China’s key equity gauges, the Shanghai Composite and the Shenzhen index of A-shares, both tumbled more than 7% today, erasing more of this year’s remarkable gains and pushing the Shenzhen index into bear-market territory (more on that in a minute).

The selling pressure seemed driven by the sense that the government had become uncomfortable with the equity market surge throughout much of the first half of the year, according to the Wall Street Journal (paywall). At its peak earlier this year, the Shanghai composite was up roughly 60% and the Shenzhen index—which tracks yuan-denominated stocks of mainland Chinese companies—was up more than 120%.

But since those peaks the indices are down, way down. The Shanghai composite is 18.8% lower and the Shenzhen is off by 20.4%. (A bear market is traditionally defined as a 20% decline from a recent peak.)

The Chinese government also seems to be bracing for a continued economic slowdown, which also may have unnerved investors. News broke today that British bank HSBC has ended its sponsorship of an economic indicator that regularly showed the Chinese manufacturing sector to be weaker than official government accounts. Some reports have suggested that such a sponsorship risked angering the government and potentially damaging the bank’s business interests in the country.

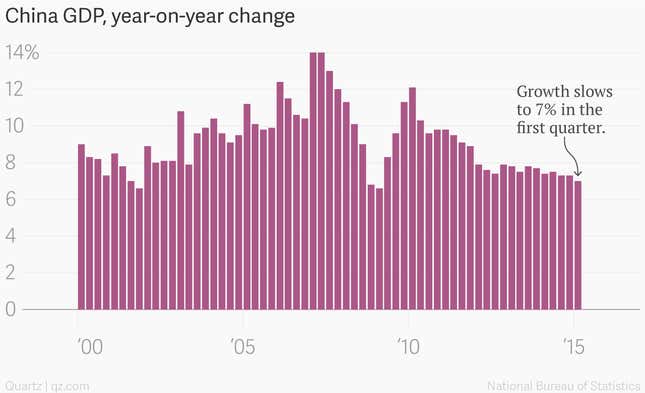

Even official statistics show the Chinese economy is in the midst of a significant slowdown. In April, China’s National Bureau of Statistics reported that growth in the world’s second-largest economy had slowed to 7%, the slowest clip in six years.