If there was ever time for Xiaomi to prove it’s more than just a smartphone company making generic slabs of hardware, it is now.

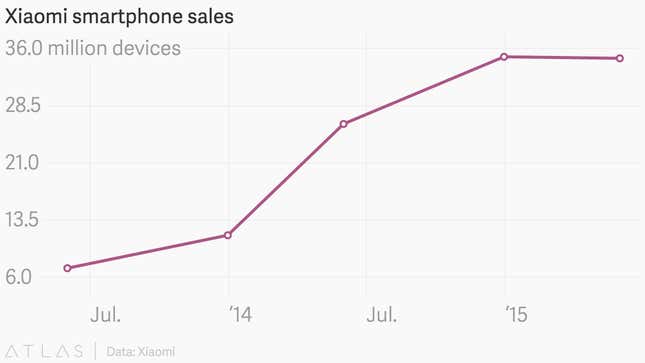

From January to June the company sold 34.7 million devices—registering no growth from the previous six month period.

Yes, sales were up 33% year-on-year. But the lack of growth between the end of 2014 and the first half of 2015 means dark clouds are gathering for Xiaomi, just as they are for nearly every smartphone maker that isn’t Apple. “Good enough” smartphones are becoming a commodity, and to stand out, phone makers need to be reduce prices or sell add-on products and services—or watch their business shrink.

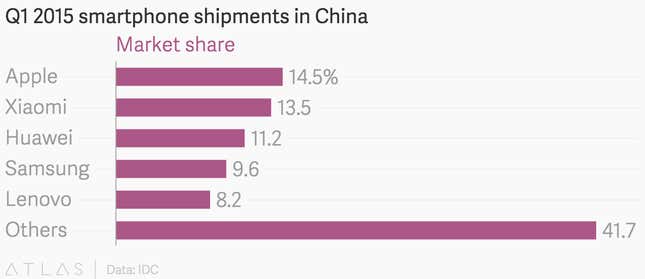

There are several specific factors behind Xiaomi’s stagnation. In China, Xiaomi leads the Android hardware market, beating out Samsung for market share in 2014.

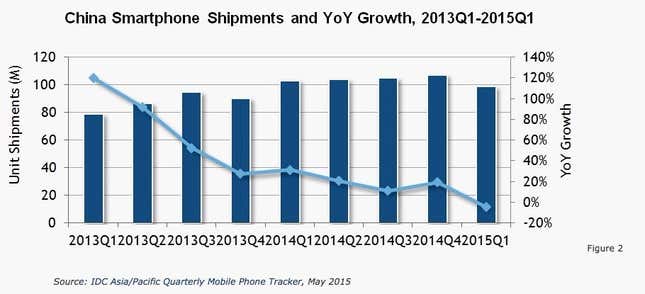

But the overall market for smartphones in China has nearly stopped growing, giving Xiaomi less room to sell new phones. As IDC reported in May, annual growth for shipments in China has gone from almost 120% year-on-year to single digits in two years time.

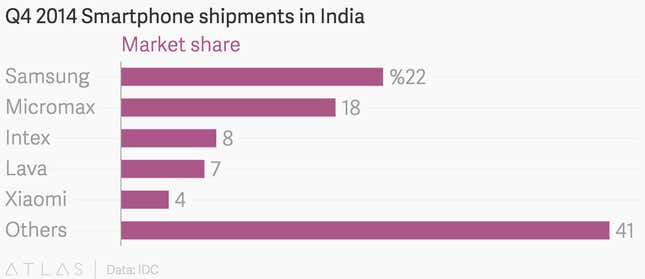

With China slowing down, Xiaomi has begun looking to other markets for growth. It moved into India in July 2014, and Southeast Asian countries including Singapore, Malaysia, the Philippines, and Indonesia throughout last year.

While Xiaomi is a well-known name brand at home, it still has a ways to go before it can become a top player in any of these markets. In India, the company managed to capture 4% of the market in the final three months of 2014.

That’s a solid start, but Samsung and homegrown competitors maintain a lead. The company recently started experimenting with print advertising in India, something it traditionally shunned in China.

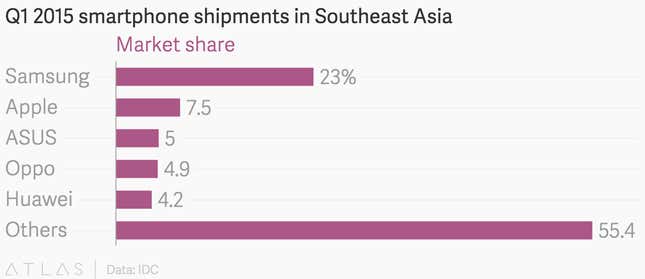

In Southeast Asia, the company isn’t even on the map, sales-wise.

This isn’t to say that there isn’t hope for Xiaomi. Indian business mogul Ratan Tata just invested an undisclosed amount in the company. Next week it will sell its first devices in Brazil, a market that looks particularly promising thanks to its large population and potential hometown love for Xiaomi’s outspoken Brazilian VP, Hugo Barra. Mexico, Thailand, and Vietnam are also in Xiaomi’s expansion plan.

But for now, Xiaomi looks set to fall behind its earlier stated target of selling 100 million devices this year. The company adjusted that goal in March to “80 to 100 million devices.”

Xiaomi has repeatedly described itself as an “internet company,” not a smartphone company, meaning it does other things to earn money besides hawking glass slabs. It’s not yet clear if that is true on a global scale.

On the one hand, the company says it will hit $1 billion in sales this year from media, gaming, and other software-related services, about 6.25% of total expected sales. It has also built up a valuable online e-commerce business, which has catapulted a $15 wrist tracker to astonishing popularity.

But Xiaomi’s fundamental strategy for China has been to use cheap smartphones as an entry point to sell customers other things. If there aren’t enough Indians or Brazilians buying these smartphones to begin, Xiaomi will have to find brand new ways to attract customers.