Later today, we’re going to get the government’s official economic and budget projections, but this morning we’ve got the goods from Government Sachs, ahem, Goldman Sachs. The chart was prepared by economist Alec Phillips, who reports that the investment bank is reducing its growth expectations for the US because it’s not so clear that the crude spending cuts Congress enacted as a cudgel to force more delicate spending reform are going to go away:

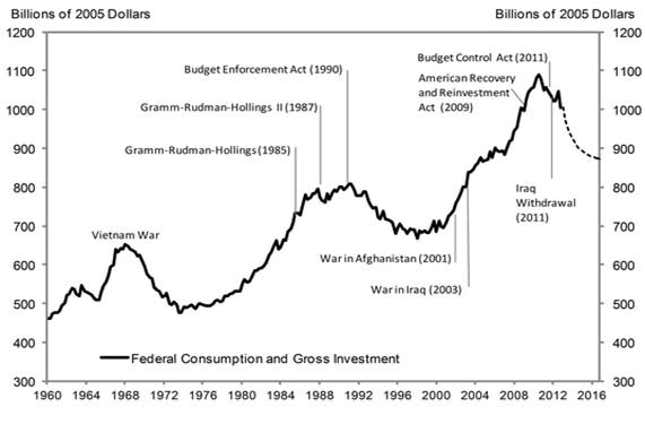

Sequestration, spending caps, and reduced war spending will together reduce real federal consumption and gross investment by 11% over the next two years. This is a large decline in historical context, but it is not without precedent. This would mark the third decline in the last 50 years; the first occurred around 1970, after Vietnam War spending had peaked, followed by another around 1990 as military spending declined following the end of the Cold War and multiple rounds of spending caps were enacted.

You can see this report and get a little freaked out, because removing demand from the US economy at a time of slow growth doesn’t make a ton of sense. Remember that the IMF’s second biggest concern in 2013 after the euro crisis is that America will start cutting its deficits faster than it already is.

You can also see this report and think, it all depends on where you cut. Economist Tyler Cowen argues that much of these spending cuts, targeted at defense and healthcare spending, won’t get passed into the real economy. That’s not an uncontroversial view, since we’ve already been cutting the deficit fairly quickly, and last quarter’s slight reduction in economic growth was largely due to a big drop in defense spending.