It looks like the gravy train is rolling through Wall Street again.

In the first quarter, US banks took in $7.7 billion (pdf) in revenue from trading stocks, currencies, derivatives, and the like. That’s the biggest pot since 2011, and the fifth-highest total ever, according to the Office of the Comptroller of the Currency, one of the primary US banking regulators.

The big moneymaker so far this year has been foreign exchange, which shouldn’t be surprising if you remember the giant move in the Swiss franc earlier this year, not to mention the rapidly weakening euro.

The conventional wisdom around bank trading has been that tighter regulations in the wake of the 2008 financial crisis was going to drive banks into more staid businesses like wealth management, but not everyone is abandoning the sector’s more volatile environs. The Wall Street Journal is reporting (paywall) that Morgan Stanley, for instance, is planning a push back into bond trading as rivals retreat.

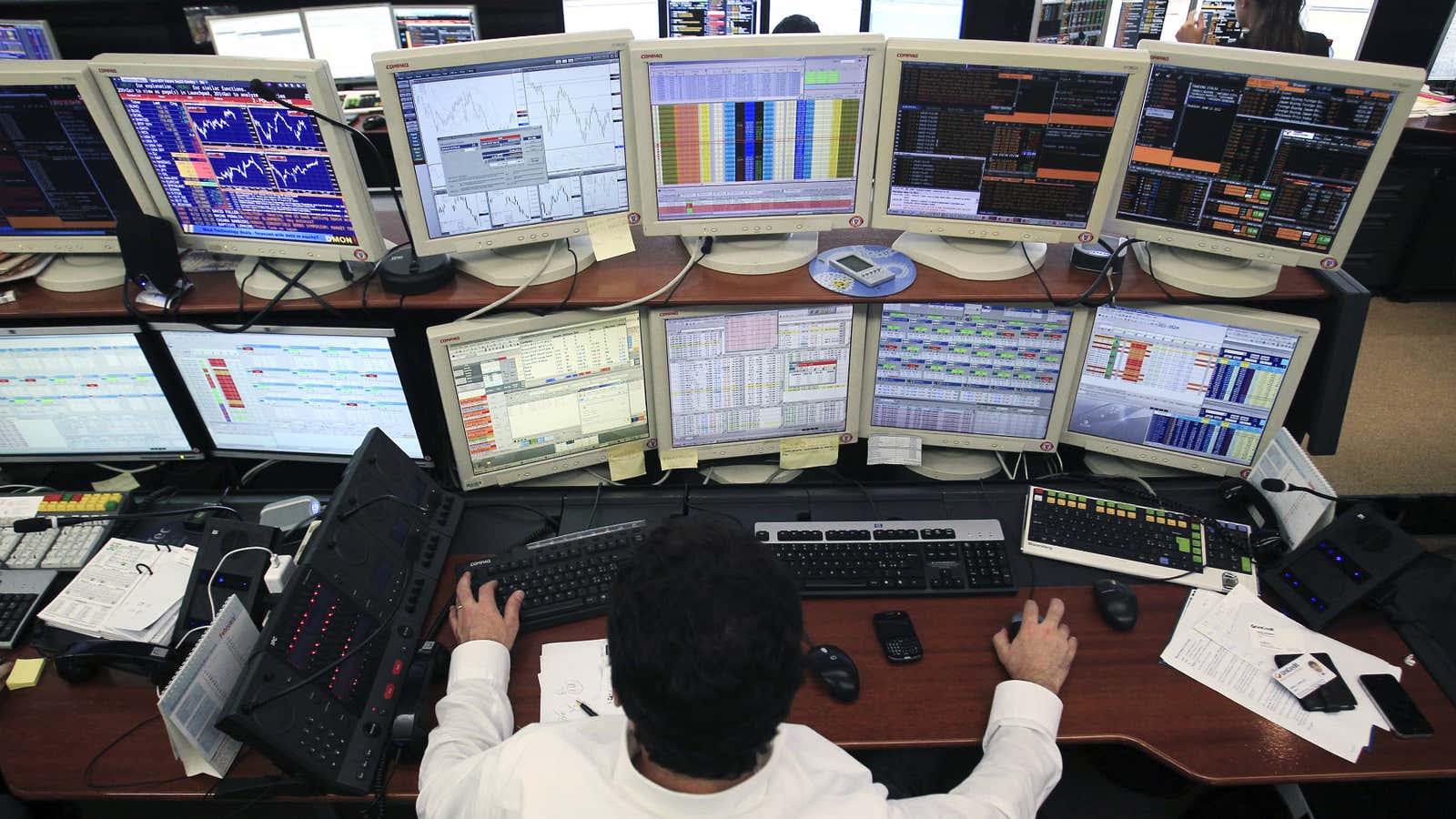

Indeed, with the prospects for interest rate hikes by the Federal Reserve, a possible Greek exit from the euro zone, and whatever happens in China, there might be a lot of money to be made out there on the trading desk.