The company envisions the two stores as complementary for that reason.

“We could see a customer shopping on a Tuesday, Thursday at the 365,” Robb said. “On a Saturday, I think of richer, deeper experiences at Whole Foods Market.”

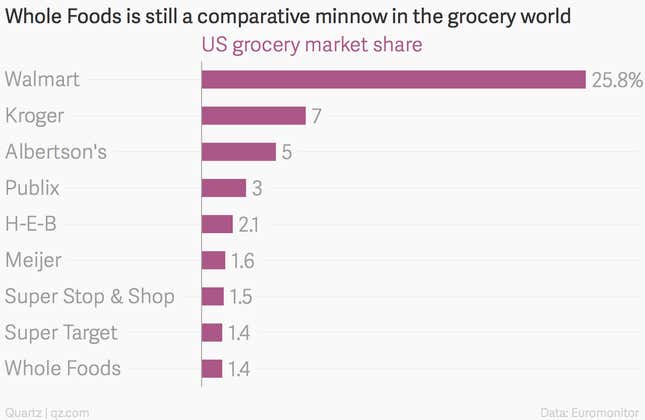

It’s still a market-share minnow

Despite its outsize public image, Whole Foods is only the 9th largest grocery brand in the United States:

Worldwide, it’s even less of a player, with just a 0.2% market share, according to Euromonitor. Simpler, smaller stores should open up new areas.

“We’re acknowledging that there are additional markets available to us,” Robb said. ”We think some towns we can’t pencil the Whole Foods Market capital model; it doesn’t work.”

The new stores are going to be cheaper to open as well, with the same food quality, but more stripped down in appearance and selection.

“We’re going to change the way that we buy, the way that we bring product to market, but also the way we build and develop a store,” said Whole Foods UK head Jeff Turnas, who will lead 365. “If we can cut that time in half and cut the amount we spend in half, then we’ve got a much easier way to bring products out at a better price point.”

He points to using cheaper materials, less marble and less steel. The new stores will also be more consistent in design and layout, making them easier to open and operate.

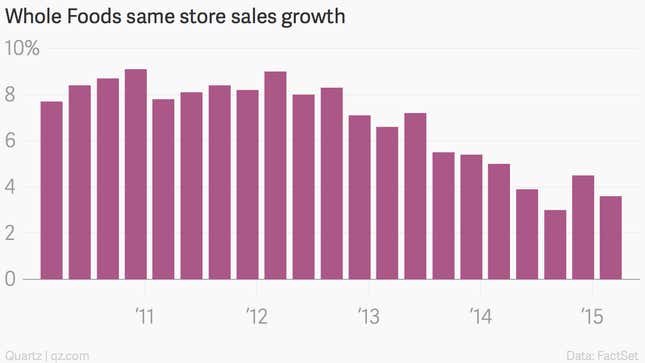

Sluggish sales

When examining the shift in strategy, the fact that Whole Foods has been struggling can’t be ignored. After years of breakneck growth, same store sales growth has been extremely slow, hovering around 3% for the past year.