Janet Yellen has finally acknowledged that I was right

We are feeling quite smug. Quite.

We are feeling quite smug. Quite.

This is even in addition to baseline readings of smugness that tend to be elevated.

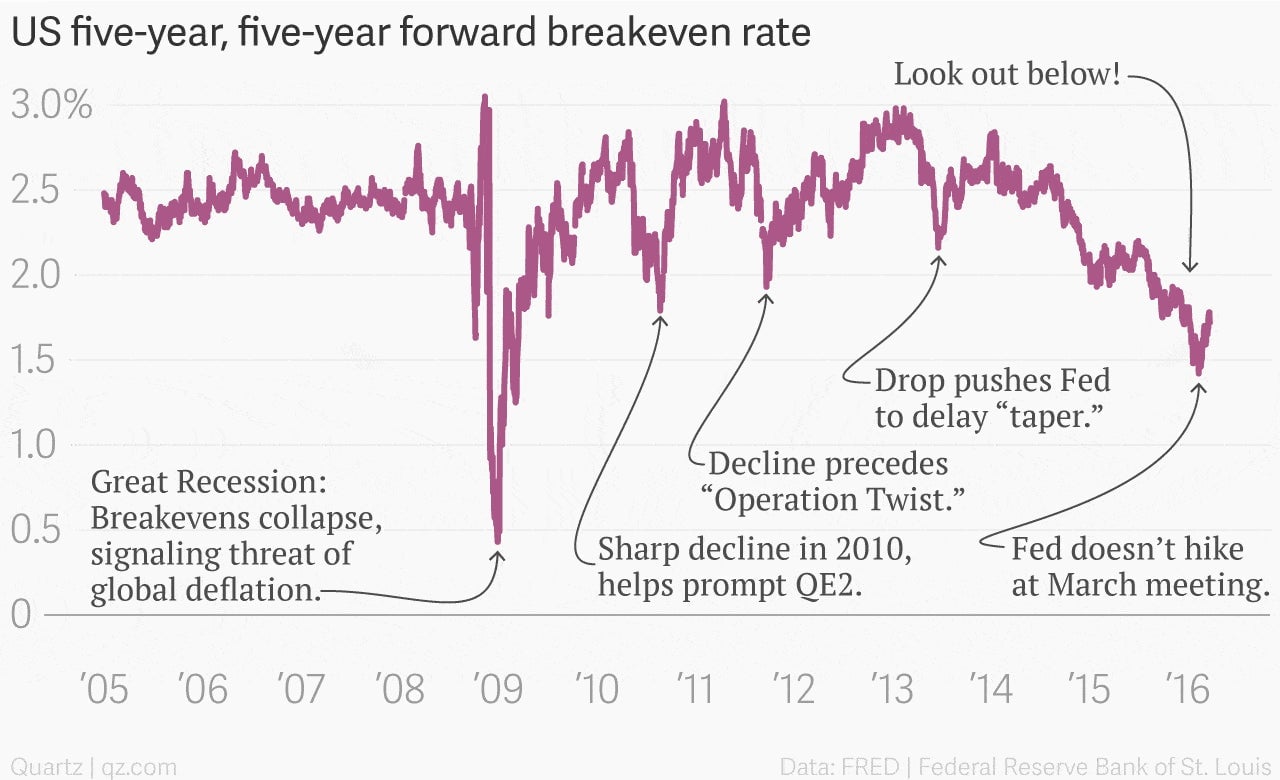

For months I’ve been yapping about the fact that inflation expectations have basically been falling of a cliff. (See here, here, here and here.)

This is a big deal, suggesting that a disinflationary—or even deflationary–psychology was potentially taking hold both among consumers and within financial markets.

Now it seems that the most influential member of the US Federal Reserve has also grown concerned about the downtrend, and the potential risk that deflation could set in.

Deflation—a broad decrease in prices throughout an economy—is the economic equivalent of trying to drive with the parking brake on. It makes debt more difficult to pay back. It prompts people to put off purchases in the hopes of getting a cheaper price later on. And it tends to come with a rise in the currency, which hurts exports.

In her much-awaited speech today to the Economic Club of New York today, Federal Reserve Chair Janet Yellen spent quite a bit of time talking about low inflation expectations, saying “continued low readings for some indicators of expected inflation do concern me.”

Yellen did reiterate the Fed’s party line that, broadly speaking, inflation expectations remain “well-anchored.” But she acknowledged that “the decline in some indicators has heightened the risk that this judgment could be wrong.”

As we’ve said before, the trend in one of the Fed’s traditionally watched metrics of inflation expectations, the five-year, five-year forward breakeven inflation rate, has been dropping like a stone until very recently, when the Fed opted not to raise interest rates at its March meeting.

Yellen’s speech today dwelt more on the potential risk that inflation could fall too low, rather than rise too quickly. As a result, the markets may now believe that the Fed may not carry on with its plan to lift interest rates at its next meeting in late April. Unsurprisingly, stocks rallied and the dollar fell today, after Yellen’s comments.

More importantly, Yellen’s speech suggests that the power-center of the Fed has swung toward paying attention to a key piece of data that the bank has, at times, ignored as it geared up for the the first interest rate increase in December 2015. And paying attention to the data is exactly what a “data-dependent” Fed should do.