After two decades of subpar growth and enervating deflationary pressures, the Bank of Japan still doesn’t get it.

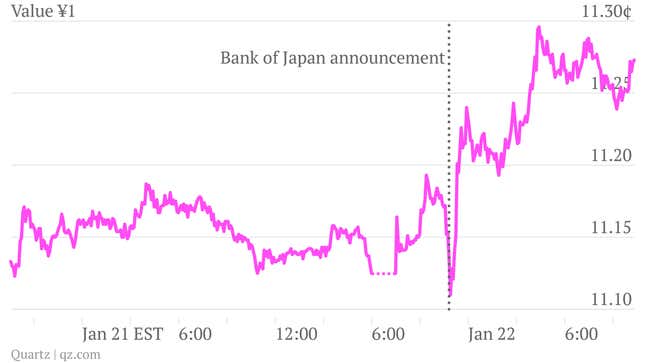

This chart illustrates the knee-jerk strengthening of Japan’s currency against the US dollar after what was supposed to be the BoJ’s big announcement today, in which the conservative central bank was expected to embrace an new, activist—dare we say Bernankesque—approach to monetary policy. And this was the result…

Bear in mind, this morning was supposed to be a big moment for the BoJ. New prime minister Shinzo Abe rode to victory in parliamentary elections last month partly on his campaign promises aimed at driving the Bank of Japan to take more aggressive action against the specter of deflation. And there have been plenty of indications that the bank got the message. As a result, the yen had been on a nice weakening trend for the last few months, as the chart below shows. This was helping out the country’s flagging exports—something today’s gain has dented, albeit only slightly:

At least on paper, today’s statement makes it look like the BoJ is going in the right direction. It did move to a stated inflation target of 2% to be accomplished at the “earliest possible time.” The bank also issued a statement vowing to strengthen cooperation with the elected government to get the economy growing. And when will the BoJ undertake these new efforts to invigorate the Japanese economy? 2014.

Which is funny, because to most humans, “the earliest possible time” would be something like “now.”

This is classic Japanese policy-making. Take one step in the right direction, and one risk-averse step back and then hope things get better on their own. In recent decades policy mistakes have continually cut off nascent recoveries at the knees. In 1997, as Japan seemed about to finally emerge from the recession that followed its own real-estate driven financial crisis of the early 1990s, the government cut down on spending and raised taxes—austerity—in an effort to get the budget under control. That drove the economy down into the dumps. (The country’s debt load only got worse.) The Bank of Japan didn’t help matters much raising interest rates in 2000, further inhibiting growth. And that’s why many economists—including a one-time Princeton prof by the name of Ben Bernanke—have argued that Japan’s economic malaise is essentially “a case of self-induced paralysis.”

Officials at the Bank of Japan should know, but in case they don’t, we’ll lay it out for them: Financial markets do not do subtlety. You have to threaten investors, pretty clearly. The best recent example of this is European Central Bank president Mario Draghi’s “whatever it takes” speech back in the summer of 2012. But for an entity like the BoJ, the time for jawboning is long gone. It has to act. Governor Masaaki Shirakawa’s term ends this spring. If Abenomics is for real, that should be much sooner. Like, say, now.