Walmart is losing two key executives that were hired to revive its flagging business in China. The departures, from the Walmart-backed e-commerce venture Yihaodian, are yet another sign that the American retail giant can’t replicate its success in the East.

Domestic media reported (link in Chinese) that Yihaodian chairman Yu Gang and CEO Junling Liu have left to start a new venture.

Walmart purchased a 51% stake in Yihaodian in 2012, in an effort to crack the market through e-commerce. The purchase marked an unexpected shift for the retail giant, which has traditionally focused on bricks-and-mortar.

But the company turned to e-commerce after its retail expansion in China proved costly, sluggish, and fraught with internal strife. In August 2014, Bloomberg reported on the company inflating its numbers in China by selling bulk goods to other retailers at little or no markup, among other shoddy practices. Same-store sales for the quarter ending in January dropped 2.3%.

Meanwhile, online retail in China continues to boom. In the first quarter, reported China’s National Bureau of Satistics, e-commerce sales made up 10.7% of total retail purchases in China, marking an estimated $123.5 billion. In the US, the figure is 7%.

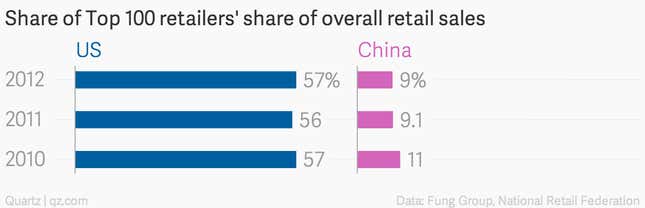

Additional factors, like China’s fragmented logistics industry, have prevented a single bricks-and-mortar retail player from dominating the market the way Walmart does in the United States.

Yihaodian isn’t a complete non-entity in China. Walk around Beijing and you’ll spot trucks sporting the company’s branding, delivering fresh fruits and other grocery items around the city. But it’s a bit player compared to Tmall (from Alibaba Group) and JD, which own an overwhelming majority of the consumer delivery market.

Few foreign megastores have found success in China. Tesco effectively exited when it merged with a domestic conglomerate in 2013, and Carrefour suffered a 7.8% quarterly sales drop last December. Tellingly, Costco entered the Middle Kingdom by bypassing bricks-and-mortar altogether and opening a shop on Tmall.

One need not be in China to sell to the Chinese.