The world’s biggest sneaker brands are rethinking the way they make their products. As technology such as 3D printing advances, China gets more expensive, and brands look for ever-faster ways to bring customers what they want, the old rules of manufacturing are being upended.

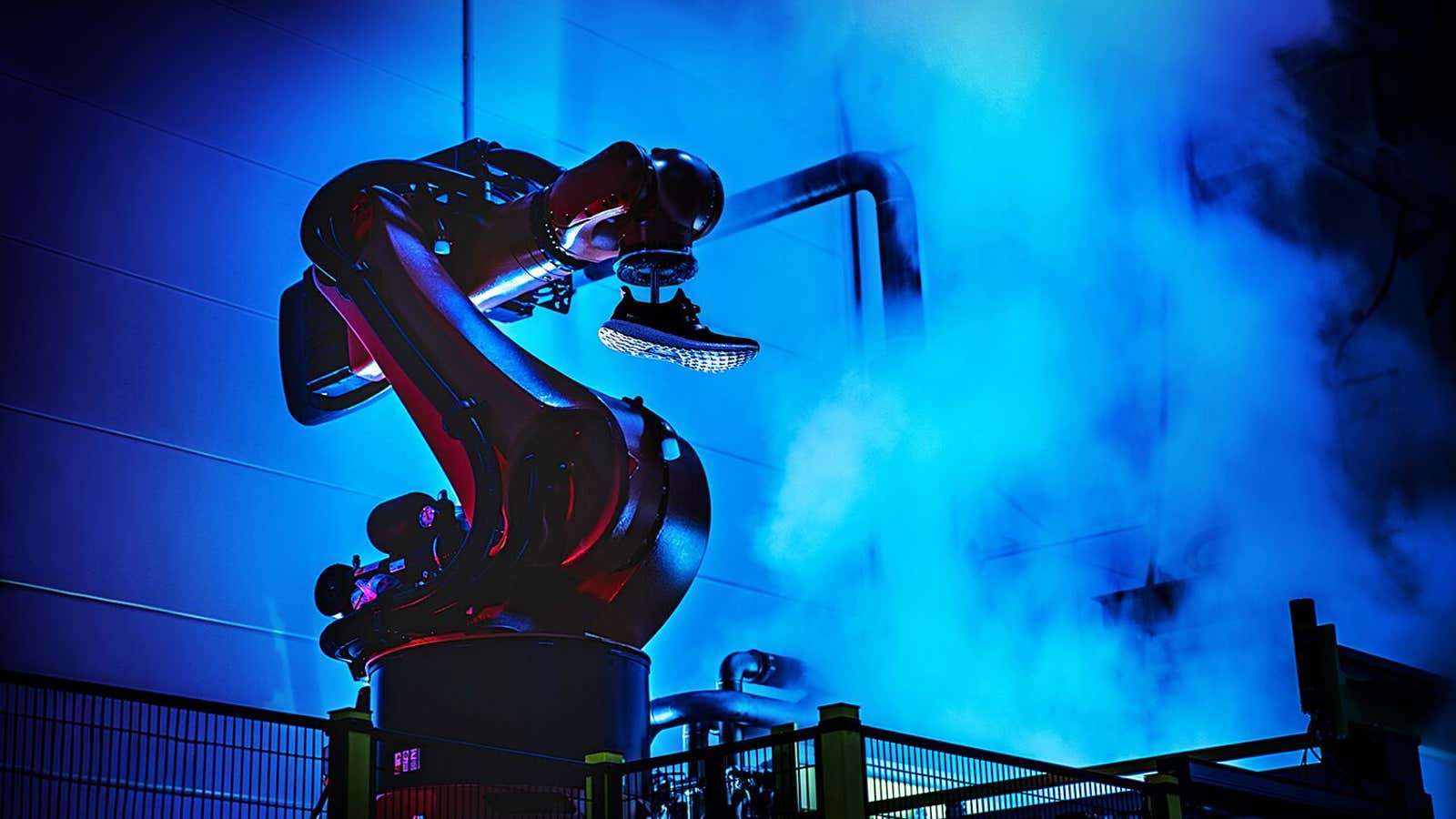

One great example of how the field is changing is Adidas’s new robot-run “Speedfactory,” which the German company hopes could one day revolutionize the industry.

Today, (Dec. 9) it released a first glimpse of the new high-efficiency—and slightly ominous looking—pilot shoe factory in Ansbach, Germany, which will use “intelligent, robotic technology” to produce Adidas sneakers faster than ever.

The first 500 pairs of a concept running shoe made in the Speedfactory will hit stores in early 2016. Adidas plans to start large-scale commercial production in 2017, eventually bringing “speedfactories” to the US.

Separately, Adidas has also revealed plans to begin shifting production away from China over the next five years. John McNamara, Adidas’ head of global sourcing, said at an investor workshop recently that as Chinese worker wages increase and material costs rise, it will look to other Asian nations such as Vietnam, Cambodia, Myanmar, and Indonesia for cheaper manufacturing.

Both plans reflect a larger shift in how footwear and apparel companies make their products.

As it develops, China is fading as a guaranteed source of inexpensive, efficient production. Its labor costs are growing, while its working-age population is starting to shrink, portending less cheap labor in the years to come. Meanwhile, advances in automation have made it more attractive to use robots, whose falling prices help offset other rising costs and protect brands’ profit margins. As Andrew Lo, head of one of Levi’s major suppliers in China, told the Wall Street Journal, “Labor is getting more expensive and technology is getting cheaper.”

For a company such as Adidas, which makes about 600 million pairs of shoes and clothing items each year, any boost in efficiency and decrease in cost can mean a real boost in profit.

Adidas says its Speedfactory isn’t a response to rising labor costs, and that it is intended to complement existing operations, not replace them. But one of the key components of Adidas’ turnaround strategy is to respond to customer demand in different markets more quickly. According to the company, a global web of robotic factories like the Speedfactory would make that possible.

“Our move toward automation is really driven by our desire to give our consumers what they want, when they want it, and where they want it,” an Adidas spokesperson tells Quartz.

“Automation gives us unprecedented flexibility with manufacturing, so we can produce product closer to our consumers and stay ahead of trends. It will open doors for endless customization opportunities for our consumers.”

On that last point, Adidas recently launched 3D-printed, custom midsoles for a better fit.