The world’s biggest pension fund—Japan’s Government Pension Investment Fund (GPIF)—just reported a blowout last quarter of 2012. According to GPIF’s fiscal year 2012 report, it raked in ¥5.14 trillion ($55.5 billion) from October to December of 2012—a tidy 4.8% return (pdf). Not bad compared to July-September’s ¥528.7 billion.

And that’s thanks in no small part to promise of a stimulus rampage from new Prime Minister Shinzo Abe, which has sent Japan’s stocks soaring.

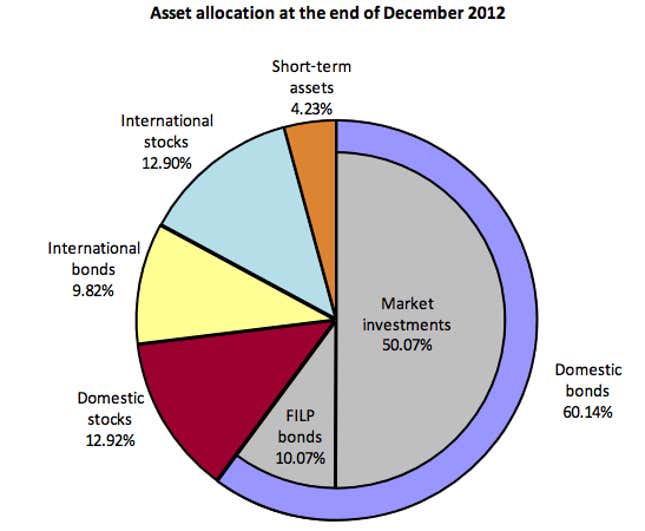

But if GPIF wants to keep benefiting from Abenomics, it’s going to need to adjust—a lot. And that could be a challenge for such a conservative fund—as of last year, it invested 67% of its assets passively (pdf, p.28.) Here’s a look at its portfolio as of the end of 2012:

In short, heavy on domestic bonds—and most of them in Japanese government bonds (JGBs)—and light on everything else. Fortunately, adjustment plans are underway at the $1.18-trillion fund, the Wall Street Journal reported today (paywall). This is how it will need to change to ride Abe’s fiscal and monetary surge:

GPIF needs to get out of domestic bonds. As everyone knows, Japan’s population is graying fast. So fast that GPIF started paying out more each year than it received back in 2009 (pdf, p.3). That makes the 60% of its portfolio parked in money-losing domestic bonds a real problem.

Mind you, it should probably have been doing this even before Abe entered office. But Abenomics makes this shift a truly urgent thing. Here’s why, says GPIF president Takahiro Mitani:

“JGBs were how we made money over the past 10 years…. The BOJ said that they are increasing buying bonds, but they’re also putting power into lowering interest rates.”

With the BoJ likely to start open-ended asset-purchasing, including of JGBs, yields will go down—and take a chunk of the pension fund’s future returns with it.

It needs to get in on the Abenomics-fueled Japanese stock bonanza. At least, that’s what Mitani thinks. Despite that the Nikkei returned some 18% since Abe took office, “Japanese stocks do not look expensive,” Mitani told Bloomberg. “We’re still in the middle of a rising stocks, weakening yen trend. It will continue for a while.”

There’s probably something to this. The bump so far has mostly been based on talk alone. The effects of open-endedly loose monetary policy, fiscal stimulus and the exports rebound from yen depreciation could keep the Nikkei moving upward.

And thanks to Abenomics, GPIF can now invest overseas. (More confidently, at least.) In the past, Japan’s steadily strengthening currency ate up returns in foreign investments such that, as of late 2012, only just around 23% of GPIF’s assets were invested overseas. The rapid slide of the yen since late November, when Abe looked set to win, helped foreign assets return almost 14% for the GPIF in the last quarter of 2012. Mitani has already taken steps toward investing in emerging markets—it hired emerging-markets specialists in September 2011—and that’s likely only to intensify.