The tea leaves on BlackBerry’s attempt to save itself with a slick new operating system and phones are pretty unambiguous: The company is doomed. Let’s start with the fact that the company’s former CEO, Jim Balsillie, agrees: He just sold off his entire stake in the company, going from one of the largest individual shareholders in BlackBerry, with 26.8 million shares, to zero.

In addition to this vote of no-confidence, there are a number of reasons BlackBerry is in for a drubbing even if its new software, called Blackberry 10, were a hit. One of the few brights spots in the company’s future was that BlackBerry was doubling down on its core market, the enterprise, and rolling out features that would appeal to the governments, law firms and financial institutions that have long been BlackBerry stalwarts.

Enterprise exodus

But the anecdotal evidence continues to mount that enterprise customers are no longer interested in Blackberry: The police force of New Zealand just opted for iPhones over BlackBerrys. That’s 6,000 iPhones and an additional 3,900 iPads. One telling detail: The force has been testing the devices for a year, and with Blackberry 10 only just rolled out, it’s evidence that the company’s sluggishness in relaunching has cost the company significant momentum, as well as 33% of its market share in 2012 alone.

In the US, construction and hardware retailer Home Depot finds Apple’s hardware and software so compelling that even older-model iPhones are better, in their analysis, than the new BlackBerry phones. A spokesperson at Home Depot told me that 10,000 new iPhone 4S smartphones will be handed out to members of the company’s management team.

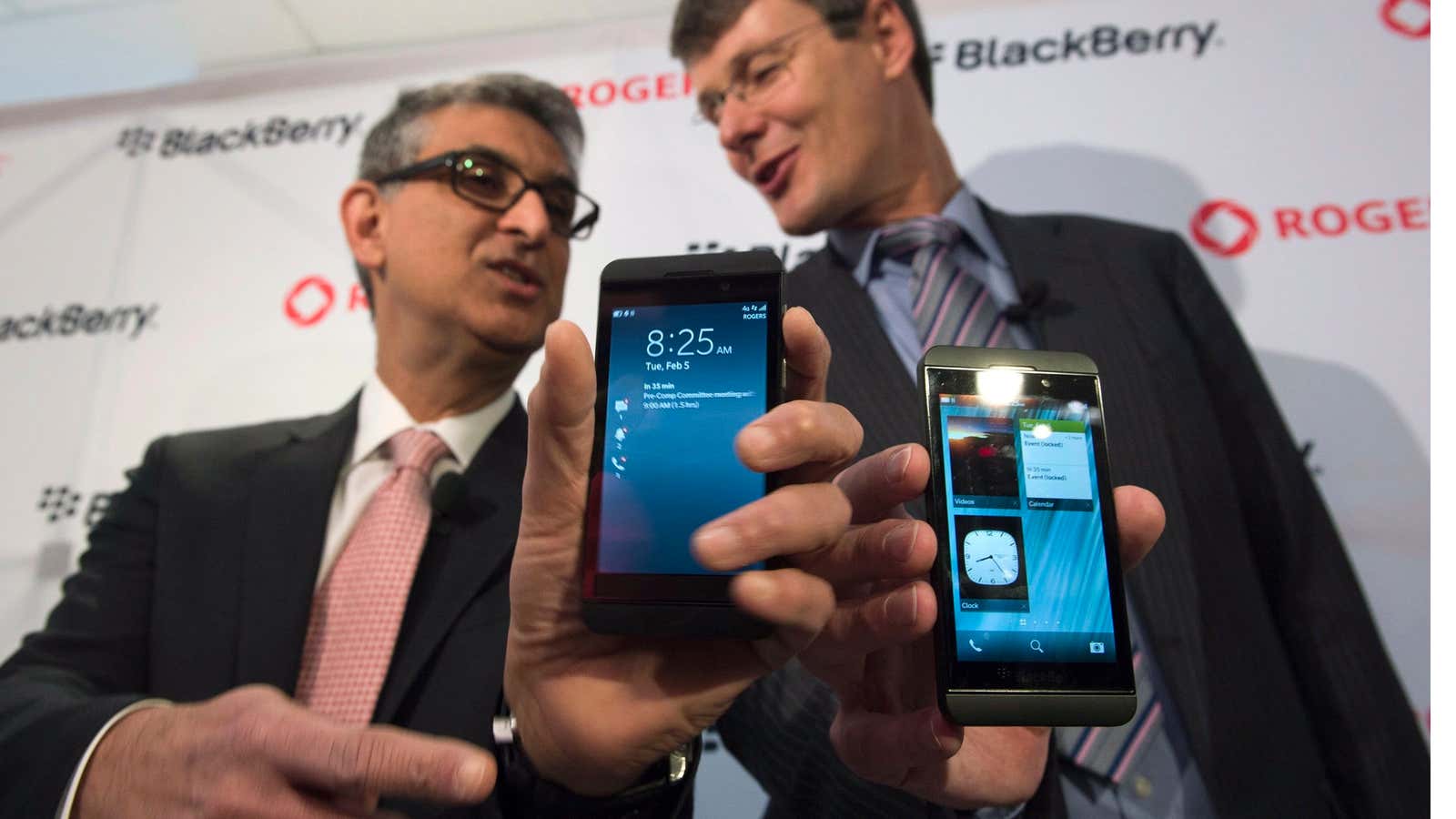

Little excitement after BlackBerry 10 launch

Analysts are cutting their revenue and profit forecasts for BlackBerry. Only 43% of current BlackBerry owners plan to make BlackBerry their next phone (compare that to 85% of iPhone owners). The bad news goes on and on: The US launch of the BlackBerry Z10 has been pushed from January to March, and the phone’s hardware is about to be leapfrogged by new Android models from Samsung.

Not to mention the fact that reviewers who took the perspective of everyday, non-corporate consumers just can’t see themselves making the switch from Android or iPhone. As the Verge’s Joshua Topolsky put it: “The problem with the Z10 is that it doesn’t necessarily do anything better than any of its competition.”

If Blackberry is losing customers in enterprise and hasn’t created something compelling enough to lure ordinary consumers, what has the company got left? I’ll tell you: Revenue propped up by a dwindling supply of subscribers in the developing world, who are in the middle of a mass exodus to cheaper Android phones. It’s not time to stick a fork in Blackberry just yet, but as a business, it appears to be doing little more than coasting on its own momentum.